easyJet beats expectations

The airline reported revenue of £1.49 billion in the year to the end of September, less than half the £3.00 billion delivered the year before as capacity dropped 48.9% and passenger numbers plunged over 57%. Still, that came in above the £1.44 billion forecast by analysts.

Its headline loss before tax swelled to £1.14 billion from £835.0 million last year, also slightly better than expected. The headline profit after tax widened to £900.0 million from the £725.0 million loss reported last year. That beat the £976.2 million loss pencilled in by analysts.

Although the airline industry has started down the long road to recovery in recent months, the results were poorer than last year, when the first half was largely unaffected by the pandemic and travel restrictions. The airline attempted to offset this by cutting headline costs by one-third, driven by a reduction in capacity to meet lower demand and the savings made across several areas of the business.

How will the Omicron variant weigh on easyJet’s outlook?

easyJet flew 155,664 flights over the year and carried 20.4 million passengers at a load factor of 72.5%. As outlined below, activity over the first three quarters were depressed thanks to strict government restrictions on travel before ramping-up in the fourth quarter over the three months to the end of September as travel rules eased.

|

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

|

|

Flights |

23,428 |

11,672 |

24,682 |

95,882 |

|

Passengers (Mns) |

2.86 |

1.23 |

2.99 |

20.43 |

|

% of 2019 Capacity |

18% |

9% |

17% |

58% |

|

Load Factor |

65.70% |

60% |

66% |

72.50% |

However, the discovery of the Omicron variant has prompted a wave of new travel restrictions being imposed by nations around the world while scientists scramble to understand exactly what we are dealing with and whether existing vaccines still prove effective. The news sent airline stocks markedly lower on Friday.

Notably, the CEO of vaccine maker Moderna, Stephane Bancel, predicted this morning that existing vaccines will be less effective against the Omicron variant than earlier strains of the virus, prompting fears that the world will need to wait months for a new jab to be produced and then further time for them to be distributed. The Financial Times said the high rate of mutation of the new variant is a concern.

‘It's too soon to say what impact Omicron may have on European travel and any further short-term restrictions that may result. However, we have prepared ourselves for periods of uncertainty such as this. While we've seen an increase in transfers with some softening of trading for Q1 it is really encouraging to see that we are still seeing good levels of new bookings for H2 and we still expect that Q4 FY'22 will see a return to near pre pandemic levels of capacity as people take their long awaited summer holidays,’ easyJet said this morning.

The airline said it expects capacity to be around 65% of pre-pandemic levels in the first quarter covering the three months to the end of December. That has been cut from its original goal of 70%, but will improve from just 58% in the latest quarter.

However, capacity should reach 70% of pre-pandemic levels in the second quarter, easyJet said, and return to ‘close to’ 2019 levels in the fourth quarter of the new financial year covering the three months to the end of September 2022 – representing the busy summer holiday period.

easyJet said demand is still accelerating for now, with bookings for the October half-term, ski breaks and Christmas trips all performing well. Plus, revenue from bookings for summer 2022, which will be key if airlines have any chance of bouncing back over the next year, are already ahead of pre-pandemic levels, partly thanks to it adding an extra 25 planes to its operational fleet to capture growth opportunities. It has also taken the opportunity to add new slots at key hubs including Gatwick, Porto, Lisbon and Linate.

The company said customers will be ‘looking for value’ as the economy recovers and said short-haul leisure travel will lead the uptick in demand.

‘Having delivered FY'21 ahead of consensus, we have seen an encouraging start to this year with strong demand returning for peak winter holiday periods, coupled with increasing summer demand with Q422 capacity expected to be close to FY'19 levels. As the UK's largest carrier, easyJet expects a significant benefit as the UK bounces back next summer. Our winning formula combined with the improvements made during the pandemic will accelerate our recovery,’ the airline said.

The airline said it is determined to return capacity to pre-pandemic levels by 2023 at the latest and recover Ebitdar margins in the mid-teens, with a return on capital employed to be in the low-to-mid teens over the medium-term. It also wants easyJet holidays to contribute at least £100 million in pretax profit to the group. Ebitdar margins and ROCE both came in negative in the recently-ended financial year.

Can easyJet weather another storm?

Although it is unclear how the Omicron variant will hit the travel industry over the longer-term, easyJet has strengthened its balance sheet after completing a £1.2 billion rights issue in September. Net debt was slashed to £910 million at the end of the financial year as a result, just short of the £900 million forecast by analysts, but that has been dramatically reduced from over £2.0 billion at the end of June.

The airline has unrestricted access to over £4.4 billion of liquidity heading into the new financial year and has no debt maturing until 2023. That has improved significantly from the £2.3 billion of liquidity it had a year ago. With the airline burning through £36 million of cash each week on average over the financial year (ahead of the £40 million guided by the company), easyJet should have enough cash to see it through another tough period.

It is also worth noting that easyJet has hedged 55% of its fuel for the new financial year to the end of September 2022 at a price of $498 per metric tonne. That will help partly shield it from the rise in commodity prices this year, with fuel currently trading at around $658 per metric tonne.

easyJet buys an additional 19 planes from Airbus

easyJet confirmed this morning that it has agreed to take delivery of an additional 19 aircraft from Airbus between January 2025 and September 2027. This means the airline has a total of 118 outstanding orders for Airbus A320 NEO aircraft.

The company said the agreement ‘secures valuable, supply constrained, delivery slots’ and that the latest aircraft ordered have a value of $2.25 billion based on delivery at 2021 list prices. However, the airline enjoys a ‘substantial discount from list prices’ as it has been purchasing aircraft under an agreement struck back in 2013. Under that deal, it still has unexercised purchase options over another 53 aircraft.

For context, easyJet had 308 aircraft in its fleet at the end of September 2021, down from 342 a year earlier.

Where next for the easyJet share price?

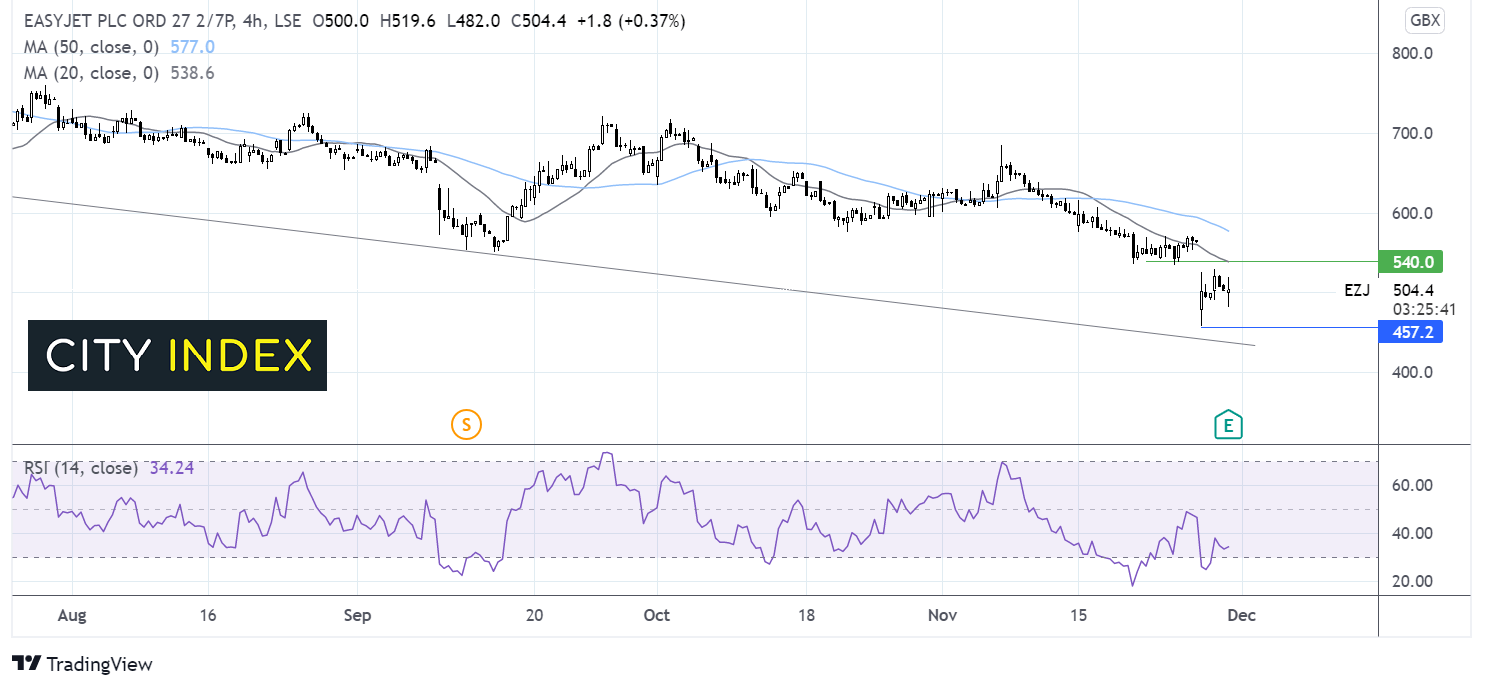

easyJet share price has been trending lower since early May. The price dropped to a yeasr to date low of 457p before rebounding higher.

The price trades below its 20 & 50 sma on the 4 hour chart. The 20 sma crossed below the 50 sma in a bearish signal.

The RSI has moved back above 30 so is no longer oversold but remain in bearish territory, suggesting that there could be more weakness to come.

Sellers will be looking for a move below 500p round number and 457p for fresh year to date lows.

Buyers need a move above 538p the 20 sma and a level which offered support across most of last week. A move above here could negate the near term down trend.

How to trade easyJet shares

You can trade easyJet shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘easyJet’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade