When will Burberry release H1 earnings?

Burberry will release interim results covering the six months to late September on the morning of Thursday November 11.

Burberry H1 earnings preview: what to expect from the results

Burberry revealed that comparable sales were 1% ahead of pre-pandemic levels in the first quarter, instilling a buoyant mood ahead of the interim earnings this week. The luxury fashion brand has been reducing the discounts its offers after having to slash prices over the last 18 months, with full price sales up 26% from 2019 levels in the period, driven by demand for leather goods, outerwear and shoes.

The improvement is impressive considering Burberry’s business has historically been geared toward wealthy tourists looking to splash the cash on their holidays, which is still severely subdued due to the myriad of travel restrictions still in play. Still, strong demand in Asia, particularly in China and Korea, a rise in domestic spending, alongside a surge in digital sales has helped lift sales this year. Digital sales more than doubled in the first quarter compared to pre-pandemic levels.

An expansion in its retail space is also helping to drive higher sales, with Burberry continuing to open new stores under a refreshed image and concept in Asia alongside new flagship stores being opened in the UK. This is part of a wider plan to boost sales and improve its omnichannel offering.

Analysts forecast revenue will rise to £1.22 billion in the six months to late September from £877.7 million last year, when sales were severely hit by the pandemic and lockdown restrictions. Notably, that would be just shy of the £1.28 billion booked in the first half of the 2019 financial year, before the Covid-19 crisis began.

Adjusted operating profit is expected to jump to £174.2 million from just £51.0 million last year, but trail the £203.0 million booked in the first half of 2019. Adjusted diluted EPS is forecast to come in at 31.38p compared to 4.60p last year and 36.9p two years ago.

Profitability will be closely-watched considering a number of major headwinds. Demand will remain below optimal levels whilst tourism remains lacklustre and costs could come under pressure amid the widely-reported supply chain pressure that has been hitting all sorts of industries this year. Still, consensus numbers from Bloomberg suggest Burberry could report a gross margin of around 70% in the first half compared to 68.1% the year before. Meanwhile, Burberry’s target to improve its adjusted operating margin to 20% by the end of the 2023 financial year looks achievable but still highly sensitive to the volatile economic situation. The margin came in just 5.8% in the first half of the last financial year before significantly improving in the second half to average out at 16.8% over the full year.

Burberry is targeting annual high-single-digit percentage growth in revenue over the medium-term compared to what was delivered in the last financial year, underpinned by its focus on driving full price sales and reducing discounts. Comparable sales are seen rising by a mid-single digit percentage over the full year. Burberry also raised its guidance for wholesale revenue back in July and said this is expected to rise 60% in the first half thanks to a stronger order book as restrictions ease and retail stores reopen, having raised it from its original target of 50%.

Where next for the Burberry share price?

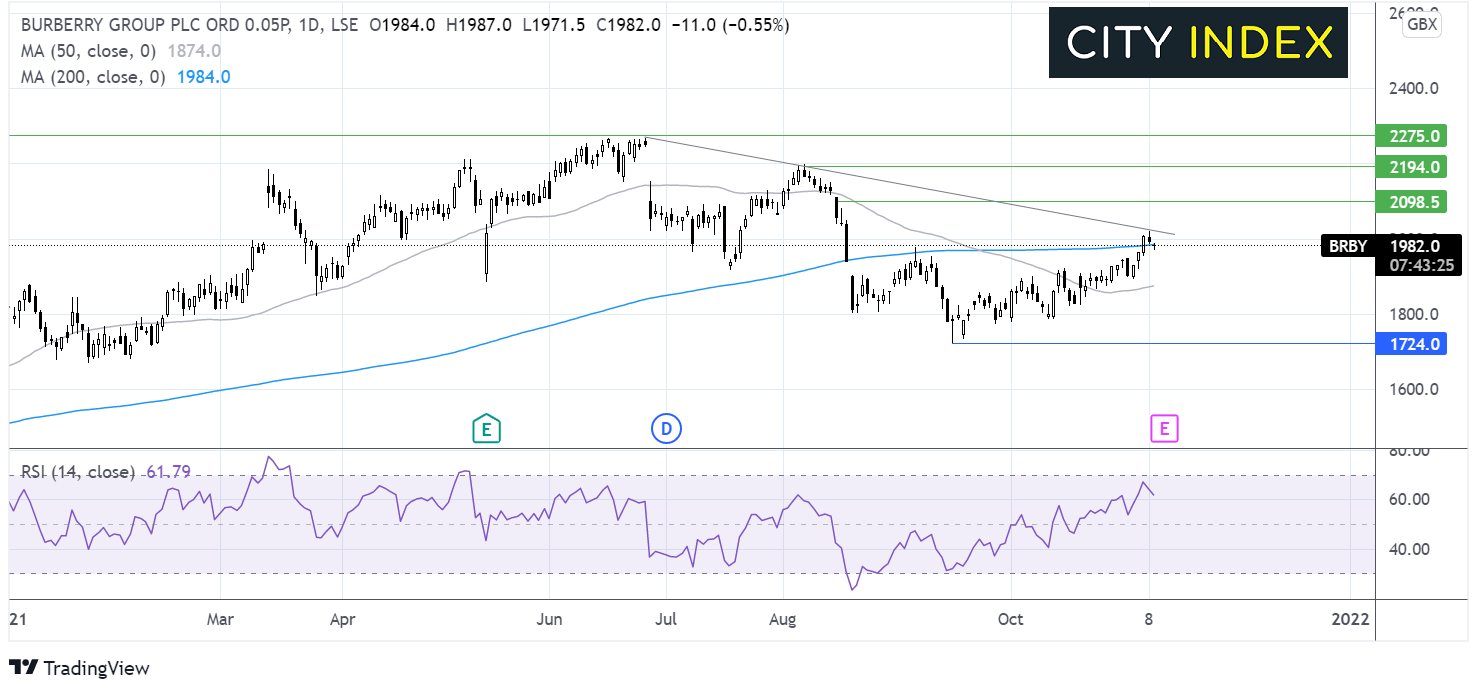

The Burberry share price scaled to fresh post pandemic high of 2267p in mid-June. From there, the share price trended lower reaching support at 1724p in mid-September.

The share price has been extending its rebound from 1724p, retaking the 50 sma and is currently testing the 200 sma at 1980p. The RSI is supportive of further upside.

A move beyond here brings the multi-month descending trendline into focus at 2018p, also the November high. Beyond here buyers could look towards 2100p round number and August 16 high and then 2194p, the August high.

On the flip side, failure to retake the 200 sma could see the share price ease back towards the 50 sma at 1870p and target 1724p, the September low.

How to trade Burberry shares

You can trade Burberry shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Burberry’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade