When will Tesla release Q3 results?

Tesla will release third quarter earnings after US markets close on Wednesday October 20.

Tesla Q3 earnings preview: what to expect from the results

Tesla delivered a record 241,300 cars during the third quarter, setting a bullish tone ahead of its earnings. That was up from just 201,250 deliveries in the previous quarter and came in well ahead of expectations, supporting the view that Tesla is mitigating the global chip shortage that is plaguing the global automotive industry far better than its rivals.

There may be no issues with demand for Tesla’s cars, but supply is another matter. Tesla warned in its last set of quarterly results that the level of growth it will deliver will be dependent on how the supply chain fares, citing the shortage in chips and port congestion as the two biggest problems. The company has said it is confident it can keep growing if it can get its hands on the parts it needs, but also warned that the chip shortage ‘remains quite serious’. Plus, profitability could be hurt even if it is able to source everything it needs if it has to pay more as a result of rising costs.

Still, Tesla has so far mitigated the supply chain woes far better than its rivals considering three of the largest carmakers – Toyota, Volkswagen and Ford – have all had to cut production due to the chip shortage. One reason Tesla has fared better is its ability to source alternative chips and rewrite the software on them, while its superior automotive margin may have also made Tesla a bigger priority for chip suppliers.

Growing output in China – where over 40% of its production capacity lies – also seems to have played a key role. Data out from the China Passenger Car Association suggested Tesla produced a record of over 56,000 cars in the country during September, the bulk of which are exported to other key markets. Notably, other Chinese electric carmakers such as NIO have also reported a surge in output, suggesting the scramble for chips is not as severe in China as in other countries.

The key question ahead of the earnings is whether Tesla can keep up supply going forward or whether the supply chain problems will start to bite. TSMC, the world’s largest semiconductor foundry, has said capacity will remain tight until at least 2022.

Still, Tesla has said it is aiming to deliver average annual growth in deliveries by 50% and said that 2021 will be a year when it will grow even faster. Having delivered just under 500,000 cars in 2020, that implies Tesla is aiming to ship at least 750,000 cars this year but, with the firm having already delivered over 627,000 cars in the first nine months of 2021, this may now be viewed as conservative. That seems sensible considering the current climate, but also means there is good chance that Tesla will achieve that 50% growth target.

Notably, one of the co-founders of Tesla, Jeffrey Brian Straudel, recently said that the huge simultaneous shift to electric vehicles by the majority of carmakers means the industry could face a whirlwind of supply issues over the coming years. ‘I don’t think that they have done the math fully when it comes to what it entails in the supply chain and tracing it all the way back to the mines,’ he said. ‘It will be maybe nickel shortages, cathode shortage, maybe on another day it will separator shortage.’

A lengthy spell of supply problems could spell trouble for Tesla, especially as it ramps-up production capacity in the US and Europe. Tesla is hoping to see the first Model Y to roll-off its production line in Germany before the end of this year but has warned it will take much longer to reach volume production. Currently, it is hoping to be making 5,000 to 10,000 cars per week in Berlin by the end of 2022.

Meanwhile, the new capacity in Austin will also be key to unleashing Tesla’s next new vehicle to the market, the Cybertruck, which will rely on the site ramping-up Model Y output first. This is being closely watched by investors considering the Cybertruck relies on a completely new architecture, including a new battery cell. The project has already seen delays and, as a result, competitors are starting to get a head start with Rivian having already launched the R1T pickup. Investors will also be keeping an eye out for any news on its Semi truck cab and the new Roadster, both of which are expected to be in production from 2023 – when Tesla believes it ‘should be through our severe supply chain shortages’.

For now, Tesla looks set to keep on delivering but concerns are growing that the uncertain supply chain outlook could weigh on the company’s earnings growth going forward.

Wall Street is expecting total revenue of $13.50 billion in the third quarter which, if achieved, would mark a new record and be up from $8.77 billion the year before and from $11.96 billion in the second quarter. Analysts also expect adjusted EPS to hit a new quarterly record by rising to $1.50 from $0.76 the year before.

If delivered, that would mark the ninth consecutive quarter of profit. However, this is expected to be only the second of those quarters to be profitable without being flattered by the sale of regulatory credits.

Margins will be under the radar. Tesla’s automotive margin came in at over 28% in the second quarter, well above the industry standard that lies closer to 10%. However, that could come under strain with supply costs likely to rise and average selling prices falling as it sells a higher proportion of cheaper models. Still, Tesla has said it is confident it can keep growing margins as scale increases.

Tesla shares have soared over 45% since hitting their 2021-low in May although remain below the $880 all-time high hit in January. The recent rally has brought back concerns surrounding Tesla’s valuation, with brokers believing the carmaker is currently over 17% overvalued compared to their average target price of $700.30. Notably, Tesla remains the most-shorted stock among our UK clients.

Where next for the Tesla share price?

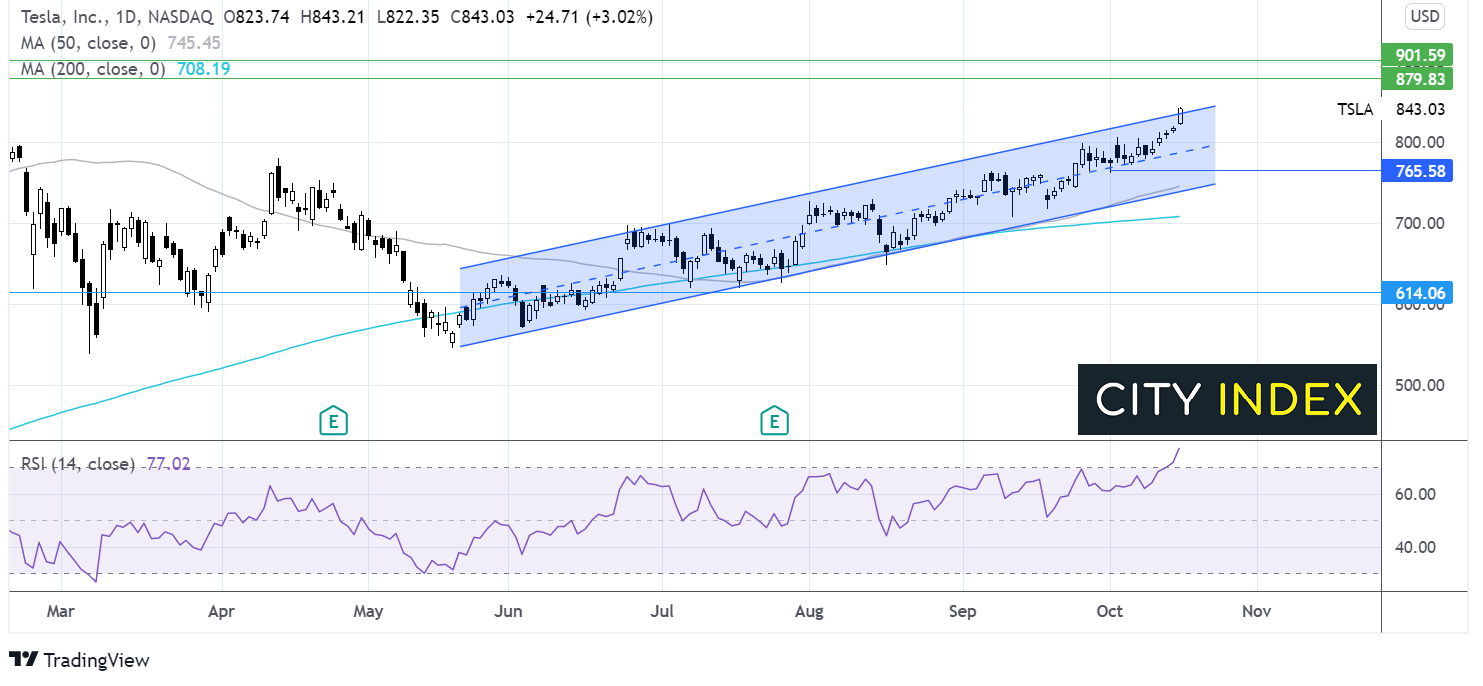

Tesla share price has been forming a series of higher highs and higher lows since late May. It trades above its 50 & 200 sma and has just broken out on the upside of its multi-month ascending channel. Adding to the bullish picture the 50 sma crossed above the 200 sma.

The RSI has moved firmly into overbought territory so a period of consolidation or a move lower could be on the cards.

Resistance is seen at $880 the February high ahead of $900 and fresh all-time highs.

On the downside $835 guards the rising channel and $790 the mid-point of the rising channel could offer support. A move below $765 the October low could negate the near-term uptrend and expose the 50 sma and lower band of the rising channel at $742.

How to trade Tesla shares

You can trade Tesla shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tesla’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade