When will PayPal release Q3 earnings?

PayPal is scheduled to release third quarter earnings on Monday November 8.

PayPal Q3 earnings preview: what to expect from the results

PayPal continues to acquire new customers while getting its burgeoning user base of over 403 million accounts to spend more money more frequently, and markets are expecting another solid performance when it releases its next set of earnings.

The company is eyeing strong double-digit topline growth this year despite the fact it is facing tough comparatives from 2020, when lockdowns sparked a boom in online payments as commerce shifted online, demonstrating the strength of PayPal’s position in the market and the vast room left to keep growing.

Total payment volume grew 40.3% year-on-year in the second quarter to $311.0 billion and analysts believe this will grow further to hit a new record of $313.6 billion in the third quarter, which would be up 41.5% from last year.

Analysts anticipate PayPal added 13.3 million net new active accounts in the third quarter, accelerating from the 11.4 million acquired in the second. The rate of growth has slowed markedly from the surge in demand seen last year, with PayPal having added 21.3 million new customers in the third quarter of 2020.

PayPal has said it is aiming to grow payment volumes by 33% to 35% and add 52 million to 55 million net new active accounts over the full year.

Wall Street forecasts net revenue will stay flat from the previous quarter at $6.23 billion, at the upper end of PayPal’s guidance, and rise from the $5.45 billion reported a year ago. GAAP EPS is expected to come in at $0.72, above the guided $0.68, compared to $0.86 the year before, with adjusted EPS to stay flat at $1.07.

PayPal upgraded its guidance for the full year in the last quarter and is targeting 20% net revenue growth at constant currency to $25.75 billion. Guidance is for GAAP EPS to dip to $3.49 from $3.54 but for adjusted EPS to jump 21% to $4.70.

Investors will be expecting updates on newer aspects of the business in the hope that they can provide further catalysts. It has made waves in the fast-growing Buy Now, Pay Later (BNPL) market after bolstering its ammunition with the acquisition of Plaidy, as well as the recent initiative to scrap fees for late payments. Meanwhile, eyes will be on Venmo’s performance and how it is faring, now that its service to allow customers able to buy, sell and hold cryptocurrencies has fully ramped-up since being introduced in April. There is also likely to be news on its latest acquisitions of Chargehound, Happy Returns and Curv.

There could also be some questions around Pinterest during the earnings call with management after PayPal implied the door to a deal could still be ajar after stating ‘it is not pursuing an acquisition of Pinterest at this time’ last month following reports it was set to buy the social media platform at a large premium – an idea that was not well received by markets.

PayPal shares have gained over 84% since the start of the pandemic but have plunged by over 26% since hitting all-time highs in July. Brokers are extremely bullish on PayPal’s prospects and believe it can easily achieve new highs. They currently have a Buy rating on the stock and an average target price of $325.93, implying there is over 43% potential upside from the current share price.

Where next for the PayPal share price?

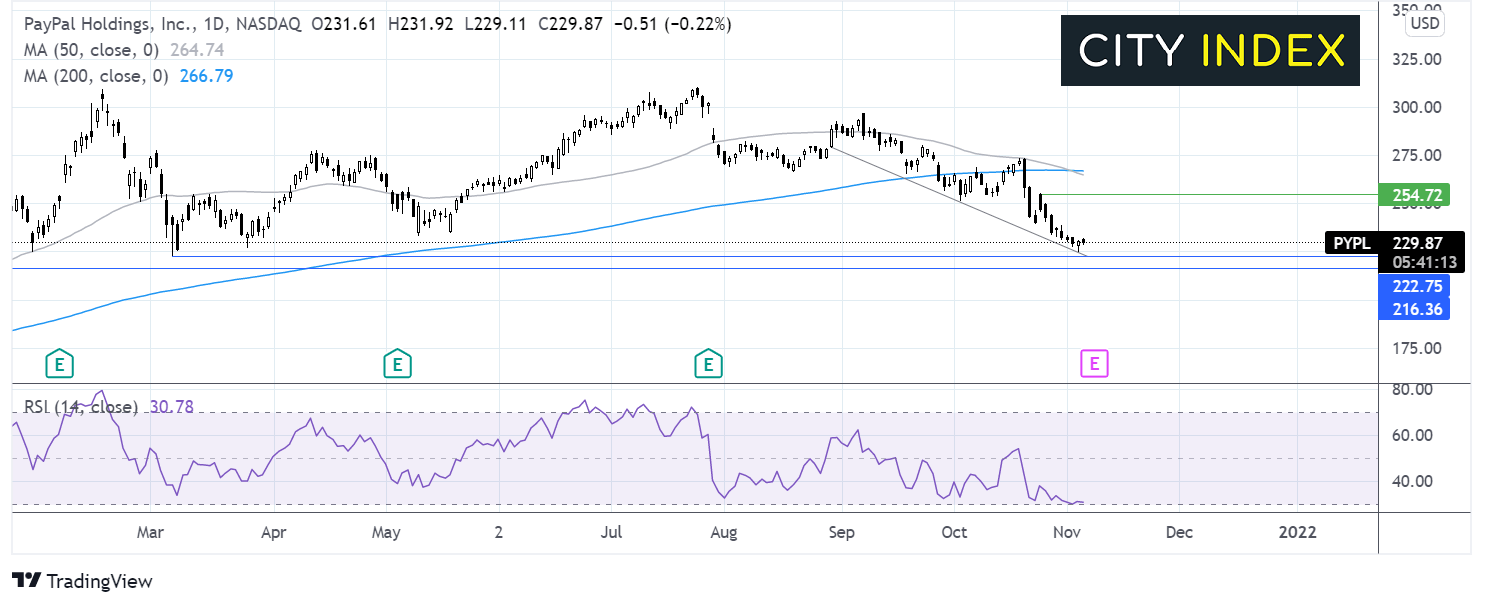

After hitting an all-time high of $310.16 the share price has been forming a series of lower highs and lower lows.

The most recent leg lower has taken the share price below the 50 & 200 sma. The 50 sma is also crossing below the 200 sma in a death cross pattern. However, the RSI is approaching oversold territory so much consolidation or an ease higher could be on the cards.

Strong support can be seen around $223 the year to date low and the falling trendline support. A break below here could open the door to $216, the October 2020 high.

Any meaningful recovery would need to retake $254 to negate the near-term downtrend and expose the 50 sma at $264.

How to trade PayPal shares

You can trade PayPal shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘PayPal’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade