When will Airbnb release Q3 earnings?

Airbnb is scheduled to publish third quarter earnings after US markets close on Thursday November 4.

Airbnb Q3 earnings preview: what to expect from the results

Airbnb made a bold statement in its last quarterly update, stating that ‘people are ready to travel, and Airbnb is ready to host them’. That followed the company’s strong set of second quarter results that showed the number of nights and experiences booked was just 1% shy of pre-pandemic levels, showing that Airbnb has been among the swiftest recovery plays in the travel market.

The company warned that bookings and cancellation rates remain highly sensitive to the evolution of the Delta variant and that things are likely to remain volatile as a result. It has already revealed that bookings of nights and experiences will be lower in the third quarter compared to the second, largely down to seasonality.

However, that did not stop Airbnb from boasting that the third quarter would deliver record revenue, margins and adjusted Ebitda, which is its preferred profit measure for the underlying business.

Wall Street forecasts Airbnb will post third quarter revenue of $2.05 billion compared to just $1.34 billion the year before. That would also mark a strong improvement from the $1.33 billion posted in the second quarter of 2021, demonstrating the speed of its recovery this year.

Meanwhile, analysts forecast adjusted Ebitda will jump to $817.5 million from just $501.4 million last year and $217.4 million in the previous quarter. Airbnb posted a negative adjusted Ebitda margin in the first quarter of this year followed by a 16% margin in the second. Consensus numbers from Bloomberg suggest that could climb to as high as 40% in the third quarter. The significant improvement in profitability is set to be fuelled by the strong revenue growth twinned with a dramatic reduction in fixed costs, and lower variable spending on the likes of marketing following the most recent campaign launched in the first half, as well as lower support expense.

Adding further colour to the upcoming results, Wall Street expects a net profit of $497.3 million compared to the $219.3 million profit booked last year and the $68.2 million loss seen in the second quarter.

Airbnb shares have risen over 5% over the past month and currently trade at $174.30, having booked solid gains from its IPO price of $68 when it listed back in December 2020. Brokers currently have a Buy rating on the stock but only see 1.7% potential upside to the average target price of $178.56 following the recent increase.

Where next for the Airbnb share price?

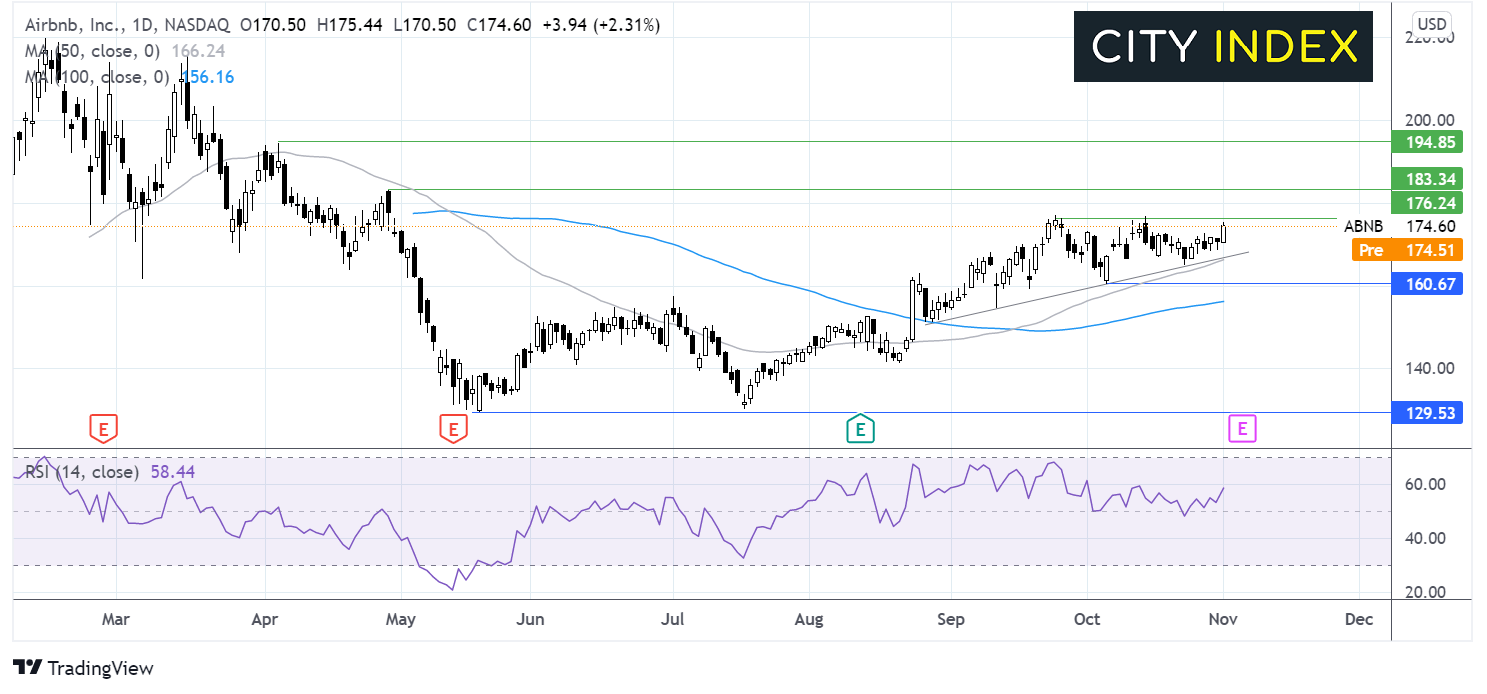

The Airbnb share price is extending its rebound from the double bottom reversal pattern at $130. The share price trades above its 50 & 100 sms with the 50 crossing above the 100 sma in a bullish signal.

The RSI is supportive of further upside, pointing northwards and in bullish territory.

Buyers could look for a move over $176, the September and October high, in order to target $183, the late April high, and $194, the April high.

On the flip side, a break below the rising trendline support and 50 sma at $65 could prove a tough nut to crack. It would take a move below $161 for sellers to gain traction and expose the 100 sma at $155.

How to trade Airbnb shares

You can trade Airbnb shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Airbnb’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade