When will Ocado release H1 results?

Ocado will release interim results covering the six months to the end of May on the morning of Tuesday July 6.

What to expect from the Ocado results

The latest data on the grocery sector from Kantar suggested Ocado currently has its highest-ever share of the market at around 1.7%, driven by ‘industry-high sales growth’ of 42.2% in the 12 weeks to June 14. For comparison, its larger peers Tesco, Sainsbury’s and Morrisons delivered growth of around 10% to 12% in the period.

Kantar said the industry-leading growth was down to the continued boom in online grocery shopping, which plays into Ocado’s hands as the only online-only grocer. It is thought around one-in-five Brits are now ordering online even as lockdown eases.

The consensus among analysts, according to Bloomberg, is for revenue in the first half to rise to £1.84 billion from £1.08 billion the year before, and for Ebitda to jump to £65.7 million from £19.8 million.

Still, the question hanging over Ocado is whether Brits will maintain their appetite for online grocery shopping as lockdown eases. While its rivals have store sales to fall back on should there be any drop in online orders, Ocado does not enjoy the same level of resilience. Investors will be closely watching the growth figures between the first and second quarters for signs of a slowdown.

Importantly, the results in the second quarter will be impacted by strong comparatives from the year before when demand initially exploded when the pandemic erupted. So, whilst its retail unit, the grocery arm working with Marks & Spencer, delivered just under 40% growth in the 13 weeks to the end of February 2021 when the country was still in lockdown, it will struggle to deliver that level of growth in the second quarter when it comes up against tougher figures.

Still, Ocado has said revenue will be higher in the second quarter than the year before.

Ocado believes it can maintain the momentum going forward, with Melanie Smith, CEO of Ocado Retail, stating that ‘large numbers of

Ocado is more than just a grocer and also licenses its automation technology to other major retailers around the world. Although it is currently loss-making due to the ongoing expansion overseas, it is seen as the future of Ocado so it is closely watched. It is an exciting time for the business after it booked its first capacity-related fees from its partners after opening its first international warehouses for Groupe Casino in France and Sobeys in the US. Investors will want to hear more positive news on this front.

Where next for the Ocado share price?

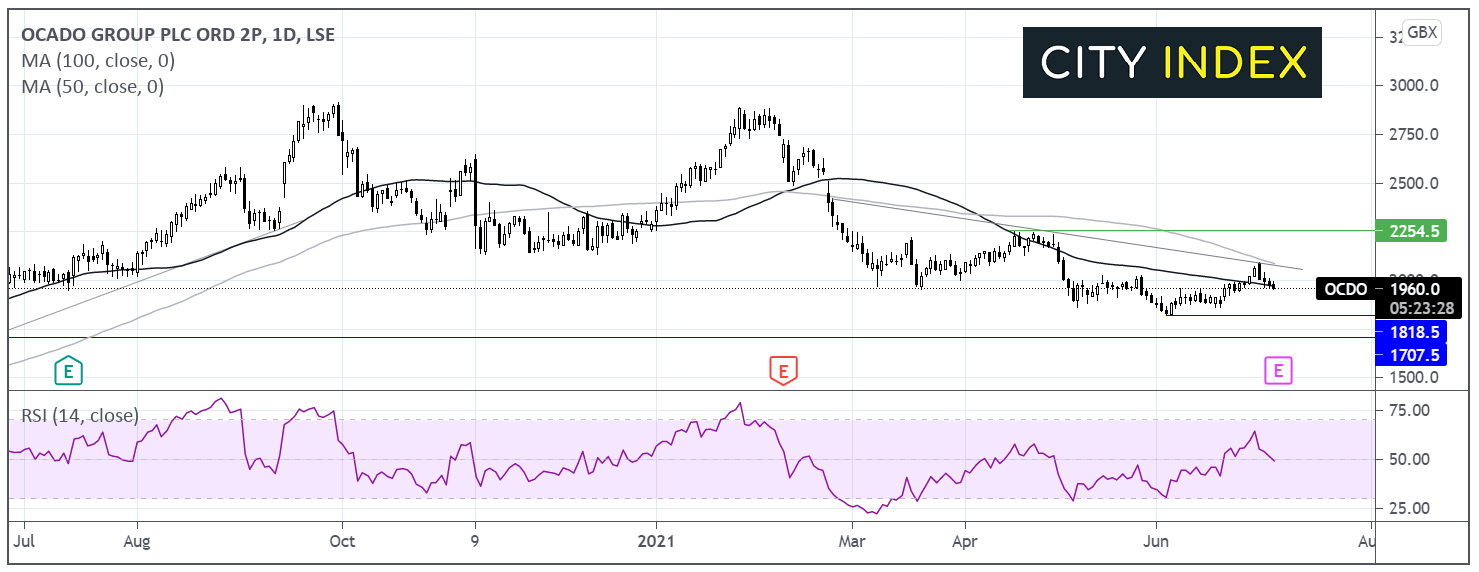

Ocado has been forming a series of lower lows and lower highs since early February. The share price ran into support at 1825p and has since picked up sightly to current levels of 1860p.

The Ocado share price trades below its downward sloping 100 sma and its descending trendline dating back to mid-February portraying an established bearish trend. The price is currently testing the 50 sma.

The RSI is at 50 showing a neutral bias ahead of the earnings release.

A disappointing release could see the share price push below the 50 sma support at 1970p which could reignite sellers’ interest. A break below the year-to-date low at 1825p could open the doors towards 1700p a level last seen in May 2020.

Should the 50 sma hold, any recovery would need to retake 2090p the descending trendline support and 100 sma which could prove a tough nut to crack. Beyond here, buyers could look to target 2250p.

How to trade Ocado shares

You can trade Ocado shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Ocado’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade