When will Shell release Q3 earnings?

Royal Dutch Shell will release third quarter earnings on the morning of Thursday October 28.

This will set the stage ahead of BP - its main rival in London – reporting earnings next week.

Shell Q3 earnings preview: what to expect from the results

Shell’s recovery from the pandemic is expected to have continued to gain pace in the third quarter, underpinned by the rapid rise in oil and gas prices this year. A surge in demand led by the global economic recovery from the pandemic twinned with tight supply has pushed Brent and natural gas prices past pre-pandemic levels and to their highest level since 2014.

Adjusted Ebitda on a current cost of supply basis – Shell’s headline profit measure – is forecast to almost double year-on-year to $14.61 billion from $7.95 billion as a result.

Shell is expected to report adjusted earnings of $5.31 billion in the third quarter, according to a company-compiled consensus. Not only would that be up from just $955.0 million the year before but it would also be greater than the $4.86 billion profit booked during the entirety of 2020 – demonstrating the degree of improvement seen in the oil industry this year.

Importantly, Shell has already revealed that adjusted earnings will take a hit of between $350 million to $500 million as a result of Hurricane Ida that hit the US in late August, leaving a trail of destruction and causing significant disruption to the oil industry’s onshore and offshore operations. However, with Shell having warned of this earlier this month, this should already be largely priced-in.

Adjusted EPS is forecast to stay flat from the second quarter at $0.71 in the third, up from just $0.12 last year, according to consensus figures from Reuters. Reported EPS, which includes all one-off charges, is expected to rise to $0.77 from just $0.06.

The strong improvement in results should provide further fuel for Shell to step-up shareholder returns. The company prioritised debt reduction during the pandemic but achieved its goal to get net debt down to $65 billion six months earlier than planned in the second quarter, allowing it to rebase the dividend and restart buybacks. Shell had net debt of $65.7 billion at the end of June compared to over $77 billion a year earlier, prompting it to pay a 24 cent dividend (vs 17.35 cents in Q1) and launch a $2 billion buyback in the last quarter.

Still, quarterly dividends remain almost half the levels Shell was paying before the pandemic hit – having dished-out $0.47 per share in the final quarter of 2019. The company is eager to restore shareholder payouts and the improving environment could prompt Shell to step-up dividends again in the third quarter.

Where next for the Shell share price?

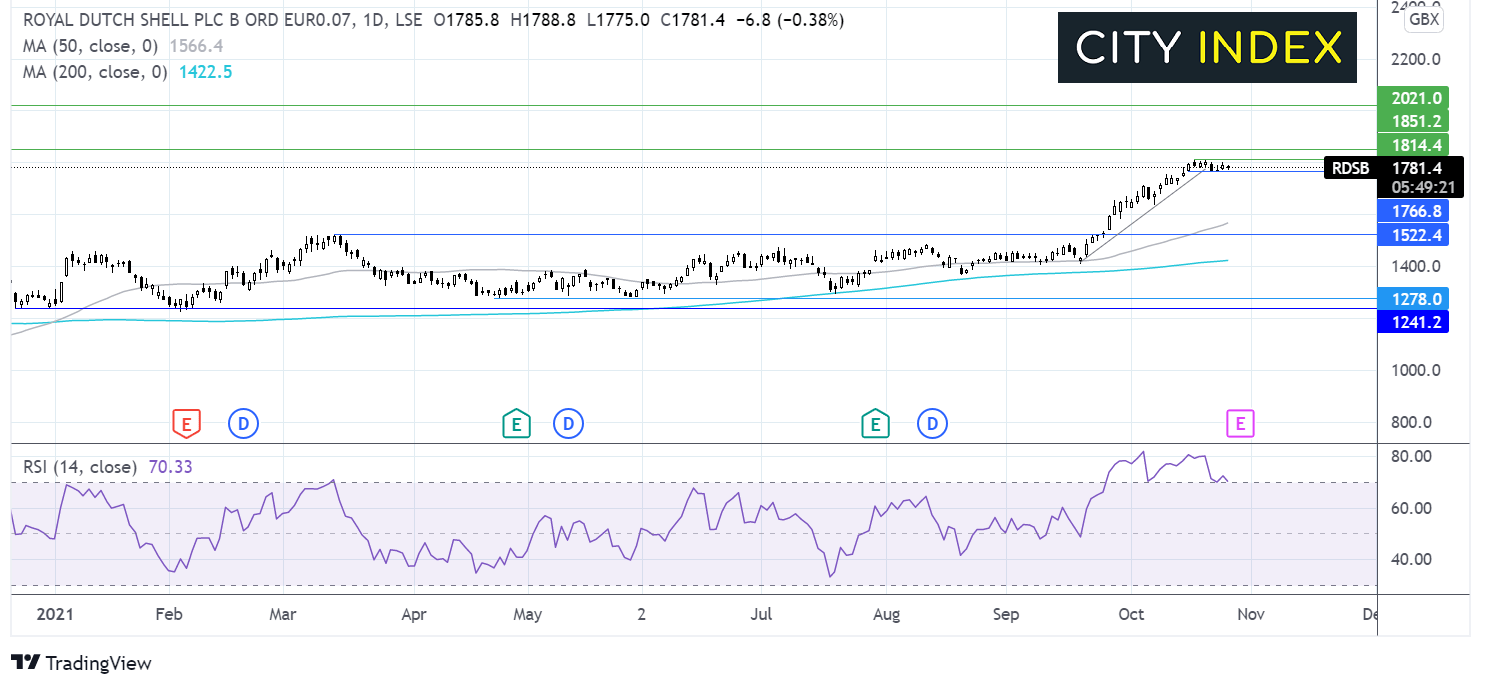

After trading around the 1400p mark for most of the year the Royal Dutch Shell share price surged higher from mid-September. The price rallied 27% to a post pandemic high of 1812p and the RSI tipped into overbought territory.

The price is consolidating at this level, trading in a holding pattern which is bringing the RSI back below 70.

Buyers will be looking for a move above 1812p to target 1850p before looking towards 2020p, the March 2020 high.

Meanwhile sellers could look for a close below 1760p for further losses.

How to trade Shell shares

You can trade Shell shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Shell’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade