When will Rolls Royce release its next set of results?

Rolls Royce is scheduled to release a trading update covering the 11 months to the end of November 2021 and provide an outlook for the remainder of the year on the morning of Thursday December 9.

Rolls Royce earnings preview: what to expect from the results

Rolls Royce should have delivered an improved performance since the end of the first half as the airline industry started to bounce back and restrictions began to ease, but the primary focus will be on the outlook going forward as it approaches the end of the year and how the new Omicron variant threatens to derail the recovery.

Rolls Royce: Full year expectations

Rolls Royce will provide an updated outlook for the full year when it releases results.

The key metric to watch will be free cashflow. Rolls Royce has been burning through cash during the pandemic, having reported an outflow of £1.17 billion during the first six months of the year. The company said it would start generating positive free cashflow sometime during the second half, but this will not be enough to offset the rest of the year. As a result, Rolls Royce has said it will report an annual outflow of between £2.0 billion to £4.2 billion – with a wide range providing room for this to be tightened.

Below is an outline of what analysts expect over the full year, according to consensus numbers taken from Reuters and Bloomberg. Notably, markets believe free cashflow will be toward the better-end of its guidance range and that Rolls Royce can squeeze out a small profit at the bottom-line following the heavy pandemic-induced losses seen last year:

|

(£, millions) |

FY2020 |

FY2021E |

|

Underlying Revenue |

11,763 |

11,754 |

|

Underlying Operating Profit |

(1,972) |

412.4 |

|

Reported Pretax Profit |

(2,910) |

51.3 |

|

Adjusted EPS (pence) |

(66.78) |

(0.78) |

|

Reported EPS (pence) |

(52.95) |

(0.09) |

|

Free Cashflow |

(4,185) |

(2,018) |

Rolls Royce has no debt maturing until 2024, giving it headroom and time to start generating cash again. Still, it had around £7.5 billion of liquidity at the end of June, including £3.0 billion in cash, suggesting it has the resources needed to weather another storm. Rolls Royce’s first priority for cash is to strengthen the balance sheet to recoup its investment grade credit profile followed by investment, after which it will consider returning surplus cash to investors. Importantly, Rolls Royce raised £5 billion last year to help shore up the balance sheet, including £2 billion from investors through a rights issue.

Rolls Royce: Divisional breakdown

Below is an outline of analyst expectations for the company’s three core divisions over the full year and how they performed in 2020:

|

Underlying Revenue (£, mns) |

FY 2020 |

FY2021E |

|

Civil Aerospace |

5,089 |

5,132.9 |

|

Defence |

3,366 |

3,389.8 |

|

Power Systems |

2,745 |

2,952.1 |

|

Underlying Operating Profit |

FY 2020 |

FY2021E |

|

Civil Aerospace |

(2,574) |

(128.9) |

|

Defence |

448 |

455.7 |

|

Power Systems |

178 |

272.2 |

Rolls Royce’s core business is supplying the engines for commercial aircraft and being paid for maintaining them, meaning a large proportion of revenue is based on the amount of time they are in the air. This has understandably been hit hard by the pandemic as travel restrictions have hamstrung airlines over the past two years. In fact, the number of flying hours booked by its large engines was equal to just 43% of pre-pandemic levels in the first half. Importantly, Rolls Royce has said it expects to deliver £750 million in free cashflow (excluding disposals) within 12 months of flying hours returning to 80% of pre-pandemic levels. It had originally said it expected this to occur before the end of 2022, but warned earlier this year that this could take longer due to the uneven and unpredictable nature of the industry’s recovery.

Although we have seen airlines start to make a recovery in recent months as restrictions have eased, the emergence of the Omicron variant injects fresh uncertainty into the outlook and prolongs the travel industry’s recovery. As a result, analysts believe the civil aerospace division will deliver mild topline growth versus last year, although losses are expected to significantly improve thanks to Rolls Royce’s efforts to make its business more efficient, with the majority of the 9,000 roles to be cut by the end of 2022 to be made in this division. The impact of the Omicron variant on the travel industry and Rolls Royce’s outlook will be the key thing to watch out for this week.

Meanwhile, its defence division is forecast to report a minor topline improvement this year but deliver lower profits. The company said the second half will be tougher than the first, but said around 70% of its expected revenue in 2022 is covered by the order book.

Its smallest unit, power systems, is expected to deliver the biggest improvement in both revenue and profits this year. Rolls Royce has said its end markets should largely recover by the end of 2021 and that revenue will return to pre-pandemic levels by 2022.

Rolls Royce: Asset disposals

Rolls Royce is currently readjusting its portfolio by offloading non-core businesses. The aim is to reduce the capital intensity of the company and generate at least £2.0 billion in proceeds by ‘early 2022’. Plus, the restructuring, which has seen it cut 8,000 roles so far, is set to deliver an additional £1.0 billion of cost savings to be delivered in 2021. It plans to cut another 1,000 roles and save another £300 million by the end of 2022.

Since its last update covering the first half of 2021, Rolls Royce has completed the sale of its civil nuclear instrumentation and control business, agreed to sell its interest in AirTanker Holdings for £189 million and struck a deal to sell ITP Aero for EUR1.7 billion in proceeds – with the deal set to generate the bulk of targeted proceeds when it closes in the first half of 2022.

Rolls Royce: Nuclear ambitions

With much of the business still subdued thanks to the pandemic, Rolls Royce has started to branch out into new areas such as electricals and small modular nuclear reactors in the hope of generating new growth.

The company announced in November that it had established the Rolls Royce Small Modular Reactor business with partners BNF Resources and Exelon Energy to invest around £195 million over three years, allowing it to access a further £210 million in government funding. The company has been established to ‘deliver a low cost, deployable, scalable and investable programme of new nuclear power plants’. The trio plan to seek more funding but is now progressing plans to build a number of small nuclear reactors to help the UK improve energy generation capacity while meeting clean energy and climate change targets. They also hope other countries will take-up the technology.

This new area of technology opens the door for nuclear capacity to be added quicker and cheaper than a traditional plant. Instead, the firm is hoping the bulk of construction can be conducted in factories and simply assembled at the desired location, with capacity building-out by adding more smaller reactors.

This will be a slow burner for now, with the first plant not expected to be hooked-up to the UK’s power grid until the early 2030s. Still, investors will hope to see progress is being made both operationally and in terms of funding.

Rolls Royce: Broker recommendations

Brokers have a very mixed view on Rolls Royce’s prospects over the next 12 months. Of the 17 brokers covering the stock, three rate it as a Strong Buy, two at Buy, seven at Hold, three at Sell and two at Strong Sell. Overall, the average rating is Hold and the target price sits at 121.44p – some 3% below the current share price.

Where next for the Rolls Royce share price?

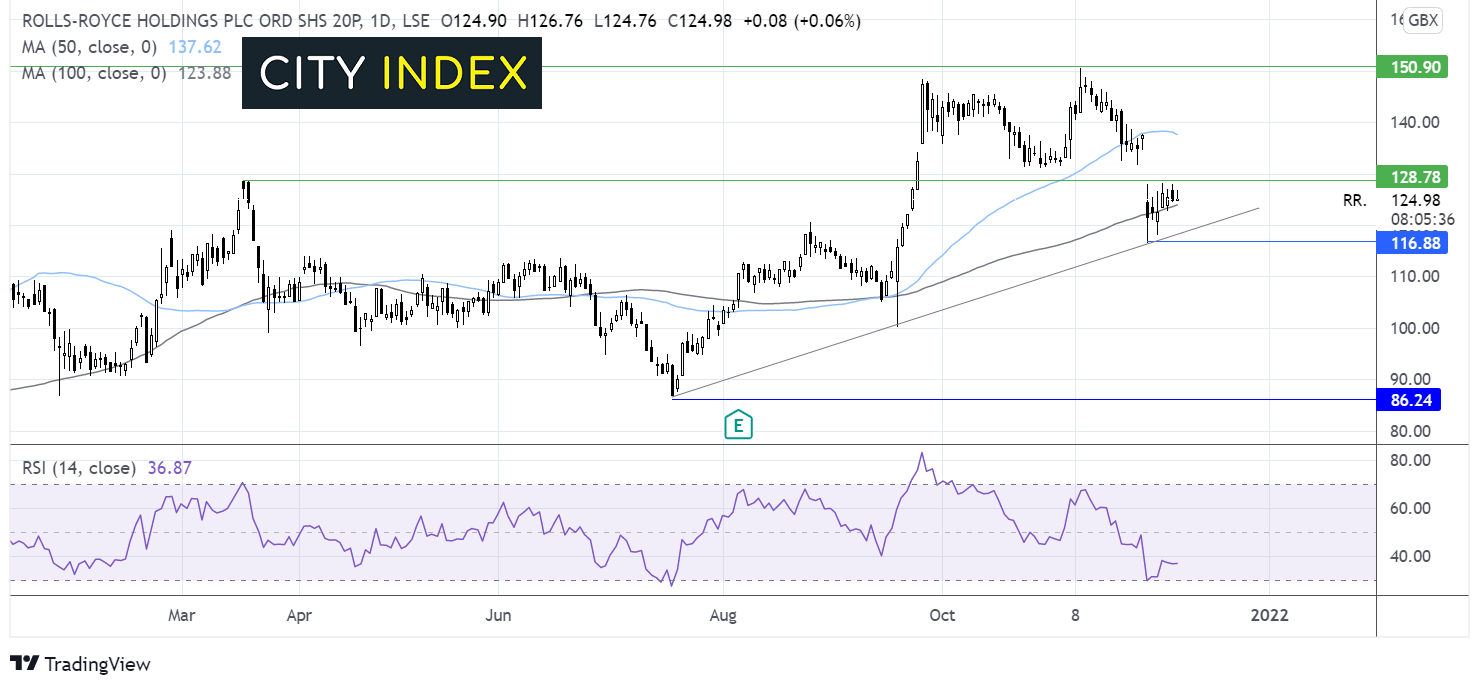

The Rolls Royce share price faced rejection for a second time at 150p in early November, falling lower to 116p.

The share price has rising from the six-week low of 116p, pushing back above its 100 sma. However, the recovery has so far been capped by 129p, the March 18 high.

The RSI is supportive of further losses and, combined with the shooting star candlestick, suggests that there could be more downside to come.

Sellers will look for a move below the 100 sma at 124p to negate the near-term uptrend. A move below 116p could see sellers gain traction.

Meanwhile buyers will look for a move over 129p and 131p, the October low, to expose the 50 sma at 137p.

How to trade the RR share price

You can trade Rolls Royce shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Rolls Royce’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade