When will Disney release Q4 earnings?

Disney will publish fourth quarter and full year earnings after US markets close on Wednesday November 10.

Disney Q4 earnings preview: what to expect from the results

As has been the case for much of this year, Disney’s fourth quarter earnings will be a tale of two halves. The first has seen its streaming services rapidly grow as people consume more entertainment at home, while the second has seen its sprawling empire of theme parks, cruises and stores suffer thanks to restrictions.

The third quarter marked a turning point. Its streaming services saw subscriber growth accelerate while the gradual reopening of its sites allowed its Parks, Experience & Consumer Product division report its first profit since the pandemic began.

Wall Street forecasts fourth quarter revenue will rise to $18.79 billion from $14.70 billion the year before. It is also set to mark the fifth consecutive quarter of topline growth. Analysts expect income from continuing operations before tax of $787.5 million to turn from the $580.0 million loss booked the year before.

Breaking down the results, consensus numbers from Bloomberg show analysts are expecting the Media & Entertainment Distribution business to report revenue of $13.32 billion compared to $11.97 billion the year before but for operating income to fall to $990.8 million from $1.55 billion. The Parks, Experience & Consumer Products division is seen booking revenue of $5.26 billion compared to $2.58 billion the year before with operating income of $864.4 million seen turning from the $945.0 million loss last year.

Much of the focus this week will be on how Disney’s Direct-to-Consumer business is faring, with the company stating it is the ‘top priority’. Disney+ added 12.4 million subscribers in the third quarter and beat expectations, but warned net additions would slow to low-single digit growth in the fourth. Consensus figures suggest Disney+ will have added just 4.9 million subscribers in the period – which would be the slowest rate of acquisition since the service was launched. Meanwhile, subscriber growth for ESPN+ and Hulu are both set to deaccelerate markedly compared to what we saw in the third quarter.

|

(Millions) |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021E |

|

Disney + Subscribers |

73.7 |

94.8 |

103.6 |

116 |

119.5 |

|

Net adds |

16.2 |

21.2 |

8.7 |

12.4 |

4.9 |

|

ESPN+ Subscribers |

10.3 |

12.1 |

13.8 |

14.9 |

16.2 |

|

Net adds |

1.8 |

1.8 |

1.7 |

1.1 |

0.75 |

|

Hulu Subscribers |

36.6 |

39.4 |

41.6 |

42.8 |

44.37 |

|

Net Adds |

1.1 |

2.8 |

2.2 |

1.2 |

1.36 |

(Source: Bloomberg)

The slowdown in growth for its streaming platforms will be a concern, and Disney will have a job convincing markets that this is a temporary blip rather than a new trend. Continued disruption to the filming of content, a large number of Hotstar subscriptions ending, and a slower than expected ramp-up in new areas like Latin America are headwinds in the fourth quarter. Meanwhile, content distribution and marketing costs are expected to rise for content sales and licensing, while advertising and sports programming costs are also expected to have increased in the fourth quarter.

Meanwhile, investors will be keen to see the Parks, Experience & Consumer Products division start to build momentum now it has returned to profit. Its theme parks should continue to build momentum, stores are reopen, and cruises have restarted. Expectations are high, with consensus numbers suggesting operating income will more than double in the fourth quarter from the third. Disney said park reservations in the early part of the fourth quarter had exceeded what was seen in the third quarter, which Disney had described as ‘pretty darn good’. This has prompted some analysts to think the segment could beat consensus expectations when it comes to profit this week. Still, the Delta variant still poses a threat but things are improving with international travel reopening, vaccination programmes progressing and lockdown restrictions continuing to steadily ease. Still, Disney has said it expects to book around $1 billion in Covid-related costs over the full year.

Disney shares have slid almost 11% since hitting its latest all-time high of $201.91 in early March. The 32 brokers covering Disney currently have a Buy rating on the stock and have an average target price of $207.72, implying there is over 18% potential upside from the current share price.

Where next for the Disney share price?

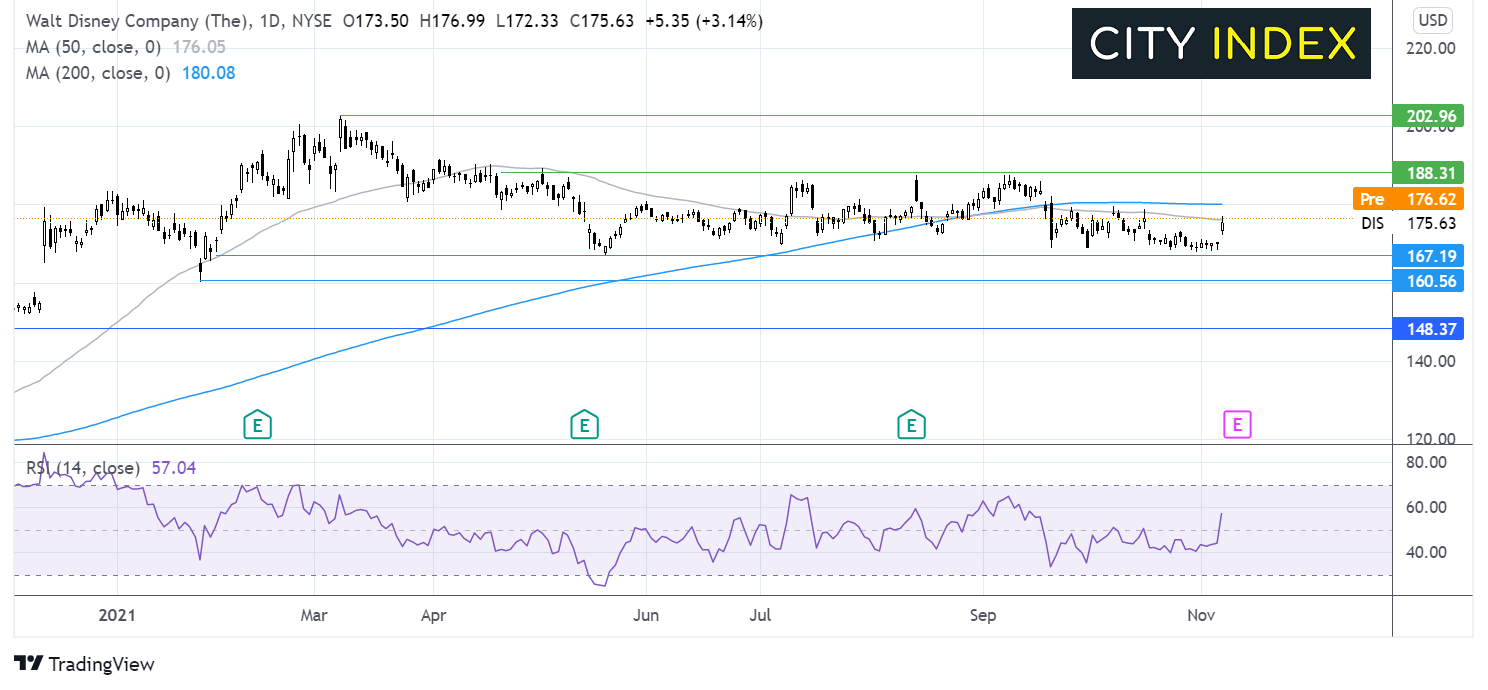

After reaching an all-time high of $202 in early March, the price eased lower before entering a holding pattern within which it has traded across most of the year.

The share price has been capped on the upper side by $188, whilst $167 has limited the losses.

The price is testing its 50 sma, which along with the bullish RSI is keeping buyers hopeful.

Traders might look for a breakout trade from Disney. Buyers looking for a move above $188 in order to target $202 and fresh all-time highs.

Meanwhile sellers could look for a break below $167 to open the door to $160, the year to date low, and $148, the December 2020 low.

How to trade Disney shares

You can trade Disney shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Disney’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade