When will Halfords release full-year results?

Halfords will release preliminary results covering the year to early April on Thursday June 17.

Halfords earnings consensus: what to expect

Halfords has emerged as one of the strongest performers in London in what has been a tumultuous year for most stocks.

Halfords shares hit an all-time low of just 50p in April 2021, with the eruption of the pandemic adding fuel to years of steady declines. But, having been an essential retailer and one of the few to stay open during lockdown, Halfords shares have surged higher and now trade over 400p.

Although lower levels of traffic during lockdown has weighed on demand for the likes of car products and repairs at times, that has been more than offset by strong demand for cycles and, with restrictions gradually easing, traffic numbers and the need for Halfords Autocentres are starting to bounce back. In fact, the 13.3% sales growth delivered by Autocentres in the first seven weeks of the final quarter outpaced the 5.1% growth delivered by its retail stores.

Halfords is aiming to report an underlying pretax profit of £90 million to £100 million compared to the £52.6 million reported in the last financial year. When it upgraded its guidance at the start of March, analysts were only forecasting annual profit of £70 million.

A Reuters-compiled consensus shows analysts are expecting revenue to rise to £1.24 billion from £1.15 billion the year before. Underlying Ebitda is expected to jump to £170.8 million from £92.6 million and reported pretax profit at the bottom-line is forecast to follow higher to £81.2 million from just £19.4 million.

Investors will want Halfords to maintain the momentum it has built into the new year, although they will be wary that it will come up against stronger comparative periods. Still, the fact demand for motoring products sold in-store is yet to recover and traffic levels remain well below pre-pandemic levels still gives Halfords room for improvement going forward.

Also keep an eye out for any news on the dividend. It did not make a final payout for the last financial year nor an interim one for the one that recently ended due to the uncertainty caused by the pandemic. Halfords said it suspended dividends because it expected a short-term hit to profits and because it had to preserve cash. But, with profits growing and Halfords repaying the government support it received, twinned with a stronger balance sheet, there is a growing expectation that payouts should return.

Where next for the Halfords share price?

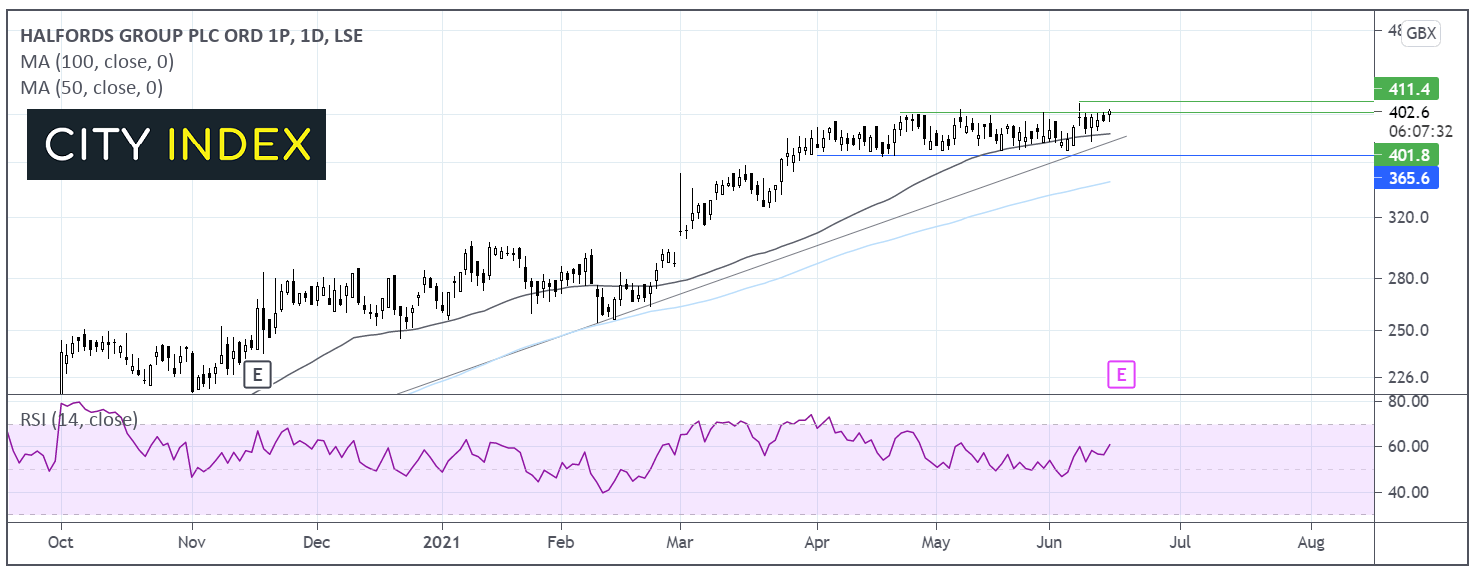

Halfords trades above its ascending trendline dating back to early May 2020. It trades above its 50 & 100 day ma indicating an established bullish trend.

The rally appears to have run out of steam, trading in a holding pattern since early April, capped on the upside by 400p and on the lower band by 365p. The share price is trading at the top end of the range.

The RSI is supportive of further upside, pointing northwards and in bullish territory.

Buyers will be looking for a break beyond 400p to test 410p, the current all-time high.

Support can be seen at 380p the ascending trend line and 50 sma. A move below 365p could see the sellers gain traction.

How to trade Halfords shares

You can trade Halfords shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Halfords’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade