When will Pfizer release Q3 earnings?

Pfizer is scheduled to release third quarter earnings on Tuesday November 2.

Pfizer Q3 earnings preview: what to expect from the results

The Covid-19 vaccine developed by Pfizer, as well as its German partner BioNTech, has transformed the business this year. Pfizer is set to ship 2.1 billion doses of its jabs – one of the most widely-used around the world - this year and reap a staggering $33.5 billion in sales. For context, the rest of Pfizer’s wider business is forecast to generate sales of $44.5 to $46.5 billion.

As orders for the vaccine continue to flood-in, Pfizer has upgraded its guidance on several occasions this year. When it made the last upgrade back in July, it said it is targeting annual 2021 revenue of between $78.0 billion to $80.0 billion with adjusted EPS of $3.95 to $4.05. If achieved, that would deliver impressive growth from the $41.9 billion in revenue and EPS of $2.22 booked in 2020.

Notably, analysts believe Pfizer can beat that guidance with consensus numbers from Bloomberg showing Wall Street is forecasting Pfizer will deliver annual revenue of $81.0 billion and EPS of $4.11, prompted by strong demand for its vaccine. This is a signal in itself that Pfizer could upgrade expectations once again when it releases third quarter earnings.

Wall Street is expecting Pfizer to report revenue of $22.71 billion in the third quarter. That would be up 87% from the $12.13 billion in sales booked the year before, marking a slight acceleration in topline growth from the 86% year-on-year rise reported in the last quarter.

Adjusted EPS is forecast to increase to $1.09 from $0.72 with reported EPS expected to jump to $1.03 from just $0.39 the year before.

There seems little doubt that 2021 will be a blowout year for Pfizer, with demand for its vaccine poised to almost double overall revenue. However, analysts are far more uncertain going into 2022. Vaccine sale estimates for 2022 are wide-ranging, from as low as $9 billion to as high as $34 billion, according to numbers from Bloomberg. The reason for the large gap between forecasts is largely down to the uncertainty over how developed nations will use booster shots going forward and because more sales will shift to lower-and-middle-income countries, where the economics may different. Markets would welcome any update that could allay concerns over vaccine sales next year, although they may have to wait for the fourth quarter earnings to get a full picture.

Pfizer shares are currently trading over 24% higher than pre-pandemic levels but have lost steam since hitting fresh all-time highs in August. The 22 brokers covering the stock currently have a Hold rating on Pfizer but the average target price of $46.45 implies there is over 8% potential upside from the current share price.

Where next for the Pfizer share price?

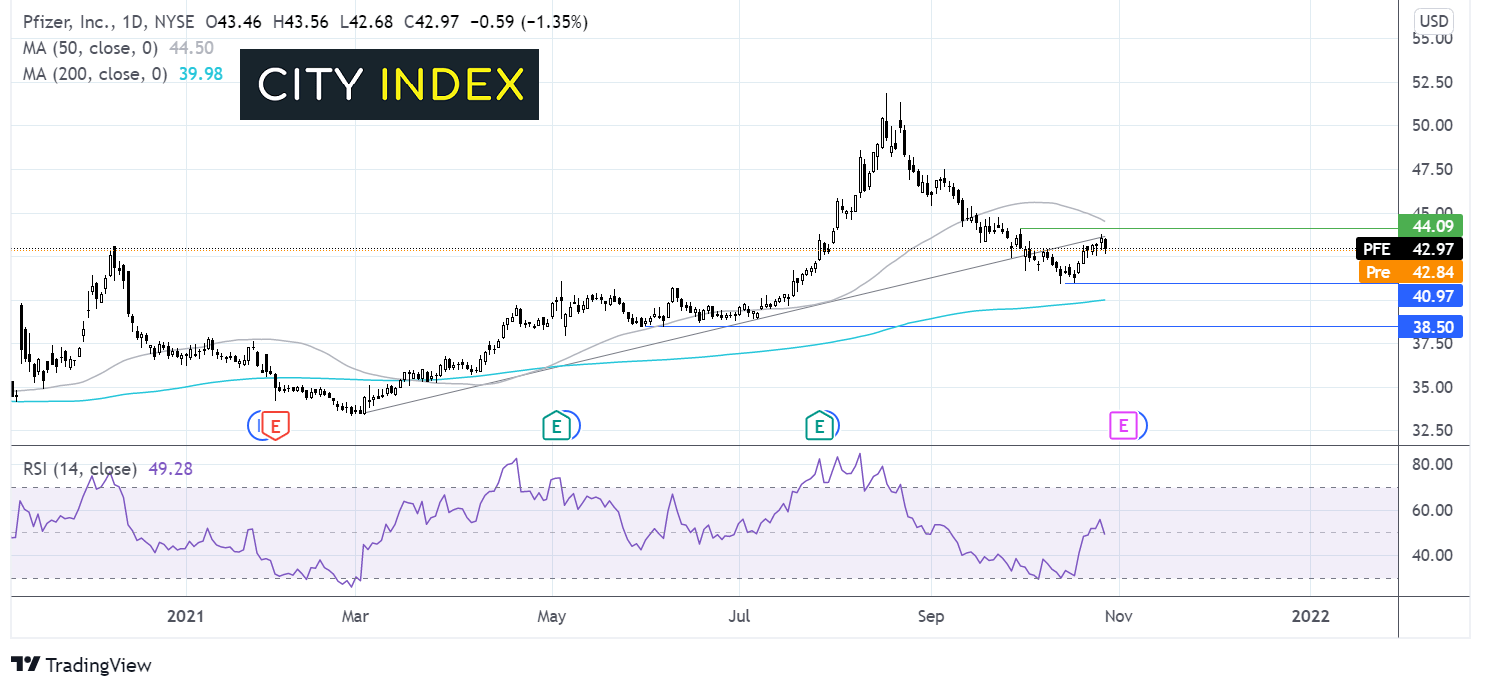

The Pfizer share price steadily trended higher across the year accelerating the runup to $51.86, the all-time high hit in mid-August. The price then trended lower finding support at $41.

The price is extending its rebound from $41, the 3-month low, and is attempting to retake the ascending trendline dating back to early March.

Buyers will be looking for a move over $44 the monthly high and $44.50 the 50 sma in order for bulls to gain traction.

Meanwhile, sellers are looking for a move below $41 which would expose the 200 sma at $40. Beyond here, the stock could eye $38.50.

How to trade Pfizer shares

You can trade Pfizer shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Pfizer’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade