When will Facebook release Q3 results?

Facebook will release third quarter earnings after US markets close on Monday October 25.

Facebook Q3 earnings preview: what to expect from the results

Facebook is expected to have added 14.1 million daily active users in the third quarter to take the total to 1.924 billion, while monthly active users is forecast to grow by almost 24 million to 2.924 billion, according to consensus figures from Bloomberg.

DAU growth is expected to be led by Asia and the rest of the world, with slower growth anticipated in Europe and a mild decline forecast in North America. User growth will be closely-watched as investors look to see if Facebook can keep attracting users even as people spend less time online as Covid-19 restrictions ease.

Facebook is expected to have continued benefiting from growing ad spending as businesses ramp-up marketing budgets and bounce back from the pandemic. Spending on Facebook should be further aided by the fact more marketing dollars are being funnelled online.

However, Facebook warned in its last set of earnings that it expected total revenue growth to ‘deaccelerate significantly’ on a sequential basis in the third and fourth quarters compared to what was delivered in the first half (when its topline rose 46% in Q1 and 56% in Q2), mainly because it will come up against tougher comparatives from last year.

The company also said it was anticipating ‘increased ad targeting headwinds’ for the rest of the year. This is because of the changes made to Apple’s iOS in its latest update, which is set to have a greater impact in the third quarter compared to the second. It also said it was keeping an eye on regulatory pressure on how it transfers data from Europe to the US.

It is also worth flagging the potential impact of the major outage earlier this month that knocked Facebook, Instagram and Whatsapp offline around the world for almost six hours. Analysts are not expecting any notable effect from the outage, but it may have prompted businesses to re-evaluate their reliance on Facebook for advertising and to conduct business while pushing users to rivals. For example, Twitter and Snapchat saw a surge in activity during the outage and reports suggest messaging service Telegram also acquired tens of millions of new users as a result. Notably, Facebook shares have only just managed to recover the heavy losses booked as a result of the outage on October 4.

Still, Wall Street is forecasting third quarter revenue of $29.60 billion, which would be up from $21.47 billion the year before. That is forecast to have been driven by continued lifts to advertising prices. Net income is expected to jump to $9.24 billion from $7.84 billion last year, while EPS is forecast to grow to $3.17 from $2.71, according to consensus figures from Reuters.

Going forward, there are mixed views on Facebook’s ability to introduce new growth catalysts to propel the stock higher. On one hand, its increasing investment in areas like ecommerce, video and its huge ambitions to create a metaverse could provide huge momentum for Facebook’s growth profile. On the other, there are some concerns that higher investments could weigh on margins while regulatory pressure also threatens both Facebook’s existing model and its ability to rollout new products.

There is a possibility that Facebook could have to tone down its engagement algorithms, make changes to its platform (which always comes with a risk), or have to ramp-up spending on moderators and other safety measures in order to allay growing concerns of regulators. We have already seen Facebook put plans to rollout an Instagram for under 13s on hold after being accused of putting profits over user safety by whistle blower Frances Haugen, who leaked thousands of internal documents and testified to the US Senate earlier this month. Notably, the Senate is planning to hold a similar hearing looking into how social media platforms impact younger people with rivals including Snapchat, TikTok and YouTube next week.

Brokers remain extremely bullish on Facebook shares, especially since falling from the all-time high seen in September. The 57 brokers covering the stock currently have an average Buy rating on Facebook shares and an average target price of $417.22 – some 21% above the current share price.

Is Facebook changing its name?

There is a chance that Facebook could unveil a big change when it releases its results – a new name.

Reports from The Verge suggest the company will change its name to reflect the big push it is making to create the metaverse. However, it may wait until its annual Connect conference on Thursday October 28 to make the big announcement. It is expected to be in a similar fashion to when Google changed the name of its parent company to Alphabet to reflect a broader focus beyond its core search engine.

Facebook is betting big on the metaverse, a digital world where people can communicate and travel in a virtual environment, and has complimented this with its investments in virtual and augmented reality. It has said it is hiring 10,000 workers in Europe alone to work on the project. Notably, it isn’t the first company to tout itself as a metaverse company, with Roblox also pursuing ambitions in the space.

A change in name will not be revolutionary for Facebook, but it will cement its ambitions in the space and demonstrate that it is thinking beyond its core social media platforms and has bigger ambitions. It could also help distance any new projects away from the increased regulatory scrutiny being paid to Facebook and Instagram.

It is also worth mentioning that Facebook has launched a pilot programme of its digital currency wallet named Novi in the US and Guatemala, underpinned by the Paxos Dollar stablecoin rather than its own cryptocurrency named Diem. That is being piloted in partnership with crypto platform Coinbase, which is supplying custody services. This adds another bone of contention with some politicians, with several US senators sending a letter to Facebook founder Mark Zuckerberg urging him to discontinue the pilot.

Where next for the Facebook share price?

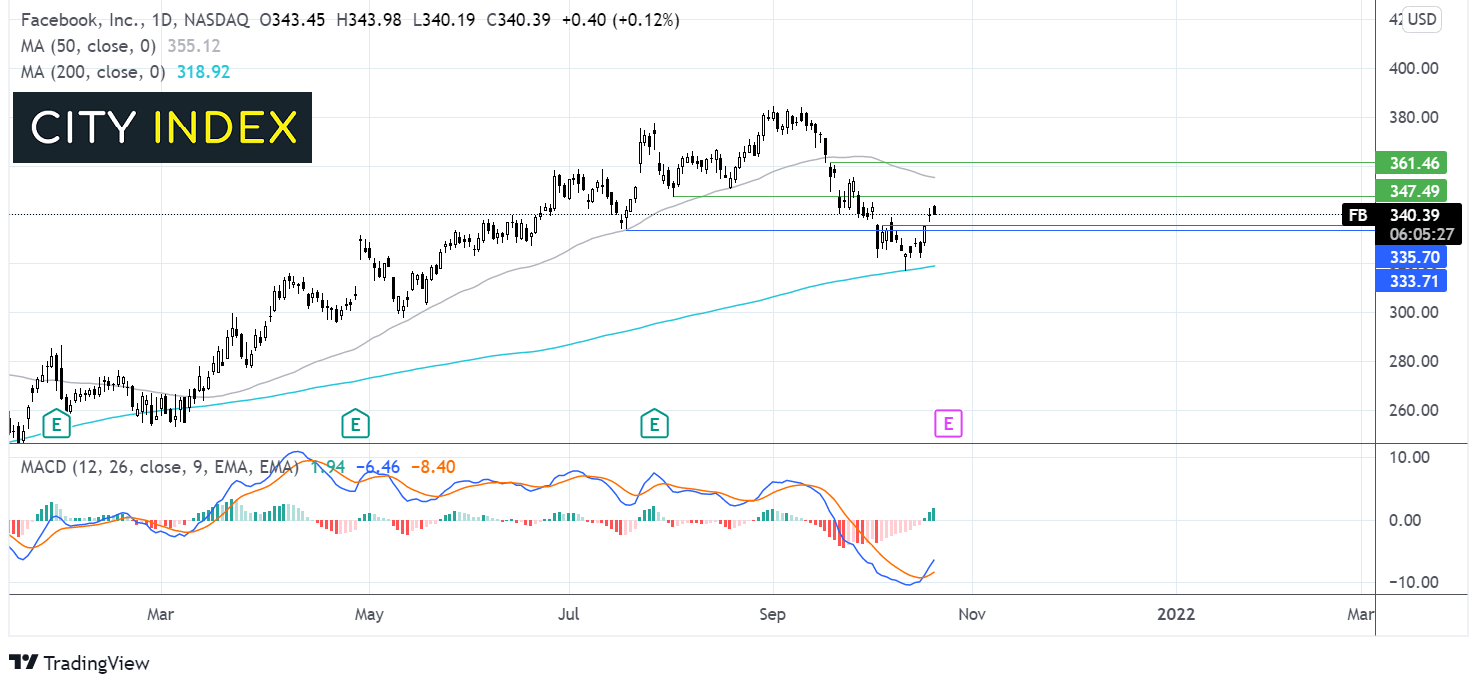

Facebook is extending its rebound off the 200 sma struck last week. A break above resistance at $335 and a bullish crossover on the MACD are keeping buyers optimistic of further gains.

Buyers will be looking for a move above $350 to expose the 50 sma at $355. Beyond here $360 comes back into play.

On the downside $335 contention zone could offer support. A breakthrough here could expose the 200 sma at $318.

How to trade Facebook shares

You can trade Facebook shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Facebook’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade