When will Wetherspoon release FY results?

JD Wetherspoon is scheduled to release preliminary full year results on the morning of Friday October 1. This will cover the 52 weeks to July 25.

Wetherspoon FY earnings preview: what to expect from the results

It has been a tough year for the pub industry. Wetherspoons has had to adapt to an ever-changing set of restrictions during the period, from having to close sites completely to only serving outdoors to only offering table service. In fact, ‘normal’ service only resumed in July. Plus, it missed out on the temporary boom in sales during the Euro 2020 football tournament as it doesn’t broadcast sports, which tempted customers to rival pubs and bars throughout June.

This, unsurprisingly, will have kept Wetherspoons in the red during the year. Analysts are expecting revenue to drop to £796.4 million from £1.26 billion the year before and for its reported pretax loss after exceptional items (and post-IFRS 16) to widen to £144.5 million from £105.4 million. Its loss per share after exceptionals is forecast to widen to 97.24p from the 89.90p loss the year before.

The pub chain has said it expects to end the year with around £833 million of net debt. It has already secured covenant waivers for the financial year and replaced them with minimum liquidity requirements that it is comfortably meeting. However, investors will be on the look out for news on any new waivers it secures for the new financial year.

Investors will be primarily focused on how Wetherspoons has performed since normal service resumed and its last update in mid-July, which will set the stage for the new financial year. Wetherspoons is currently expecting sales to recover to pre-pandemic levels in the new year to late July 2022 and for revenue to come in broadly flat from the £1.82 billion reported in its 2019 financial year.

Although conditions have improved as restrictions have eased there are several new headwinds that could hamper its recovery. Wetherspoons has adamantly denied a slew of media reports in recent months that it has struggled with everything from a shortage of beer to a shortage of workers, although it has admitted problems due to matters like industrial action and a lack of HGV drivers.

Investors will want clarification of how rising costs and a tight labour market are impacting Wetherspoons. For example, the temporary VAT relief given to pubs, which slashed the rate to just 5% from the usual 20%, starts to unwind this month (pushing it back up to 12.5% before returning to 20% in 2022) and Wetherspoons has already said it will have to raise the cost of its food by around 40p per meal as a result.

Wetherspoon shares have only managed to recover about half of the losses booked since the pandemic started. The 11 brokers that cover Wetherspoon believe the stock still has plenty of recovery potential with an average Buy rating and a target price of 1,379.0p – implying there is over 30% upside from the current share price.

Where next for the Wetherspoon share price?

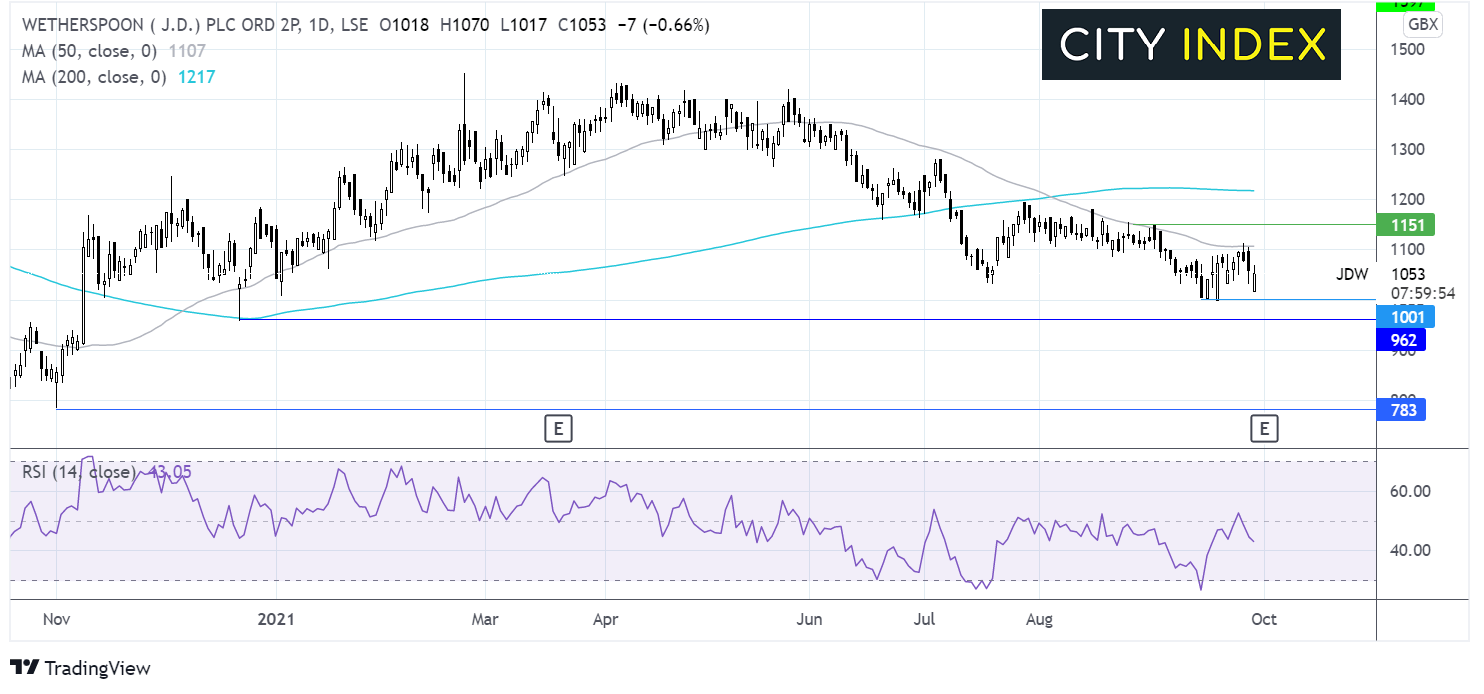

The Wetherspoon share price has been forming a series of lower highs and lower lows since late May.

The price reached a year to date low and psychological level of 1000p last week and has been range bound since, capped on the upside by the 50 sma at 1106p and on the lower side by 1000p. The RSI is below 50 and pointing lower, which favours the downside.

Traders might look for a breakout trade from the results. Sellers could look for a move below 1000p which could open the door to 960p the December low ahead of 780p the November 2020 low.

Meanwhile, upbeat results and an encouraging outlook could lift the stock. Buyers could look for a move above 1106p for a breakout towards the September high of 1150p before exposing the 200 sma at 1214p.

How to trade Wetherspoon shares

You can trade Wetherspoon shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Wetherspoon’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade