When will AMC Entertainment release Q3 earnings?

AMC Entertainment is scheduled to release third quarter earnings after US markets on Monday November 8.

AMC Q3 earnings preview: what to expect from the results

Although many businesses have started down the road to recovery as restrictions have eased this year, the ability to bounce back has been pressured by resurging Covid cases. For AMC, its revival has had the added element of being reliant on the studios releasing blockbuster titles in order to get audiences back in theatres.

Although the film slate remains highly sensitive to the evolving nature of the pandemic, the cinema industry has finally had some big-name titles to work with. The latest James Bond film, No Time to Die, had the most successful opening weekend than any film in the franchise’s history. Marvel’s Black Widow has been one of the highest-grossing films in the US this year despite Disney’s dual-approach with its streaming platform. And there have been other well-received titles such as the latest Venom film and Shang-Chi and the Legend of the Ten Rings.

Box office data suggests the Delta variant weighed on sales in late July and early August, but things have improved since then. AMC has already revealed that ticket sales (as well as food and beverage revenue) reached their highest level in October since February 2020, marking a post-pandemic record. That sets a mixed stage for the third quarter, but does suggest AMC and the wider industry has positive momentum heading into the fourth.

Still, while overall US box office sales were up 62% year-on-year in the third quarter, they remained less than half what was recorded in the same period in 2019 before the pandemic hit, showing the industry is still far from a full recovery.

Wall Street forecasts that AMC will report third quarter revenue of $713.3 million. That suggests this will be the strongest quarterly topline performance since the first quarter of 2020. That would be up from just $119.5 million the year before and from the $444.7 million booked in the second quarter of 2021.

Analysts expect AMC to report an adjusted Ebitda loss of $78.6 million, which would be narrower than the first two quarters of 2021 and smaller than the $334.5 million loss booked the year before. The net loss is expected to follow and narrow to $246.9 million from the $905.8 million loss last year, shrinking to a $0.50 loss on a per share basis from $8.41.

Currently, analysts believe the fourth quarter will improve further with estimates showing markets expect revenue to top $1.0 billion. The two biggest threats to the momentum are another resurgence in Covid cases prompting people to stay away from crowded spaces like movie theatres or new restrictions being introduced by governments, and any further delays to the film slate over the holiday season. We have already seen studios chop and change their schedule this year to ensure they reap maximum returns on their films and there is a chance that any changes to the Covid crisis could prompt them to push back titles into 2022. Major upcoming releases currently pencilled in the calendar before the end of 2021 includes Eternals and Spider-Man: No Way Home.

AMC boss Adam Aron, who has embraced the ‘Ape Army’ of retail investors that have sent the stock soaring, said earlier this year that the company could start generating positive cashflow again if US box office sales can hit $5.2 billion this year, but that has looked increasingly optimistic as the year has gone on. Bloomberg suggests the industry would need to sell a staggering $2.7 billion worth of tickets – more than what was achieved in the first three quarters of the year – in order to hit that goal. That suggests AMC will have to wait until 2022 to stop burning through cash unless the fourth quarter proves to be a blowout for the movie industry, and that is significant considering AMC needs cash to start paying-down its burdensome debt pile that stands at over $11 billion. AMC had over $2 billion of liquidity at the end of the second quarter, when it reported an operating cash outflow of $233.8 million.

AMC was valued at less than $500 million before finding itself at the centre of the retail trading frenzy in so-called meme stocks earlier this year, which sent the company’s valuation to as high as $31 billion in June. The stock has fallen over 36% since hitting those highs but is still worth over $20 billion today. While its faithful retail investors remain committed and believe AMC can go the moon, most believe AMC finds itself hugely overvalued following the volatile journey the share price has had this year. Brokers currently have a Sell rating on the stock and believe it is worth just $5.44 per share, some 86% below the current share price of $40.00.

Where next for the AMC share price?

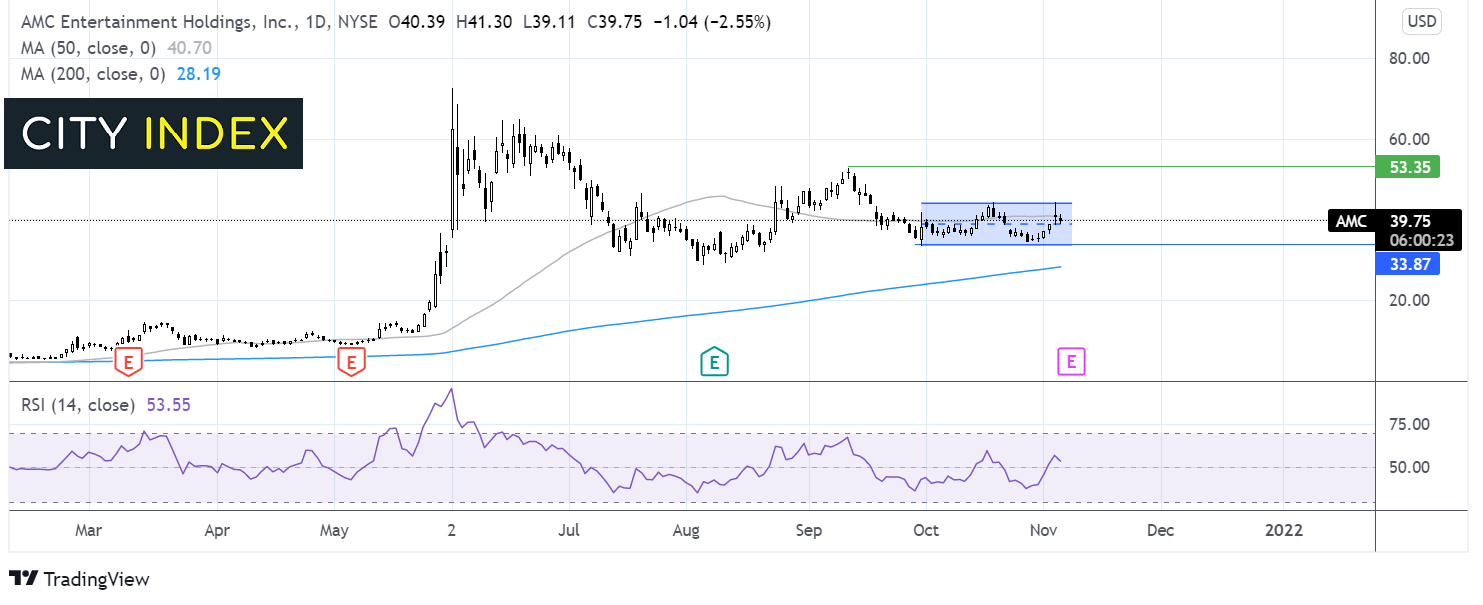

The AMC Entertainment share price rose to an all-time high on June 2 of $72.62. The share price has been on the decline since.

More recently the selloff has stalled with the price trading in a holding pattern, capped on the upside by $44.50 and on the lower side by $33.50.

The price trades on the 50 sma which is flat, and the RSI is also neutral.

Traders might look for a breakout trade with buyers looking for a move over $44.50 to target $52.80, the September high.

Sellers might look for a break below $33.50 to target the 500 sma and August low around $28.19.

How to trade AMC shares

You can trade AMC shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘AMC’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade