When will AB Foods release its interim results?

AB Foods will release interim results at 0700 BST on Tuesday April 20. This will cover its performance over the 24 weeks to February 27.

AB Foods earnings consensus

A Reuters-compiled consensus shows analysts are expecting AB Foods to report an 18% year-on-year fall in revenue during the first half of its financial year, with adjusted operating and pretax profits expected to more than halve.

|

AB Foods Earnings Consensus |

H1 2020 |

H1 2021e |

|

Revenue |

£7.64b |

£6.27b |

|

Adjusted Operating Profit |

£682m |

£338m |

|

Adjusted Pretax Profit |

£636m |

£292m |

What to expect from the results

AB Foods is unlike any other stock in London thanks to its unique business model. Although it is best known for owning low-cost clothing retailer Primark it also produces sugar, bakery ingredients, feed for livestock and a wide range of well-known grocery brands like Twinings tea and Kingsmill bread.

The diversity of the business has proven beneficial for AB Foods during the pandemic. Although Primark doesn’t naturally fit with the rest of the business, it is the main driver of both revenue and profits during normal times. And while Primark has suffered heavily during the pandemic, especially as it has no online presence, the resilience of its food-based businesses has helped cushion the blow.

AB Foods has said that all of its divisions apart from Primark saw revenue and profit grow during the first half of the year – although not enough to fully offset the severe blow from the fact Primark stores were forced shut for a large chunk of the period.

Grocery revenue will be up 7% in the first half and adjusted operating profit will grow, driven by strong sales of Twinings Ovaltine. Sugar is on course to grow profit thanks to a recovery from Illovo. Agriculture is benefiting from a significant improvement in the Chinese pig market, while margins and income have also increased from Ingredients.

As for Primark, the majority of stores have only just reopened as the UK allowed non-essential retailers to reopen earlier this month. Most of them have been shut since late November or December, and AB Foods has already estimated it lost £1.1 billion in sales as a result.

As a result, Primark is expected to report revenue of £2.2 billion and to be around breakeven at the adjusted operating profit level. That compares to the £3.7 billion in Primark sales and £441 million profit reported the year before.

Primark will undoubtedly drag down the results in the first half, but the focus will be primarily on the future considering the company is expecting around 83% of its retail selling space to be back open by April 26. It is highly confident about its prospects now it is reopening its stores and said it expects to be ‘highly cash generative’ as it starts to serve customers again. That is supported by reports of long queues outside stores when they reopened.

A recovery in cash generation is key considering AB Foods had to scrap its dividend last year to preserve cash as the pandemic erupted and will be vital to paving the way for payouts to return.

Where next for the AB Foods share price?

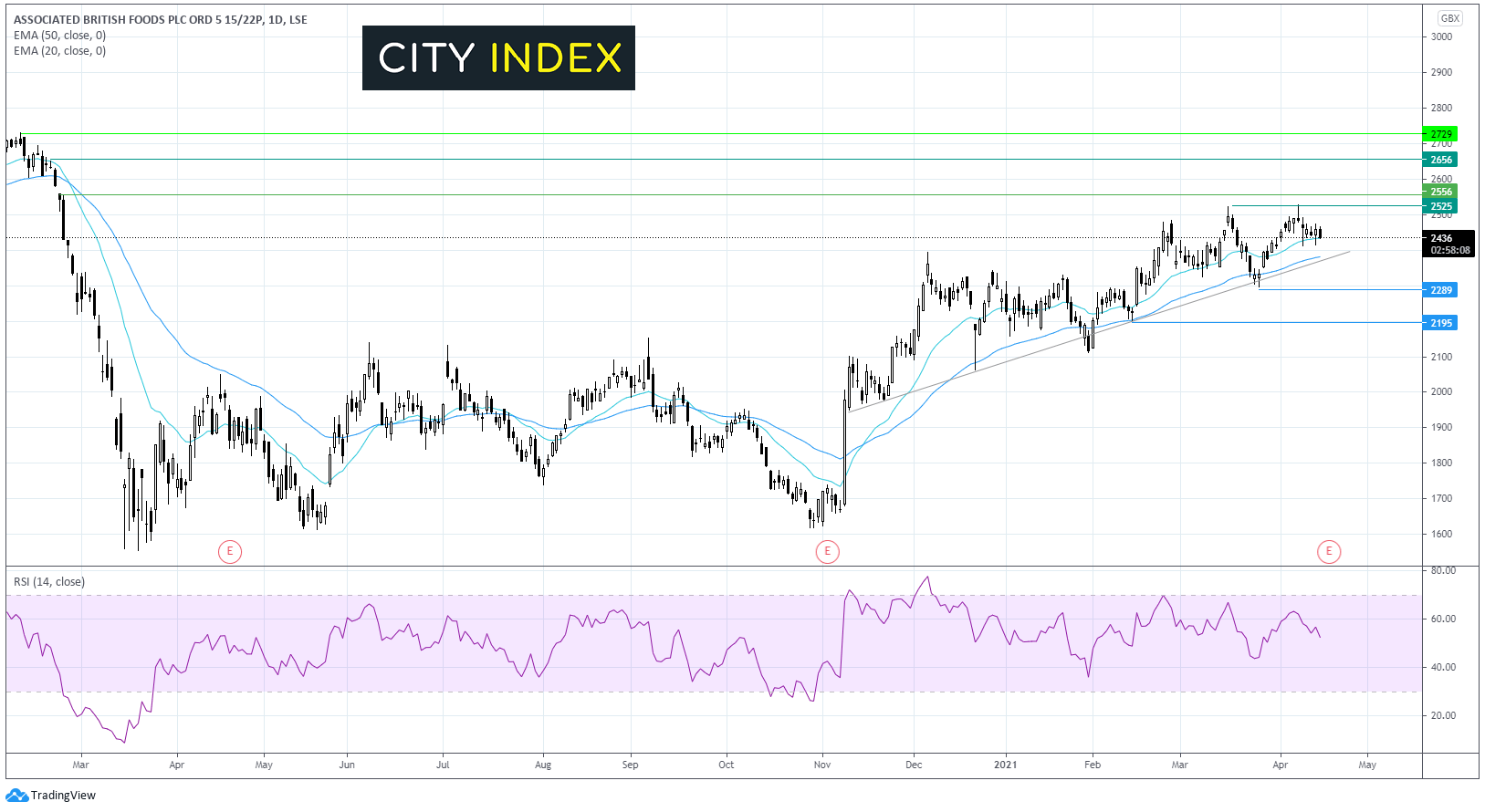

Having fallen off a cliff at the start of the pandemic, the AB Foods share price then traded sideways across most of 2020.

The share price surged higher in early November and has traded in a steady upward trend since then. The share price trades above its ascending trendline dating back to early November. It trades above its upward sloping 20 and 50 EMA.

The share price faced rejection for a second time at 2528 the post pandemic high. It is currently finding support at the 20 EMA at 2435. A break below this level could bring support at 2375 into play, the ascending trend line to 50 EMA. A move below here could point to a double top reversal pattern, in which case the sellers would look to take out 2290 for a deeper selloff to 2195 the February low.

Any move higher would need to break above 2525 to then test resistance at 2550 a late February high before 2650 the pre-pandemic level comes into focus.

How to trade AB Foods shares

You can trade AB Foods shares with City Index using spread-bets or CFDs, with spreads from 0.1%.

Follow these easy steps to start trading AB Foods shares today.

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Associated British Foods’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade