When will Tencent release Q3 earnings?

Tencent is scheduled to publish third quarter earnings on Wednesday November 10.

Tencent Q3 earnings preview: what to expect from the results

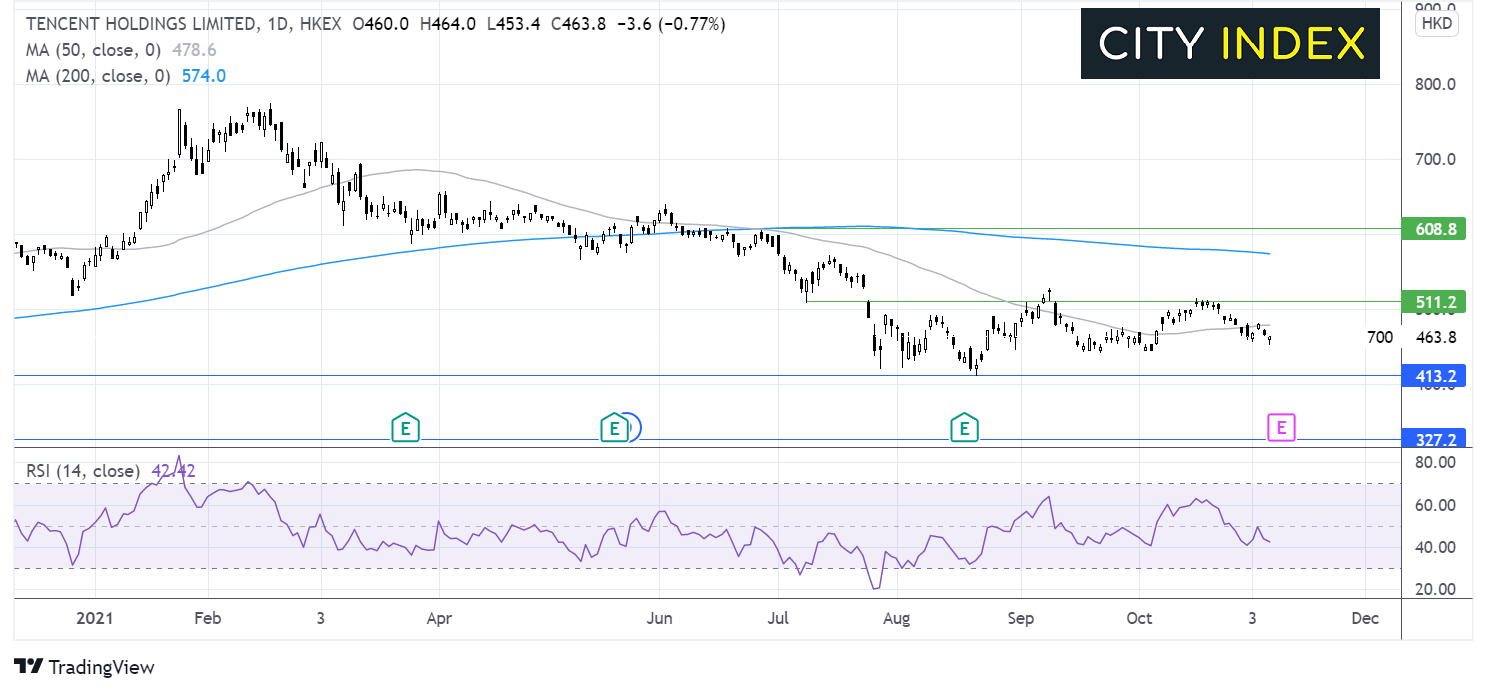

Tencent shares have plunged over 39% since hitting all-time highs in February, driven by the evolving regulatory clampdown on large, digitally-driven businesses in China. The majority of Tencent’s sprawling empire is set to be impacted as a result, from gaming and video content to ecommerce and online advertising.

The situation remains volatile and is still evolving, with the crackdown likely to drag on considering it is part of a five-year plan to tighten rules and improve the economy. This is widely expected to lead to slower revenue growth, tighter margins and increased costs for Tencent as it tries to navigate the uncertain outlook.

But, for now, Tencent is expected to keep powering ahead. Wall Street expects Tencent to report revenue of RMB146.0 billion in the third quarter compared to RMB125.5 million last year, marking a new quarterly record. Meanwhile, analysts forecast adjusted operating profit will rise to RMB42.0 billion from RMB38.1 billion the year before, with diluted EPS at the bottom-line expected to drop to RMB3.06 from RMB3.96. EPS is also forecast to come under pressure and fall compared to what has been delivered in the first two quarters of 2021 (with diluted EPS of RMB4.92 in Q1 and RMB4.39 in Q2).

Diving deeper into the forecasts, here are revenue expectations for Tencent’s key divisions with comparisons from the year before:

- Value-added services: RMB76.0 billion versus RMB69.8 billion

- Gaming: RMB44.8 billion versus RMB41.4 billion

- Online advertising: RMB24.7 billion versus RMB21.4 billion

- Fintech and business services: RMB44.4 billion versus RMB33.3 billion

Attention is also paid to Tencent’s user growth on its social media platforms Weixin, WeChat and QQ. Below are expectations for user numbers (Monthly Active Users, or MAU) compared to the year before:

- MAU of Weixin and WeChat: 1,255.9 million versus 1,212.8 million

- Mobile MAU of QQ: 588.1 million versus 617.4 million

- Fee-based VAS registered subscriptions: 236.0 million versus 213.4 million

Eyes will also be on Tencent’s free cashflow after this plunged 39% year-on-year in the second quarter, when the company also swung to a net debt position from having a net cash position in the first. Analysts believe Tencent’s cashflow is sizeable enough to avoid any serious concerns, even if this is expected to remain under pressure in the near-term. Plus, its sizeable investment portfolio, worth some RMB1,446.0 billion at the end of the second quarter, can provide significant headroom if it was needed.

The regulatory risk attached to Tencent has increased markedly this year, evidenced by the significant fall in the share price this year despite the fact its financial performance has continued to improve. Still, brokers remain bullish on Tencent’s long-term prospects and believe the selloff in 2021 has been overdone, with an average target price of HKD636.46 – implying there is over 37% potential upside from the current share price of HKD464.0.

Where next for the Tencent share price?

After hitting an all-time high in mid-February, the Tencent share price has been trending lower. More recently the price has been in consolidation mode, with HKD$511 capping gains and HKD$413 limiting losses.

The RSI is mildly bearish and the price trades below its 50 sma. Sellers might look for a break-out trade below HKD$413 to target the post pandemic low of HKD327.

Buyers may wait for a move over HKD$511 to expose the 200 sma at HKD$575 and the late June high of HKD$605.

How to trade Tencent shares

You can trade Tencent shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tencent’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade