When will Nike release Q4 results?

Nike will release fourth-quarter and full-year results after the markets close on Thursday June 24. This will cover the three-month and 12-month periods to the end of May.

What to expect from the Nike results

Since bottoming-out from its pandemic-induced fall in early 2020, Nike shares have risen over 92% despite falling back since hitting an all-time high in January 2021.

That has been the result of Nike proving highly resilient in what has been a tough year for retailers and clothing brands. The pandemic has hit the ability to shift apparel and footwear in both its own stores and that of its partners. Over half of all its own stores were closed at the end of the third quarter and over one-third of all stores in EMEA were still shut. However, its focus on selling more directly to the consumers and its strong digital offering have allowed it to navigate the challenging environment and continue to deliver growth.

Analysts are expecting fourth-quarter revenue to jump to just over $11.00 billion from only $6.31 billion the year before, and turn to diluted earnings per share of $0.51 from a $0.51 loss. Notably, Nike is coming up against weak comparatives as the three months to the end of May 2020 was when the pandemic erupted and lockdowns started to be introduced.

Nike is expected to report a strong performance in North America, spurred on by the fact lockdown has eased at a time when consumers are flush with cash thanks to stimulus cheques and tax refunds. The May Footwear Survey by Pivotal Research has suggested that people are still buying athletic footwear for running, walking or hiking even as social distancing rules are relaxed.

The question will be how well Nike capitalised on any pent-up demand in the region after it warned that sales suffered in the third quarter because of container shortages and congestion at ports. North America sales were down 11% in the third quarter as a result, but investors will hope these problems have unwound and the weak comparatives from the year before should help.

However, eyes will also be on its performance in China after Nike got caught-up in a boycott of several Western brands. China accounts for around one-fifth of Nike’s sales but reports surfaced in May that sales on Tmall, the country’s largest B2C selling platform, plunged 59% year-on-year in April. The boycott has been in response to Nike and a number of other companies, including Adidas and H&M, over their promises to stop using cotton from Xinjiang. With this in mind, investors will want to see how sales in China have been affected after jumping 42% in the third-quarter.

For the full-year, Wall Street is anticipating revenue will rise to $43.23 billion from $37.40 billion and for diluted EPS to almost double to $3.14 from $1.60.

Investors can feel safe in the knowledge that the dividend is likely to grow considering it has been raised for 19 consecutive quarters, and Nike also intends to restart its share buyback programme when it releases its results this week after suspending it a year ago in light of the uncertainty caused by the pandemic.

Where next for the Nike share price?

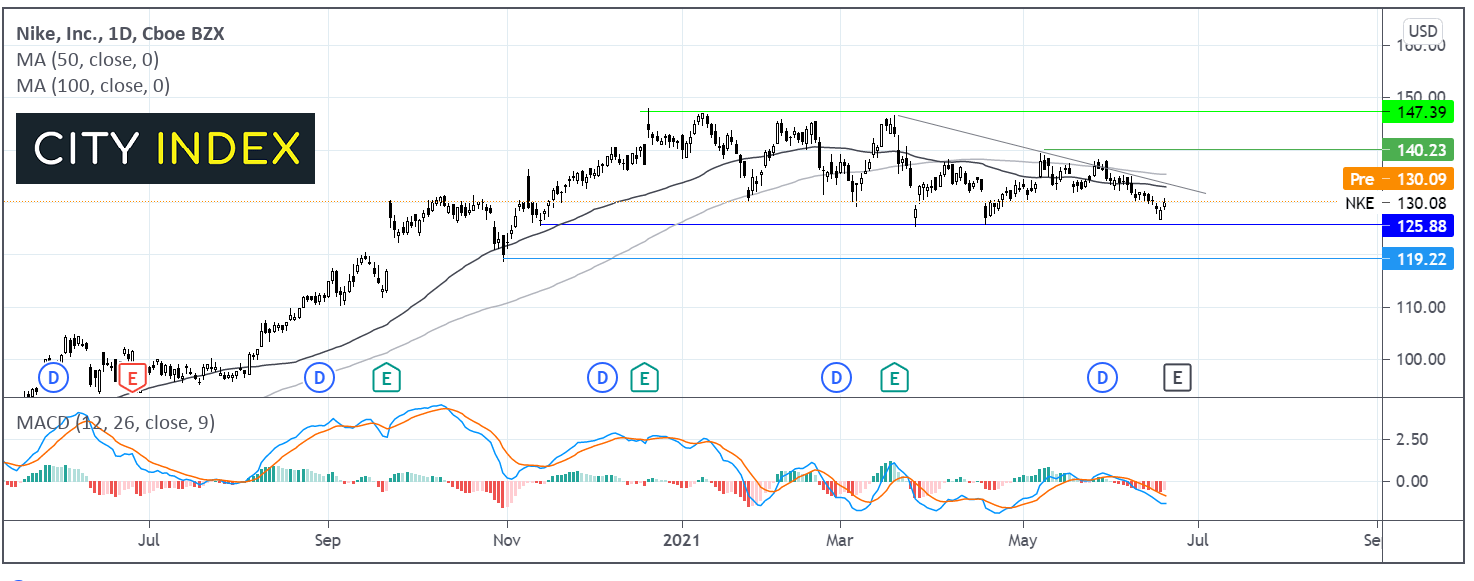

The Nike share price trended high across the second half of last year before hitting an all-time high of $147. Despite several repeated tests of this level Nike failed to break higher and instead has been forming a series of lower highs since mid-March.

Nike trades below its multi month descending trendline. The bearish MACD is keeping the sellers hopeful of further downside.

Any move lower needs to break below $125 a level which has limited losses on several occasions across the past three months. A break below this level could open the door to further declines towards $120 the low October 30.

Any meaningful recovery would need to break through strong resistance between $133-$135 made up of the confluence of the 50 & 100 DMA and the descending trendline. A break above this zone and horizontal resistance at $140 could put the bulls firmly back in control.

How to trade Nike shares

You can trade Nike shares with City Index by following these four steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Nike’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade