Tencent Q2 Earnings Preview | Tencent Share Price | Tencent Shares | Tencent Stock

When will Tencent release Q2 results?

Tencent will release second quarter earnings on Wednesday August 18.

Tencent Q2 earnings preview: what to expect from the results

Tencent’s sprawling business empire is expected to have continued to power ahead in the second quarter of 2021, building on the 25% rise in revenue and jump in profits delivered in the first when all areas of the company, from its video games and social networks to its fintech and business software units, experienced strong double-digit growth.

Analysts are expecting revenue to rise 21% year-on-year to just under RMB139.0 billion in the second quarter from RMB114.9 billion the year before, while profit is seen rising 8.6% to RMB40.5 billion from RMB37.3 billion. Diluted EPS is forecast to dip to RMB3.38 from RMB3.44.

The stellar levels of growth Tencent shareholders have become accustomed to looks set to continue, at least for now. But the growing and overriding fear is that Tencent’s growth will be hampered and its leading position in key markets will be weakened by the crackdown on internet-based companies in China.

Just this morning we saw China’s State Administration for Market Regulation issue new draft rules aimed at banning unfair competition within the internet sector, proposing a ban on companies using data, algorithms and other technical advantages in order to drive traffic or influence people’s choices, threatening third-party audits of data for those that fall foul. China is reviewing how companies in charge of swathes of data manage such information and the proposals could be potentially devastating.

Other areas of Tencent’s business are also under the spotlight. Its gaming arm has drawn attention after regulators described video games as ‘spiritual opium’ and announced a crackdown on the amount of time children under 12 should play them and banning their ability to purchase in-game items. Some of Tencent’s M&A deals have also come under scrutiny.

Meanwhile, it was recently reported that its music arm spin-off – Tencent Music Entertainment – has delayed its Hong Kong IPO after China overhauled copyright rules after accusing the company of owning 80% of exclusive rights in the country. Tencent Music’s ADRs on the NYSE have shed over 70% in value since late March.

The situation is complex, and clarity hard to come by. Tencent has so far remained fairly tight-lipped on the evolving picture in China and played down the potential impact it will have on the business, but ultimately the confidence in Tencent’s prospects has collapsed and investors now consider the company – alongside other Chinese players like Alibaba – a much bigger risk.

Tencent shares have plunged over 43% since peaking at an all-time high in January as a result.

Notably, brokers remain bullish and suggest the sell-off this year has been overdone. The 53 brokers covering the company’s Hong Kong stock currently have a Buy rating and an average target price of HK$711.17 – implying there is over 63% potential upside from the current share price.

It is likely to take time for the sweeping regulatory changes to start impacting its numbers, leaving investors closely watching the numbers for any signs of a slowdown. But Tencent is still expected to deliver strong growth for the remainder of the year and, if it can shrug-off regulatory fears and continue to deliver, then we could see it rebound from the heavy fall.

Where next for the Tencent share price?

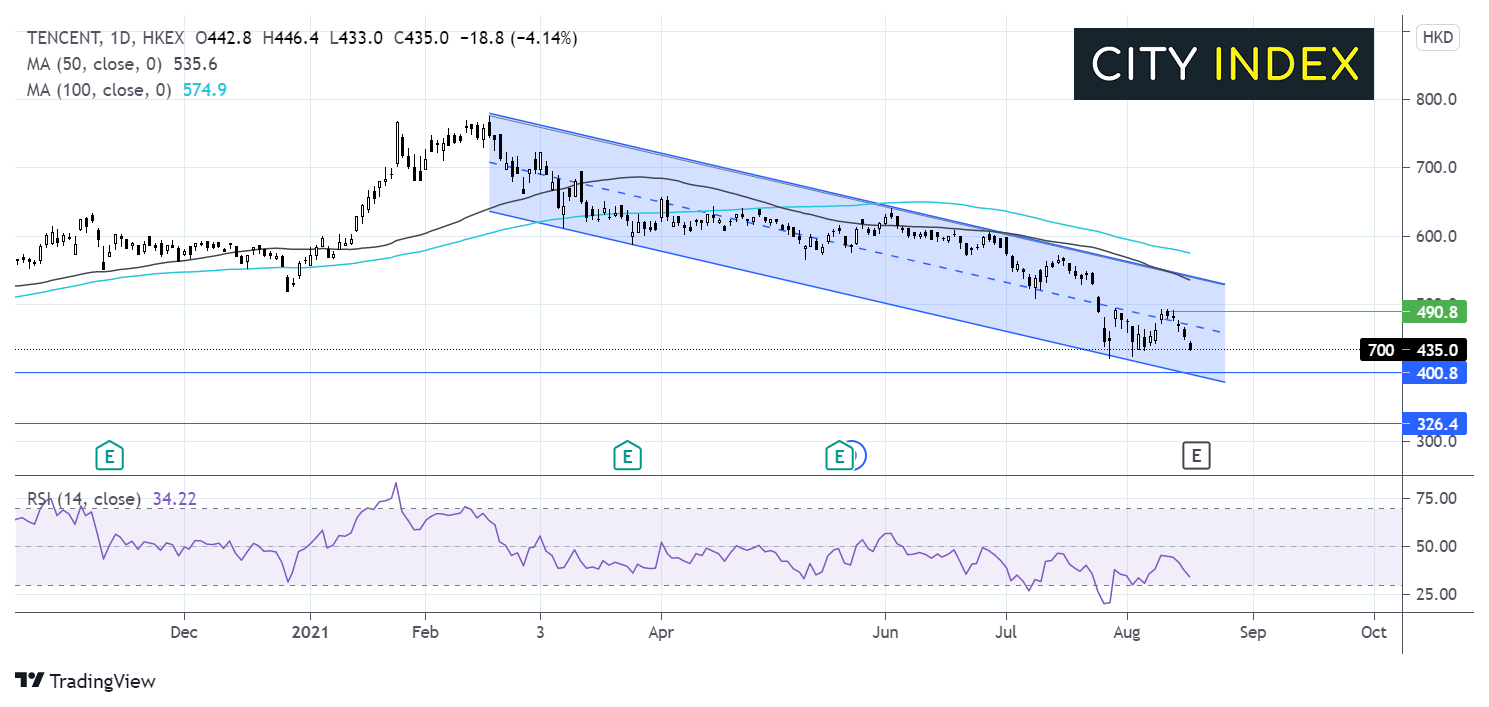

The Tencent share price steadily trended higher from late 2018. The pandemic saw the share price ascent pick up sharply from mid-March 2020 when it was trading around HK$326.00 to its all time high of HK$775.60 reach mid-February this year.

Since then, the price has been forming a series of lower lows and lower highs in a descending channel reaching a low of HK$422.00 late July, a 15-month low.

The RSI is supportive of further downside whilst it remains out of oversold territory at 30.

Immediate support can be seen at HK$422.00 the July low. Beyond here HK$400 the May 2020 low and lower band of the descending channel could offer some support ahead of 330 the March 2020 low.

On the flip side buyers would need to push beyond HK$488 horizontal resistance in order to approach HK$535 the 50 sma and the upper band of the descending channel, a level which could be tough to break.

How to trade Tencent shares

You can trade Tencent shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Tencent’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade