When will Etsy release Q3 earnings?

Etsy is scheduled to release third quarter earnings after US markets close on Wednesday November 3.

Etsy Q3 earnings preview: what to expect from the results

Etsy has reaped rewards since the start of the pandemic, having attracted millions of new buyers and sellers as people’s shopping habits shifted online. However, growth has passed its pandemic-induced peak and Etsy now has a job of putting the wave of new business it has secured over the past 18 months to work.

For example, at its peak, Etsy added 12.8 million new buyers in the fourth quarter of 2020 but that slipped to 9.6 million in the first quarter of 2021 and then down to 8.0 million in the second. Analysts are expecting it to add another 8.0 million in the third. However, while growth in the number of people using its platform has slowed it is still growing at a double-digit rate. Analysts expect new buyers to jump 32% year-on-year in the third quarter and hit 91.8 million in total, while forecasts suggest it will have ended September with 5.7 million sellers compared to 5.2 million at the end of June.

However, buyers on the platform are shopping more frequently and spending more money. Gross merchandise sales per new buyer crept up to $46 in the second quarter from just $37 a year earlier, repeat orders have increased in frequency and the number of habitual buyers – those that make the most frequent orders and spend the most money – jumped to almost 8 million in the second quarter from just 3.7 million a year earlier.

The pandemic will have helped to improve engagement. More people have become used to ordering more online, while others have set up their own businesses or side hustles amid the uncertainty that has plagued the economy. But Etsy has also been making improvements across its platform, ranging from better search results thanks to XWalk being launched in the second quarter to a surge in the number of video listings being made by sellers. It has also improved its delivery system to provide more timely and accurate shipments to buyers, while also beefing-up Etsy Ads. Meanwhile, international growth has continued to outpace the US as it expands in other countries such as Germany. Investors will be keenly on the look out for how these new elements have helped drive growth in the latest quarter, alongside any new projects that could help drive engagement further.

We also saw Etsy complete the acquisition of clothes reselling platform Depop and Elo 7, a Brazilian platform that focuses on handmade and craft goods just like Etsy’s core platform. The two platforms, alongside musical instrument recommerce site Reverb, means Etsy now has a broad range of apps to grow and new areas to expand into. All three units remain relatively small in the grand scheme of things, but provide huge opportunity in the core resale market that Etsy focuses on.

Etsy has said it is targeting revenue of $500 million to $525 million in the third quarter. Wall Street is forecasting revenue will rise to $518.9 million from $451.5 million the year before. The company has also guided for a 25% adjusted Ebitda margin (or 28% excluding Depop and Elo7), which would be down from 33.5% last year. Notably, Etsy has said its capital-light model should allow it to keep on investing while maintaining profitability.

Lower profitability and ongoing investments will contribute to a deterioration in earnings in the third quarter. Analysts expect net income to drop to $78.7 million from $91.8 million the year before. Diluted EPS is seen falling to $0.54 from $0.76.

Etsy shares traded close to $53 before the pandemic hit in February 2020 but today trade at over $250, demonstrating the huge success the company has had over the past year and a half. That has seen its value explode to over $31 billion from around $6 billion. The stock currently trades at all-time highs, but brokers believe the recent rally has been slightly overdone with an average price target of $235.5, implying Etsy is around 7% overvalued at present.

Where next for the Etsy share price?

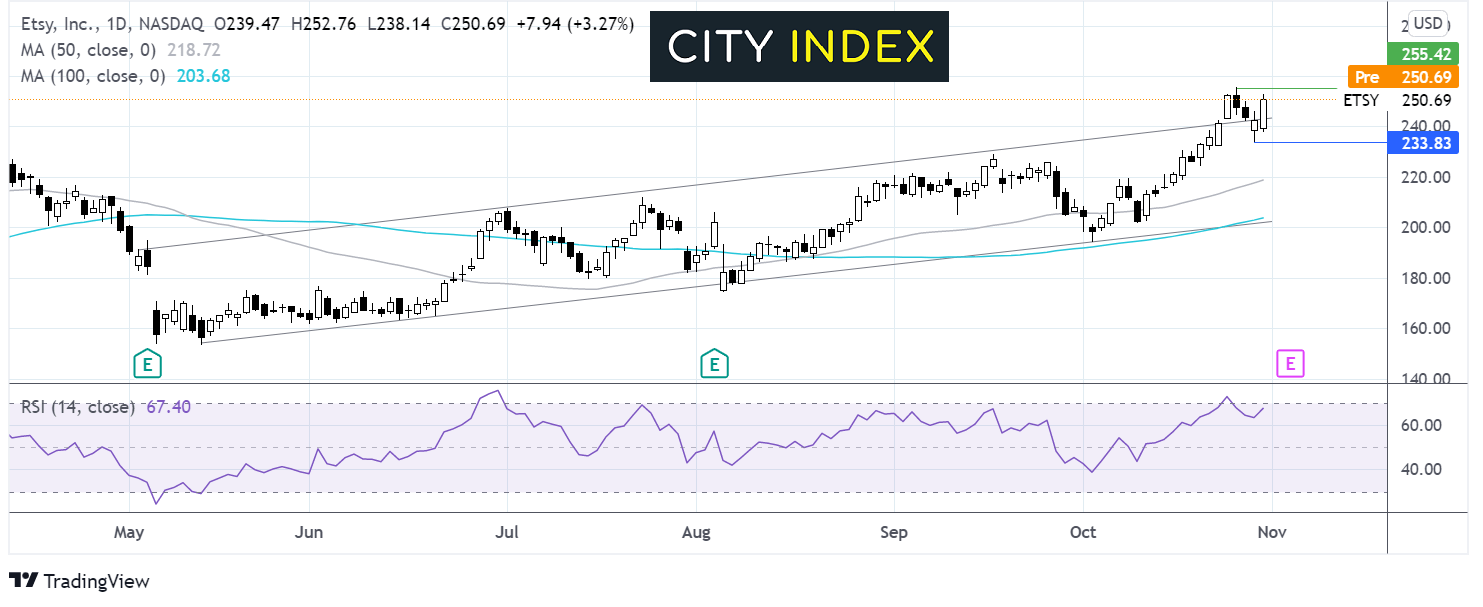

The Etsy share price has been steadily trending higher since May. It trades within an ascending channel from this date, breaking out to the upside of the channel last month.

The RSI is supportive of further upside whilst it remains out of overbought territory.

Buyers will be looking for a move over $255 for fresh all-time highs.

Meanwhile, support can be seen at $243 the upper band of the channel resistance turned support. It would take a move below $232 to negate the near term up trend and expose the 50 sma at $220.

How to trade Etsy shares

You can trade Etsy shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Etsy’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade