Tesla earnings beat expectations

Tesla beat expectations in the fourth quarter of 2021 after delivering a record number of cars in the period. It shifted a new record of 308,600 vehicles in the period, marking a strong finish to the year. Tesla delivered 936,172 cars over the year as a whole, up 87% from 2020.

Quarterly revenue jumped 65% year-on-year to $17.7 billion, coming in ahead of the $16.4 billion expected by analysts.

Adjusted Ebitda more than doubled to $4.1 billion from $1.9 billion the year before and also came in well ahead of the $3.9 billion expected by Wall Street. Adjusted EPS grew to $2.54 from just $0.80 last year and also beat the $2.31 forecast.

That meant annual revenue soared 71% in 2021 to $53.8 billion and adjusted Ebitda doubled to $11.6 billion.

Tesla is aiming to grow annual deliveries by about 50% per year going forward and said this will be achievable with its two existing sites in Fremont and Shanghai, with both sites having operated below max capacity for several quarters due to the supply chain issues hitting the wider industry. Wall Street currently believes Tesla can ramp-up deliveries by 47% in 2022 by delivering 1.375 million cars this year.

Still, Tesla said deliveries from its new Texas factory should start before the end of March and that it is still working on securing the manufacturing permits it needs to get its new site in Berlin up and running. CEO Elon Musk is due to visit the German factory in February.

Musk also said he wanted to solve the issues with Tesla’s self-driving technology, which he sees as key to improving profitability over the long-term. ‘I would be shocked if we do not achieve full self-driving safer than a human this year,’ Musk said. Tesla bumped-up the price of its Full Self-Driving system to $12,000 after releasing the latest update and Musk believes autonomous driving software will be the key driver of profits in the future. It revealed that around 60,000 US drivers are using the beta version of the software at present. Still, Musk has been promising to reach full autonomous driving for years and there are plenty of sceptics that believe it will still be some time before we see them given the green light to be used on public roads.

Why are Tesla shares trading lower before the bell?

Tesla shares proved volatile in after-market trading yesterday following the results and initially rose 2% before plunging by as much as 5% as markets digested the news. The stock has continued to face pressure today and is trading down over 1% in premarket trade.

Although Tesla looks poised to retain its position as the leading electric vehicle automaker this year, Tesla warned its ability to meet its ambitious target to grow deliveries this year will depend on the availability of equipment, maintaining operational efficiency and ‘stability in the supply chain’.

It is that last factor that markets fear the most. Tesla has so far proved to be far more resilient to the supply constraints hampering the global automotive market compared to its rivals, but the company is not immune and warned supply chain issues are ‘likely to continue through 2022’. Musk said the shortage in chips should start to alleviate in 2023.

Notably, Tesla’s gross margin improved for at least the fifth consecutive quarter in the last three months of 2021 to 27.4%, meaning the company continues to boast superior margins over traditional automakers that are more used to margins of 10% to 15%, giving Tesla a bigger cushion to absorb rising costs.

Tesla also confirmed reports that 2022 will be another year without any new models being launched, confirming the long-awaited Cybertruck and other models will start to come online in 2023. Musk also said Tesla is not working on a cheaper model at around the $25,000 mark, which some have hoped would make the brand more accessible, because it would take up too much capacity at present and it wants to focus on scaling up existing operations.

Future threats have also come into play since the start of the new year, with competition set to intensify significantly in 2022 as traditional automakers continue to push into the industry and smaller EV players get up and running, with hundreds of new electric models set to hit the market this year.

You can read more about the challenges electric vehicle stocks face in 2022 here.

Where next for TSLA stock?

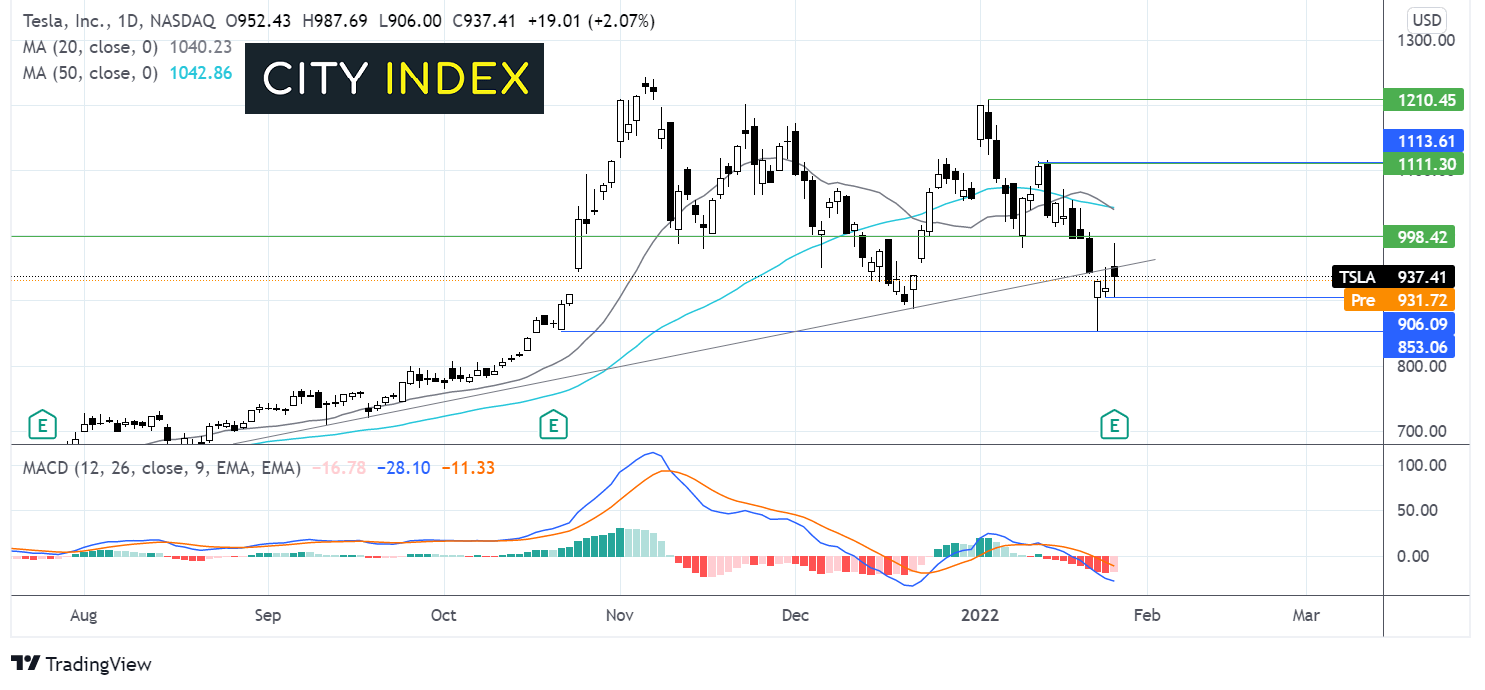

After reaching $1205 in early January, the share price has been trending lower. At the start of the week the price fell below a rising trendline dating back to mid-August last year, finding support at $850.

The price rebounded higher off this support but has failed to close above the rising trendline support turned resistance.

The bearish MACD, combined with the 20 sma crossing over the 50 sma offering a bearish signal are keeping the sellers hopeful of further losses.

Sellers will look to take out support at $906 yesterday’s low, in order to target $850 again. A move below this level would be significant.

On the upside buyers are look for a move over $950 the trendline in order to attack $1000. It would take a move over $1000 to negate the near-term downtrend.

It would take a move over $1118 for the bulls to be back in control and change the bias.

A number of brokers raised their expectations on Tesla this morning, with JPMorgan lifting its target to $325 from $295 and Wells Fargo increasing its target to $910 from $860. Overall, the 42 brokers that cover Tesla have a Hold rating an average target price of $977, over 5% above the current share price.

How to trade TSLA stock

You can trade Tesla shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tesla’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade