When will TSMC release Q3 results?

Taiwan Semiconductor Manufacturing Co (TSMC) will release third quarter earnings on Thursday October 14.

TSMC Q3 earnings preview: what to expect from the results

TSMC, the largest semiconductor foundry in the world, has delivered record revenue over the past year thanks to the explosion in demand for chips in everything from smartphones, computers and other smart devices to cars.

However, this comes against the widely-reported shortage in the market that has had damaging consequences for a wide range of industries. TSMC says this has been caused by the combination of a surge in demand for tech as people work from home and the introduction of new frontiers such as 5G, and a global shortage in supply caused by disruption from the pandemic and ‘geopolitical tensions’.

‘While the short-term imbalance may or may not persist, we expect our capacity to remain tight throughout the year and into 2022 fueled by strong demand for our industry-leading advanced and special technologies,’ TSMC said in July.

TSMC has been prioritising the security of supply for its customers as a result. For example, it raised output of microprocessors used by the automotive industry by 30% in the first half and said this will increase by 60% in 2021 compared to 2020. That, when achieved, will take output about 30% above pre-pandemic levels, demonstrating the scale of the structural shift that is happening. As a result, TSMC said the automotive component shortage from semiconductors will be ‘greatly reduced’ for its customers during the third quarter and beyond.

Although the imbalance in the market looks set to continue for the foreseeable future, TSMC expects to use its scale and reputation to outperform the wider market, continue to grow and deliver record revenues. TSMC has said the foundry industry is set to grow by around 17% in 2021 but TSMC is aiming to grow revenue this year by around 20% in US dollar terms. Over the longer-term, TSMC is aiming to grow annual US dollar revenue toward the upper end of its 10% to 15% CAGR target between 2020 and 2025.

TSMC has provided guidance that is targeting third quarter revenue of $14.6 billion to $14.9 billion. Analysts expect the company to hit the top end of that range with revenue estimates of $14.83 billion, which would be up from $12.14 billion last year and mark an 11% sequential improvement from the record revenue delivered in the second quarter. Wall Street anticipates earnings per ADR unit to grow to $1.03 from $0.90 the year before.

TSMC’s 5nm wafers, the most advanced chips on the market, will remain under the spotlight in the third quarter as sales continue to ramp-up. TSMC is anticipating 5nm wafers will account for around 20% of revenue over the full year, implying a ramp-up in the second half after accounting for 14% of sales in the first quarter and 18% in the second.

Sales of 5nm wafers is forecast to steadily grow over the coming years, driven predominantly by the smartphone and high-performance computer applications. However, the new technology offers lower margins as production ramps-up and investors will be eager to see how gross margins are impacted as a result. TSMC has warned it will take seven to eight more quarters before 5nm margins reach the corporate average. That, twinned with the significant decline in the Taiwan dollar against the US dollar, could result in tighter margins even as the topline continues to grow. USD/TWD traded close to $30 in the third quarter of 2020 but that has since declined closer to $28 in the current quarter. Importantly, this will impact its US dollar results compared to its earnings in its local currency.

Margins could also be impacted by other cost challenges, including higher costs of the basic commodities and materials needed to produce its products. It is also increasing investment in new chips and wafers and in new manufacturing capacity. However, TSMC has said it is ‘firming up our wafer pricing’ as a result, implying it is looking to pass on higher costs to customers in order to maintain profitability.

TSMC shares have more than doubled in value since the start of the pandemic back in early 2020, but have shed almost 20% in value since hitting all-time highs of $142 in February 2021, when the global shortage started to weigh on sentiment. Brokers believe TSMC can surpass those all-time highs with a price target of $141.56 – implying there is over 28% potential upside from the current share price.

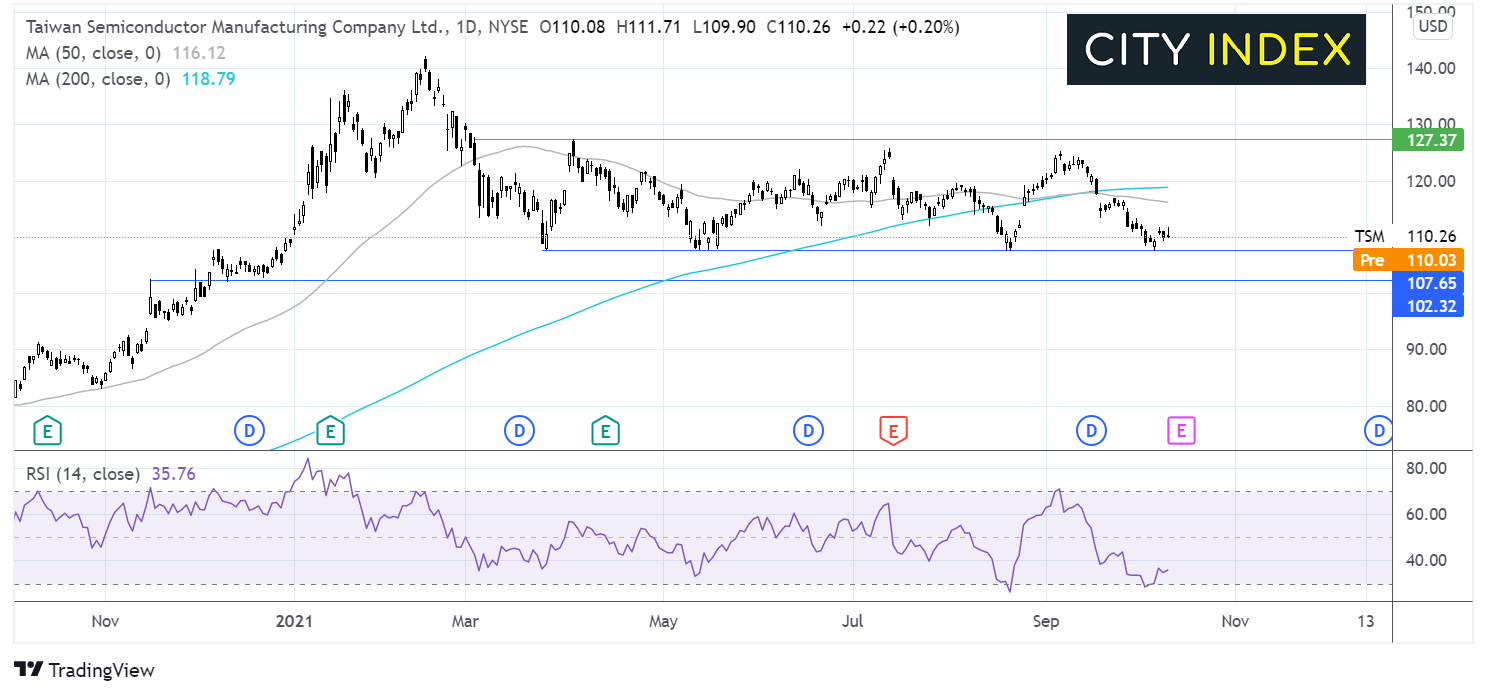

Where next for the TSMC share price?

After hitting an all-time high of $142.20 mid-February of this year, the TSM share price moved lower into a holding pattern. The price has been trading in this holding pattern since March, capped on the upside by $127 and limited on the lower side by $107.

The price trades at the lower end of this pattern and beneath its 50 & 200 sma. The 50 sma also crossed below the 200 sma in a death cross bearish signal. Meanwhile the RSI supports further downside whilst it remains out of oversold territory.

Sellers might wait for a move below $107 which could spark a deeper selloff towards $102 a level which offered both support and resistance in November and December last year.

On the upside, buyers would be looking for a move back over the 50 sma at $116 and the 200 sma at $119 to bring $127 back into focus.

How to trade TSMC shares

You can trade TSMC shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Taiwan Semiconductor’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade