When will FedEx release Q4 results?

FedEx will release fourth-quarter and full-year results after the markets close on Thursday June 24. This will cover the three-month and 12-month periods the end of May.

FedEx earnings preview: what to expect

FedEx has come into its element during the pandemic, naturally benefiting as companies need to send parcels far and wide to meet the surge in demand in online shopping in the US and overseas. This has seen FedEx shares more than double in value over the last year, although the stock has lost steam since hitting an all-time high of $318 in late May.

The momentum built over the last year is expected to have continued into the final quarter of the financial year. Analysts are expecting fourth-quarter revenue to come in at $21.5 billion, up from $17.4 billion the year before. Wall Street anticipates adjusted EPS will almost double year-on-year to $4.99 from $2.53 and that FedEx will turn to reported EPS of $4.85 from a $1.28 loss.

Notably, FedEx has beat estimates for four consecutive quarters, according to Refinitiv.

While better results have lifted FedEx shares over the last year, investors have also been pricing in the improved outlook for the business, which will be the main focus this week as they look for evidence that FedEx can maintain the momentum into the new financial year.

FedEx has previously said that the pandemic had caused several years of retail share gains to be compressed into just a few months and believes the increased demand for its ecommerce unit and its speedy international shipping arm FedEx Express will remain ‘very high for the foreseeable future’.

Still, investors will be wary that the momentum could lose steam as the economy reopens and people shop more in-store, potentially unwinding some of the demand. While revenue has steadily grown during the financial year, the fourth-quarter figure is expected to be flat compared to the third.

The other threat is that growth in earnings could be tempered by rising costs. FedEx warned in the last quarter that costs for the likes of labour had increased and although some of these have been passed on to customers there is a risk that the improvement in margins could unwind if they continue to rise.

For the full-year, analysts expect revenue to rise to $82.9 billion from $69.2 billion and for adjusted EPS to almost double to $18.01 from $9.50. Reported EPS is forecast to jump to $17.46 from just $4.90 the year before.

Where next for the FedEx share price?

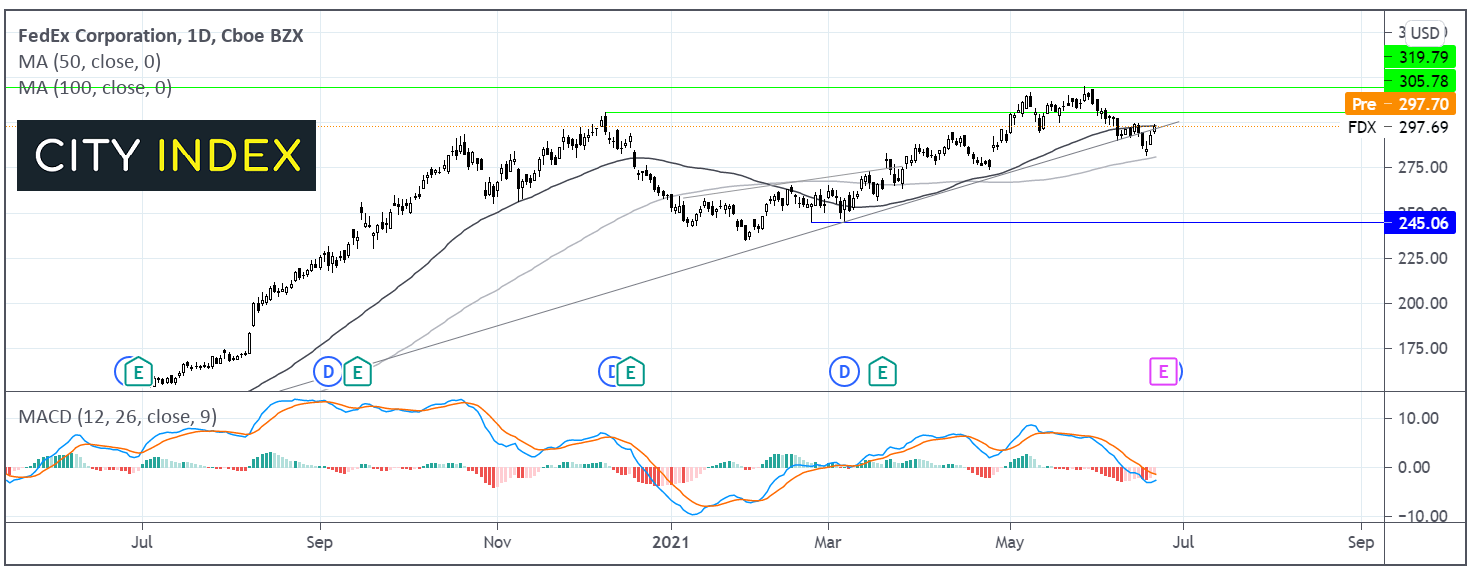

The FedEx share price trended higher across the past year, hitting resistance and an all-time high of $318. The price has since slipped lower finding support on the 100 sma at $280 on Tuesday and rebounding higher.

The price is attempting to retake the ascending trendline support turned resistance and the 50 sma at 297. The price closed at this level which is encouraging but confirmation is needed. A bullish crossover could be forming on the MACD. Again, it could be worth waiting for confirmation before placing any aggressively bullish bets.

Buyers will need to retake resistance at $304 in order to retest the all-time high of $318. It would take a move below $280 for the sellers to gain traction and bring $245 into play.

How to trade FedEx shares?

You can trade FedEx shares with City Index by following these four steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘FedEx’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade