When will NIKE release Q1 results?

NIKE is scheduled to release first quarter earnings after US markets close on Thursday September 23.

NIKE Q1 earnings preview: what to expect from the results

NIKE continued to gain momentum in the last quarter as demand for athleisure wear remains strong, its push online with its direct-to-consumer model progresses, and wholesale income recovered as more physical retailers reopened their stores.

This should continue to be the case in the first quarter, with buoyant consumer spending expected to continue driving sales higher while a focus on more full-price sales and a leaner inventory should also improve margins.

Analysts are expecting revenue to rise to $12.46 billion from $10.59 billion the year before which, if achieved, would mark another record performance for the firm. Diluted EPS is forecast to increase to $1.12 from $0.95. Notably, NIKE has beaten expectations in seven out of the last eight quarters, and several analysts believe it can beat topline forecasts once again in the first quarter.

Figures from Bloomberg suggest sales in North America will rise 17.5%, Greater China 11%, Asia and Latin America by 27%, and EMEA by 12%.

The major concern that NIKE will need to alleviate this week is over how it is coping with the driver shortage and supply chain challenges that is plaguing the wider economy at present, especially as it heads into the key holiday season. There are also some fears over supplies as cases of the Delta variant rise in China, a key production hub for the business, and amid reports of problems in Vietnam where factories have been forced to close due to the spread of the virus.

NIKE shares have rallied over 36% over the last year after going from strength-to-strength during the pandemic, although the stock is trading 11% below the last all-time high achieved in early August The 33 brokers covering the stock are extremely bullish on NIKE, with an average Buy rating and a target price of $184.83 implying there is up to 19.8% potential upside from the current share price.

Where next for the NIKE share price?

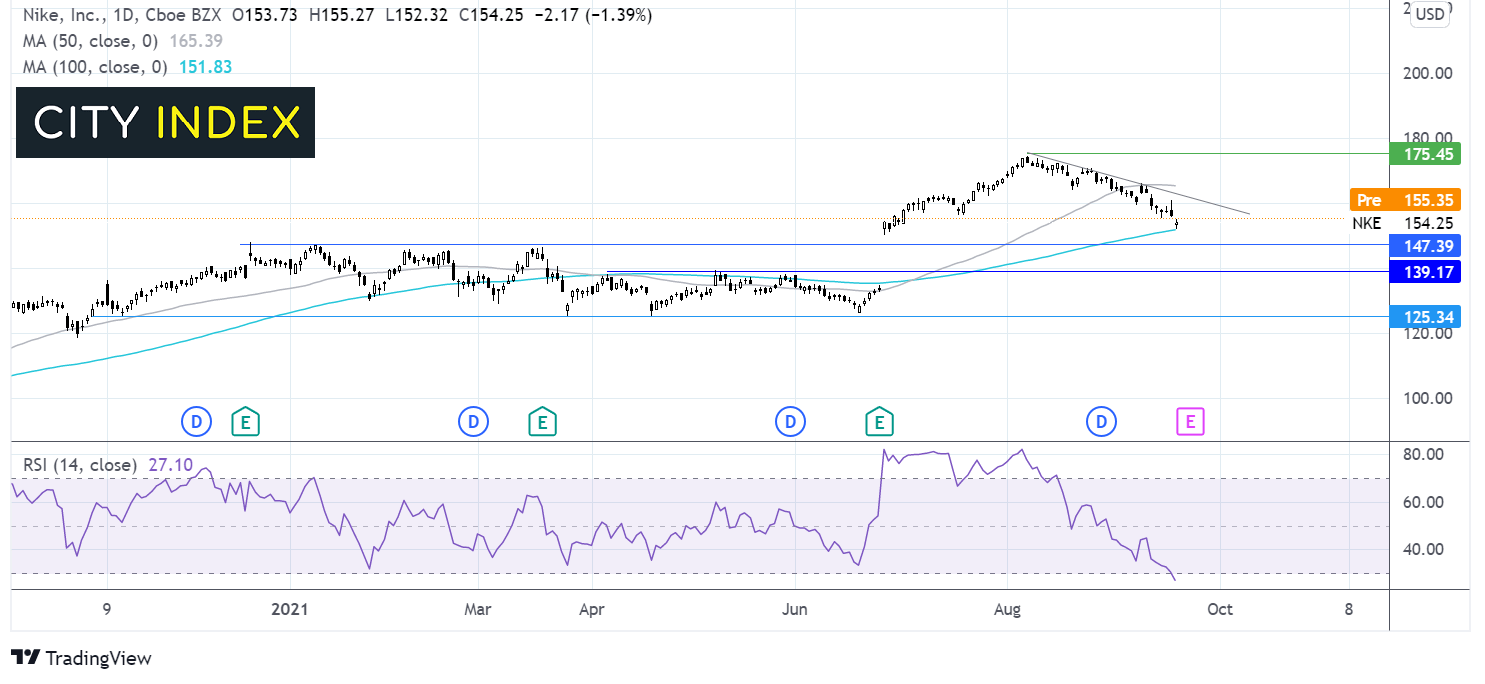

Nike’s share price traded relatively range bound for the first six months of the year with losses limited around $125 and gains failing to push above $147.

In June, following upbeat results, the share price bounded northwards scaling to an all time high of $175 before once again easing lower.

The price now trades down around 10% from the record high, falling through the 50 sma but finding support of the 100 sma at $152 yesterday.

The RSI has also tipped into oversold territory, suggesting that a period of consolidation or even a move higher could be on the cards.

Any meaningful recovery would need to retake the falling trendline resistance at $160 and the 50 sma at $165 to bring $175 back into play.

On the downside a move below the 200 sma could open the door to $147 horizontal support and $139 before $125.

How to trade NIKE shares

You can trade NIKE shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘NIKE’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade