When will Salesforce release Q3 earnings?

Salesforce will release third quarter earnings after US markets close on Tuesday November 30.

Salesforce Q3 earnings preview: what to expect from the results

Salesforce is expected to report strong topline growth in the third quarter as large businesses continue to raise spending on the company’s suite of products as industries continue to digitally transform, and thanks to the boost provided by new acquisitions, most notably the completion of the Slack purchase in July, which followed the purchase of Acumen in February. Salesforce’s ability to offer an integrated suite of digital products makes it a favourite, especially with larger businesses wanting to find the fewest solutions to handle the most tasks.

Salesforce has said revenue will be between $6.78 billion to $6.79 billion in the third quarter. Wall Street forecasts revenue will rise to $6.80 billion from $5.42 billion the year before.

Analysts also believe Salesforce could deliver around 20% growth in remaining performance obligation (RPO). Slack is seen delivering growth of 35% to 40% and, when included with the wider business, RPO could rise by over 25%, ahead of the 22% being targeted by the company.

There is a chance that Salesforce could beat expectations in the period considering it raised its full year guidance in September, stating it is aiming to deliver annual revenue of $26.25 billion to $26.35 billion (from $26.2 billion to $26.3 billion beforehand). That would be around 24% higher than last year.

However, profitability is set to come under strain as it comes up against tougher comparatives from last year, when there was a boom in demand as companies adapted to remote working, and because of the costs of its M&A this year. Still, Slack, Acumen and other acquisitions should help accelerate organic sales growth going forward and, in time, help lower the likes of sales and marketing costs as it benefits from sharing functions and scale.

Salesforce has said adjusted EPS will come in between $0.91 to $0.92 in the third quarter, with a reported loss per share to be between $0.05 to $0.06. Analysts are expecting adjusted diluted EPS to fall to $0.92 from $1.74 last year, and have pencilled in a $0.04 reported loss per share compared to the $1.15 profit delivered the year before.

Salesforce shares have rallied over 30% since the start of 2021 and hit an all-time high of $311.68 on November 9, but it has since lost steam and declined over 6%. A number of brokers have recently raised their target price on Salesforce, with Jefferies bumping it up to $360 from $325, Citigroup to $308 from $280, and BofA Global Research to $360 from $330. That is largely in-line with the wider view, with the 51 brokers covering the stock placing a Buy rating and an average target price of $324.95, implying there is over 12% potential upside from the current share price.

Where next for Salesforce stock?

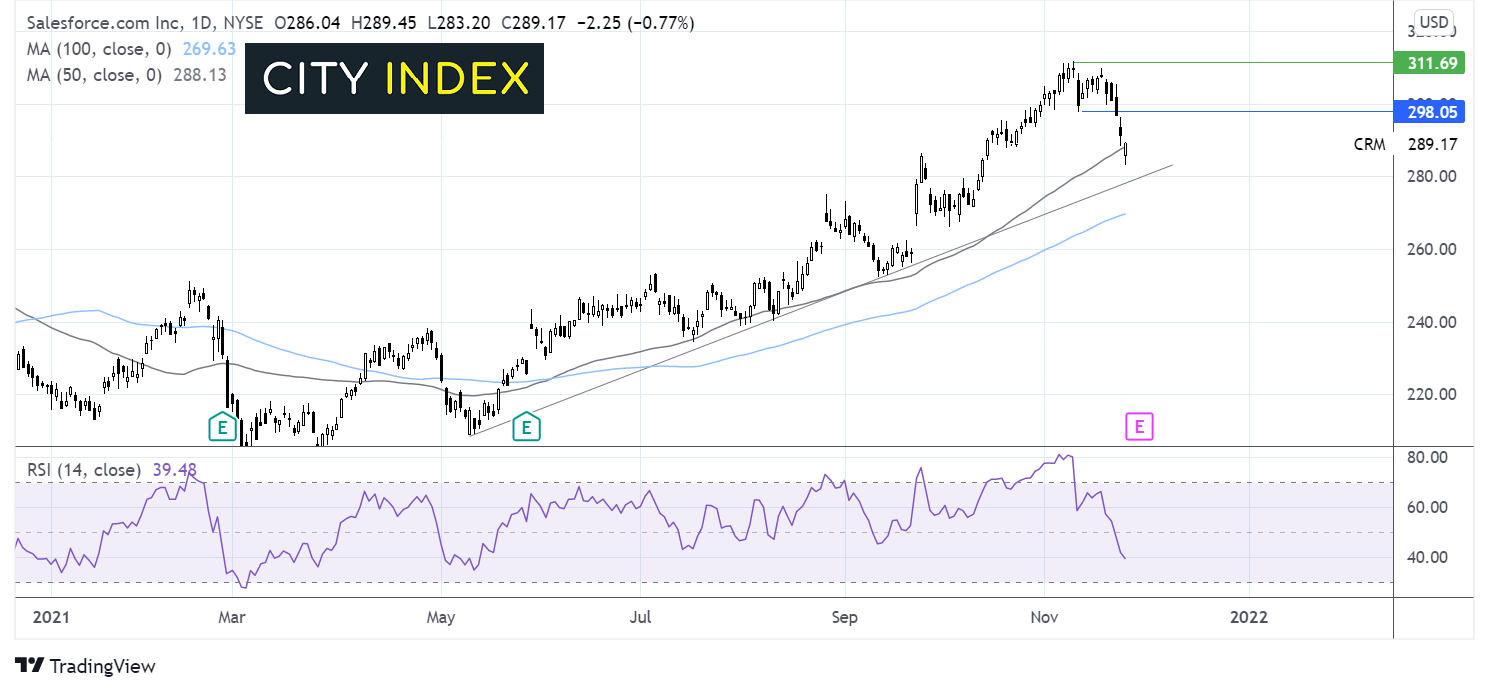

Salesforce had been steadily trending higher from May, forming a series of higher highs and higher lows. The price ran into resistance at $311 all-time high and has since rebounded lower.

The break below the 50 sma, combined with the bearish RSI, is keeping sellers optimistic of further downside to come.

Support can be seen at $277 the rising trendline and a break below there could negate the near-term uptrend. Furthermore, it would expose the 100 sma at $270. A move below here could see sellers gains momentum.

On the flipside, a move above resistance at $298 November 10 low could open the door to $311 and fresh all time highs.

How to trade the Salesforce share price

You can trade Salesforce shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Salesforce’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade