When will Lucid Group release Q3 earnings?

Lucid Group is set to publish third quarter earnings on Monday November 15.

Lucid Q3 earnings preview: what to expect from the results

This will be the first set of quarterly earnings to be released by Lucid Group since it went public through a SPAC merger back in July.

Lucid only started production in late September and started shipping its first cars in late October, which means the firm is expected to generate minimal revenue in the third quarter. The net loss is forecast to come in at around $350 million, which would compare to the $261.7 million loss booked in the second quarter to the end of June.

The primary focus will be on how production has fared since the first $169,000 Lucid Air Dream Edition rolled-off its Arizona manufacturing line, with the model boasting the longest-range of any electric vehicle at 520 miles on a single charge, snatching the title from Tesla.

The company said it plans to make 520 customer-configured Lucid Air Dream Editions before starting to deliver lower-priced models that begin closer to $77,000. Lucid said in September that it had 13,000 reservations for the Lucid Air (worth well over $1 billion in revenue), and has previously said it was aiming to churn out around 20,000 Lucid Air sedans in 2022 with a view of generating over $2.2 billion in revenue. The plant can currently produce around 34,000 cars a year.

Below is Lucid’s annual delivery, revenue, earnings and cashflow forecasts for the forthcoming years:

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

Deliveries |

20,000 |

49,000 |

90,000 |

135,000 |

251,000 |

|

Revenue ($, mns) |

2,219 |

5,532 |

9,931 |

13,985 |

22,756 |

|

Ebitda ($, mns) |

(1,090) |

(637) |

592 |

1,671 |

2,885 |

|

Free cashflow ($, mns) |

(2,759) |

(3,250) |

(1,485) |

321 |

1,515 |

(Source: Lucid Group)

It then plans to introduce its next car, an SUV named Gravity, in 2023 using expanded capacity at its existing factory. Lucid has said it expects to grow capacity at its Arizona plant so it can produce 53,000 cars per year by 2023 but said it is designed to be able to ultimately produce up to 365,000 cars per year when it is producing at scale. Beyond that, it has a target to be producing over 500,000 cars each year by 2030.

Lucid Group has already outlined a path to profitability and believes it can turn positive Ebitda in 2024, although it has warned it won’t generate positive free cashflow until 2025 at the earliest. The company said it had around $4.6 billion in cash once it completed its SPAC deal, which it said would fund the company ‘at least through 2022’.

Lucid Group will also continue to open new showrooms as part of its direct sales strategy. It has eleven already open across North America and plans to start expanding into Europe and the Middle East in the first half of 2022.

Lucid Group is also tinkering in other potentially fruitful areas, such as its energy storage system that it plans to test out by hooking it up to solar panels on the roof of its factory, and the rollout of its charger network in partnership with Electrify America. It also plans to sell its battery packs and software to other carmakers looking to get ahead in the electric vehicle market as well as new applications spanning from military vehicles and heavy machinery to aircraft and marine vehicles.

For now, the hype around Lucid shares, which has risen from its $10 SPAC price to closer to $45 since listing, is driven by the company’s potential rather than earnings power. And that is true for the majority of hot electric vehicle stocks grabbing the market’s attention, prompting questions over valuations. Electric vehicle stocks are being slapped with huge premiums as investors take their first-mover advantage and tech-led businesses into account, while traditional automakers lag behind despite producing and selling considerably more cars here and now. This is demonstrated by the fact electric vehicle companies are boasting significantly higher valuations than traditional automakers despite generating considerably less sales than the likes of Ford or General Motors.

|

Last Quarterly Revenue |

Market Cap |

|

|

Tesla |

$13.8 billion |

$1.05 trillion |

|

Rivian |

$0 (forecast) |

$105 billion |

|

Lucid |

$174 million |

$73 billion |

|

NIO |

$1.5 billion |

$41 billion |

|

Ford |

$35.7 billion |

$78 billion |

|

General Motors |

$26.8 billion |

$90 billion |

Where next for Lucid stock?

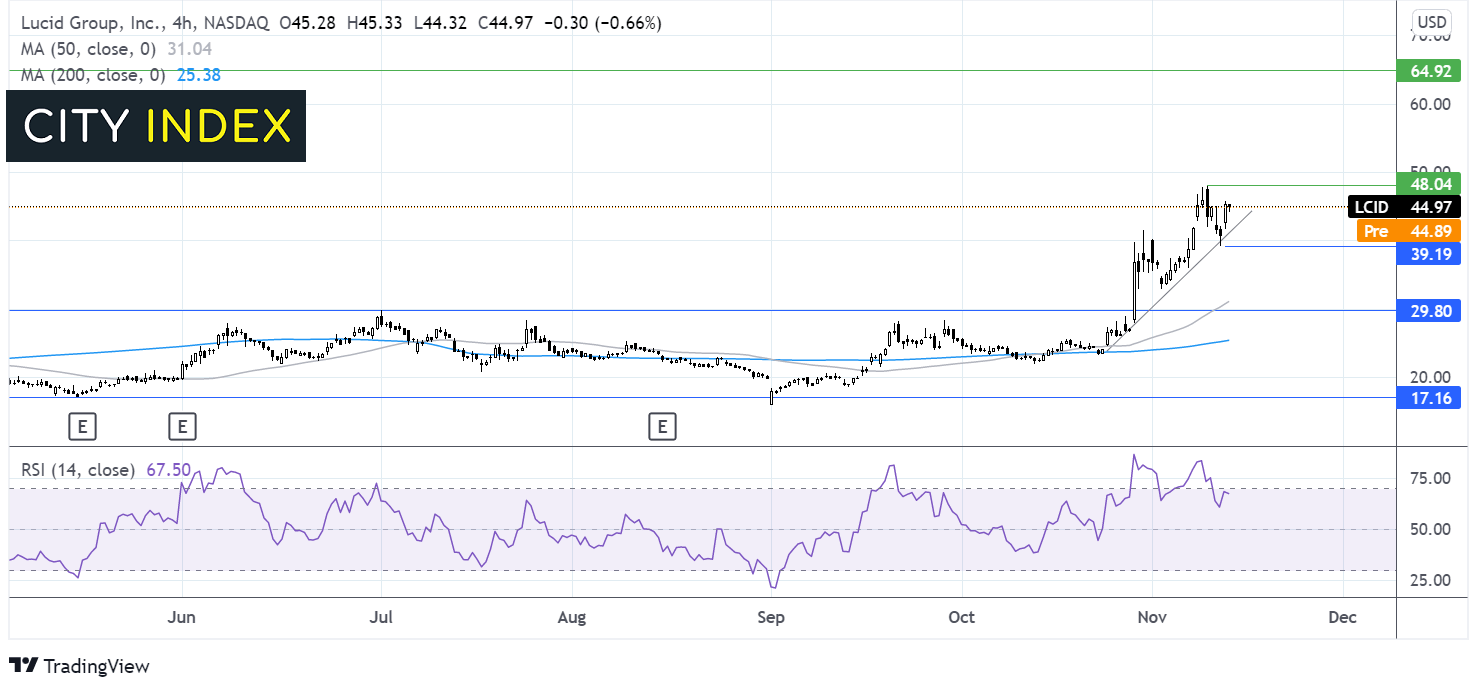

The Lucid share price has been trading in a holding pattern since late May, capped on the upside by $30 and limited on the lower band by $17.20.

The share price broke out of this parallel channel in late October and has been trending steeply higher, hitting resistance at $48. The price has eased off slightly, with the consolidation bringing the RSI out of overbought territory.

Buyers might look for a breakout above $48 to bring $65 the all-time high back into focus. On the flipside a move below $39 could negate the near term up trend.

How to trade Lucid shares

You can trade Lucid shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Lucid’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade