When will GameStop release Q3 earnings?

GameStop will release third quarter earnings after US markets close on Wednesday December 8.

GameStop Q3 earnings preview: what to expect from the results

GameStop’s new management that took over earlier this year continue to keep their cards close to their chest. They have refrained from providing formal guidance and have kept their new strategy largely under wraps, preferring to deliver results over making promises.

But we do know that GameStop is focused on scaling up, ensuring it is competitively priced, has a wide enough selection to entice customers, and investing in distribution to get products out as quickly as possible. For example, a new facility in Pennsylvania started shipping goods in the last quarter and another one in Nevada is due to come online next year, when the company will have a truly nationwide fulfilment network for the first time ever. It has also opened a new customer care facility in Florida that will house 500 new staff.

Meanwhile, it is also focused on digitally transforming the business and has hired a wave of new employees with expertise in areas including ecommerce, user interface, user experience and supply chains. A full shift online, with chairman Ryan Cohen having committed to turning the firm into the ‘Amazon of gaming’, may take time considering it still has over 4,600 stores across the country, although this is around 9% smaller than last year.

But transforming an out-of-date bricks-and-mortar retailer into a digital leader does not come cheap, and there is not a quick fix. It has been spending more cash than it generates as it invests in broadening its inventory and capex, which amounted to over $28 million in the first half, is set to continue to rise going forward. However, management took early steps to ensure the company had the resources it needs to grow and transform over the long-term. It has zero long-term debt and had $1.775 billion in cash (and restricted cash) at the end of the second quarter following the $1.1 billion it raised from investors back in June. Still, it has secured some new, untapped debt facilities to improve liquidity further after securing a new $500 million facility earlier this month on more favourable terms than the $420 million facility it replaced.

For now, investors want two things – rapid growth and new initiatives that can provide further catalysts for the stock, such as its efforts to build a new non-fungible token business. With this in mind, earnings are not a top priority for investors. GameStop is now regarded by investors as a growth stock under the new board, rather than a legacy retailer struggling to cope in modern times. The key metric that management have asked investors to focus on is net sales, which Wall Street forecasts will rise to $1.189 billion in the third quarter. That would be broadly flat from the previous quarter, but up over 18% from $1.005 billion the year before. That would be slower than the 25.5% topline growth delivered in the last quarter. We may also hear how demand fared during Black Friday and Cyber Monday.

Analysts expect GameStop to report a net loss at the bottom-line of $31.1 million. That will be the narrowest loss booked since the start of the year but wider than the $18.8 million loss booked the year before. On a per share basis, the loss is expected to widen to $0.40 from $0.29 last year.

Where next for GameStop stock?

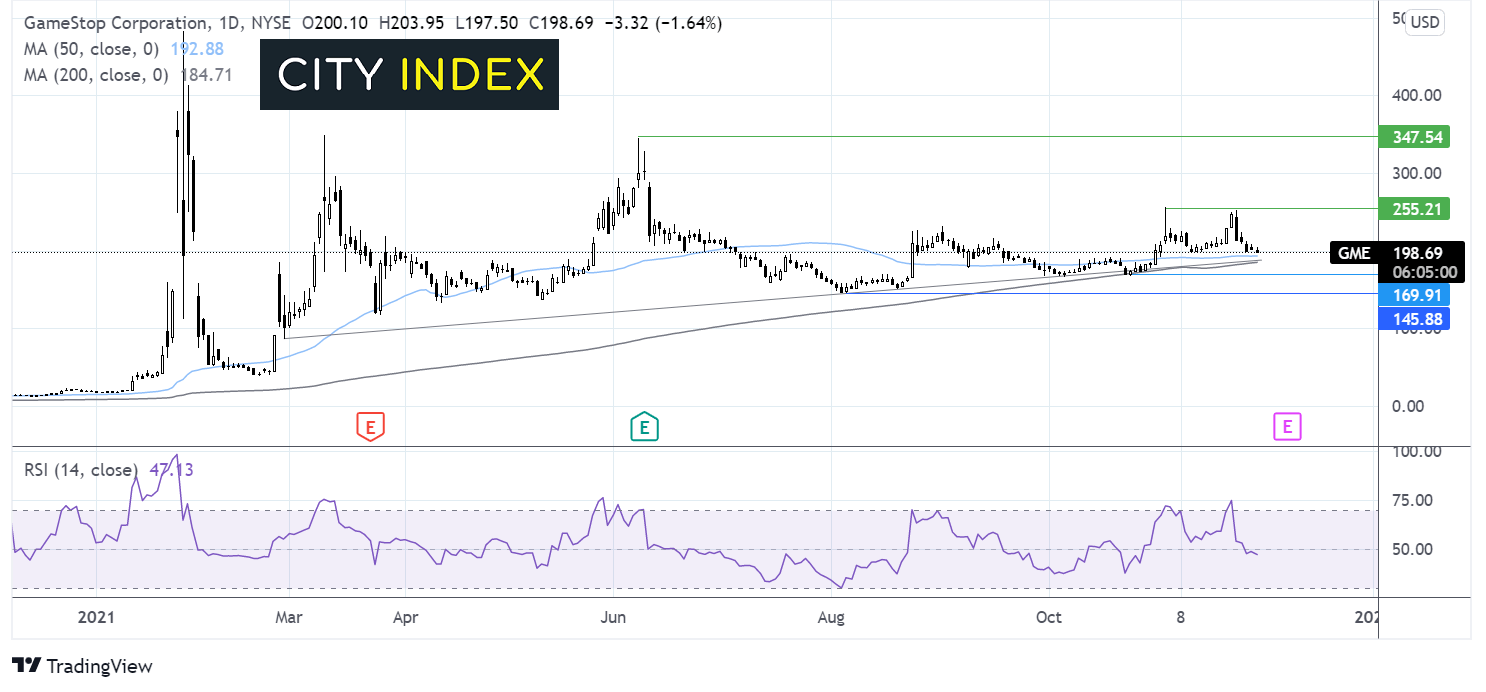

After surging to an all-time high early in 2021 of $483, the Gamestop share price dropped sharply to $40 and has traded very mildly higher across most of the rest of the year.

Gamestop has traded relatively rangebound over the past month. It trades supported on the downside by the 50, 200 and rising support trendline and capped on the upside by $255, the November high.

Currently the price is trading at the lower end of this holding pattern. The RSI is neutral.

It might be worth looking at a breakout trade here. Sellers could look for a move below the support zone of $200 to $185 in order to test $170, the October low, and $145, the August low.

Buyers might want to look for a move above $255 before buying in to target $350.

How to trade GME stock

You can trade GameStop shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘GameStop’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade