When will FedEx release Q1 earnings?

FedEx will release first quarter earnings after the markets close on Tuesday September 21. This will cover the three months to the end of August.

FedEx Q1 earnings preview: what to expect from the results

FedEx reported record results in the last quarter as demand for shipping goods continues to gain traction, underpinned by an explosion in ecommerce sales during the pandemic. That trend is expected to have continued when FedEx releases its first quarter results, even as people return to stores, while the continued recovery in higher-margin B2B shipping will also add further momentum.

However, FedEx is operating in an extremely challenging environment amid rising costs and a tight labour market. In June, the board warned that the shortage in staff and the intensifying battle for workers was resulting in ‘higher wages and lower productivity, particularly in the first quarter’ and this also meant it wasn’t always able to offer the high-quality service it strives to provide. Although management remained confident things would improve through the quarter as it prepares for the peak holiday season, it warned labour could remain an issue going into 2022.

Apart from its ability to continue meeting demand, the other major focus this week will be on FedEx’s margin and how the company counters the rise in costs. The level of demand means the company should be able to push up prices without losing customers considering FedEx and rivals like United Parcel Service have both had to turn down business at points during the pandemic when demand exploded. Still, analysts are expecting earnings growth to slow in the quarter as a result of rising costs.

Analysts are expecting revenue to rise to $21.90 billion from $19.32 billion the year before. FedEx Freight is set to lead topline growth with daily shipments forecast to increase 14% as demand from ecommerce continues to grow. Meanwhile, its international Express arm and FedEx Ground, which has been seeing a recovery in B2B shipments, are expected to see volumes grow by 4% to 6%.

Wall Street is anticipating quarterly reported net income to edge up to $1.36 billion from $1.24 billion, with diluted EPS to follow higher to $4.93 from $4.72.

Notably, FedEx has beaten expectations for the last five consecutive quarters, according to data from Refinitiv. There is every chance we could see FedEx surprise the market once again considering the level of demand and its ability to pass through cost increases to customers. But there is a risk that the struggle to recruit workers could weigh on its performance.

Where next for the FedEx share price?

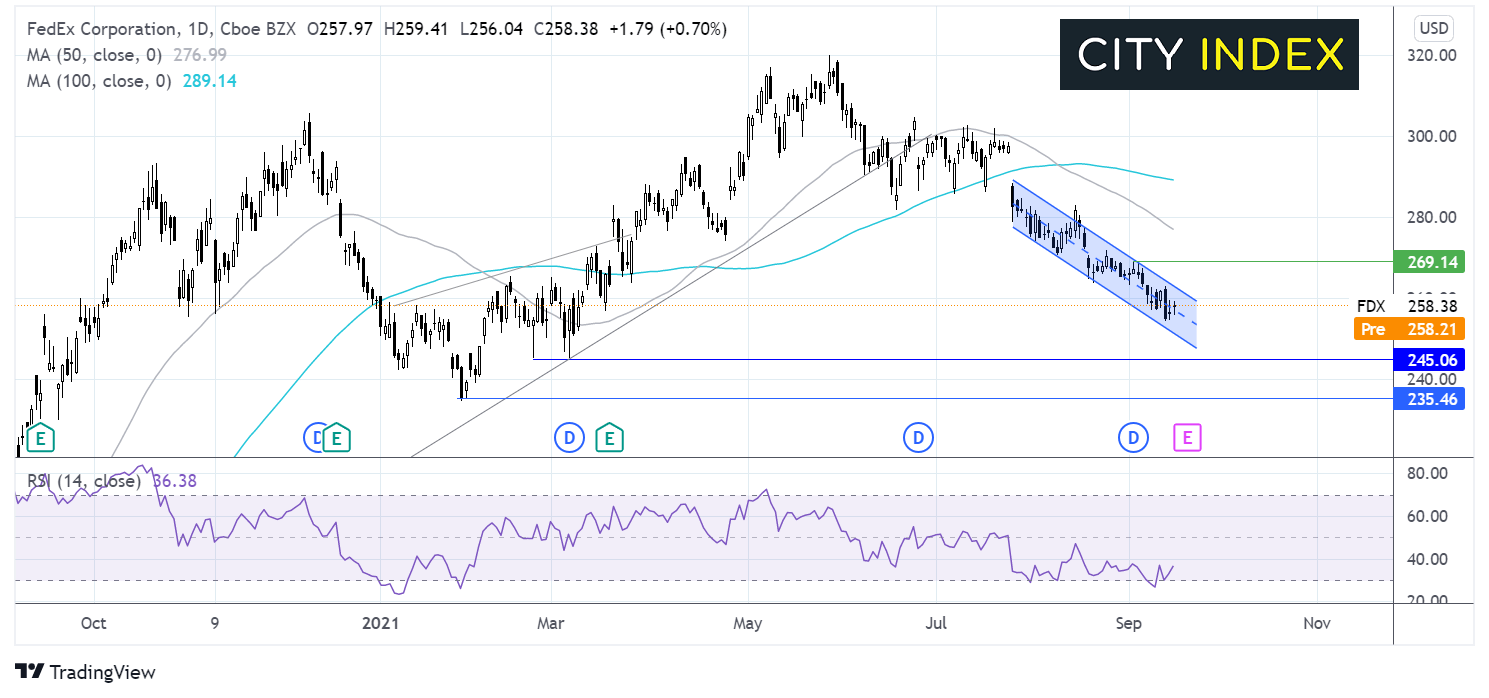

The FedEx share price rallied across the first half of the year, hitting an all-time high of $320. Since then, the price has been trending lower.

After a brief period of consolidation around $300 the down trend resumed. The FedEx share price trades within a descending channel dating back to late July.

The RSI is well below the 50 midline and has recently moved out of oversold territory, support of further downside.

A break below $250 the lower band of the falling channel could see the sellers gain traction towards $244 the March low and $235 the year to date low.

On the flip slide a daily close above the resistance trendline of the falling channel at $262 could be significant, prompting bulls to look up towards $269 the September high and $277 the 50 sma.

How to trade FedEx shares

You can trade FedEx shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘FedEx’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade