Burberry Earnings Preview | Burberry Q1 Results | Burberry Share Price | Burberry Shares

When will Burberry release Q1 results?

Burberry will release a first-quarter trading update on the morning of Friday July 16. This will cover the three months to June 27.

What to expect from Burberry’s results

Markets are expecting Burberry to continue on the road to recovery when it releases first-quarter results this week, although the news last month that chief executive Marco Gobetti is leaving the business at the end of this year could overshadow its performance.

Gobetti has been spearheading the transformation of Burberry over the last three years, but there is still work left to do and there are, understandably, nerves among investors about who will takeover at the helm and start a new era at Burberry.

Still, for now, Burberry’s quarterly trading updates focus solely on revenue figures. Analysts are expecting first-quarter revenue of £444.5 million. That will be a marked improvement from the £257 million booked the year before, flattered by the fact sales were hard-hit as the pandemic erupted and lockdowns started to bite.

Revenue will also start to benefit as Burberry focuses more on full-price sales and reducing the number of markdowns it makes in the new financial year. While this should benefit topline revenue it will hurt comparable store sales. Comparable store sales returned to growth in the final quarter of the last financial year as recovery momentum gained ground but will be disrupted by the reduction in markdowns. Burberry warned in May that first-quarter comparable sales will be negatively impacted by ‘high single digits’ as a result.

Geographically, Asia Pacific has been leading the recovery in sales in recent quarters, particularly in China and Korea, while full-price sales have also been growing strongly in the US. Investors will want to see those trends continue in the new year.

Notably, analysts are Berenberg said it was expecting ‘strong’ results from luxury brands in the quarter because of exceptional demand for luxury goods in the US and China and improving trends in Europe. However, it noted it was more cautious on Burberry than some other brands until it saw more evidence that growth will accelerate and because of the lack of near-term catalysts for its share price, prompting it to reiterate its Hold rating on the stock.

That view is echoed by the majority of brokers. The 20 brokers covering Burberry currently have an average rating of Hold and an average target price of 2185.95p – over 6% higher than the current share price.

Investors will also want to see evidence that its wholesale division is recovering after third-parties cut orders last year as stores closed during lockdowns. Burberry has said it expects wholesale revenue to rise 50% in the first-half.

Where next for the Burberry share price?

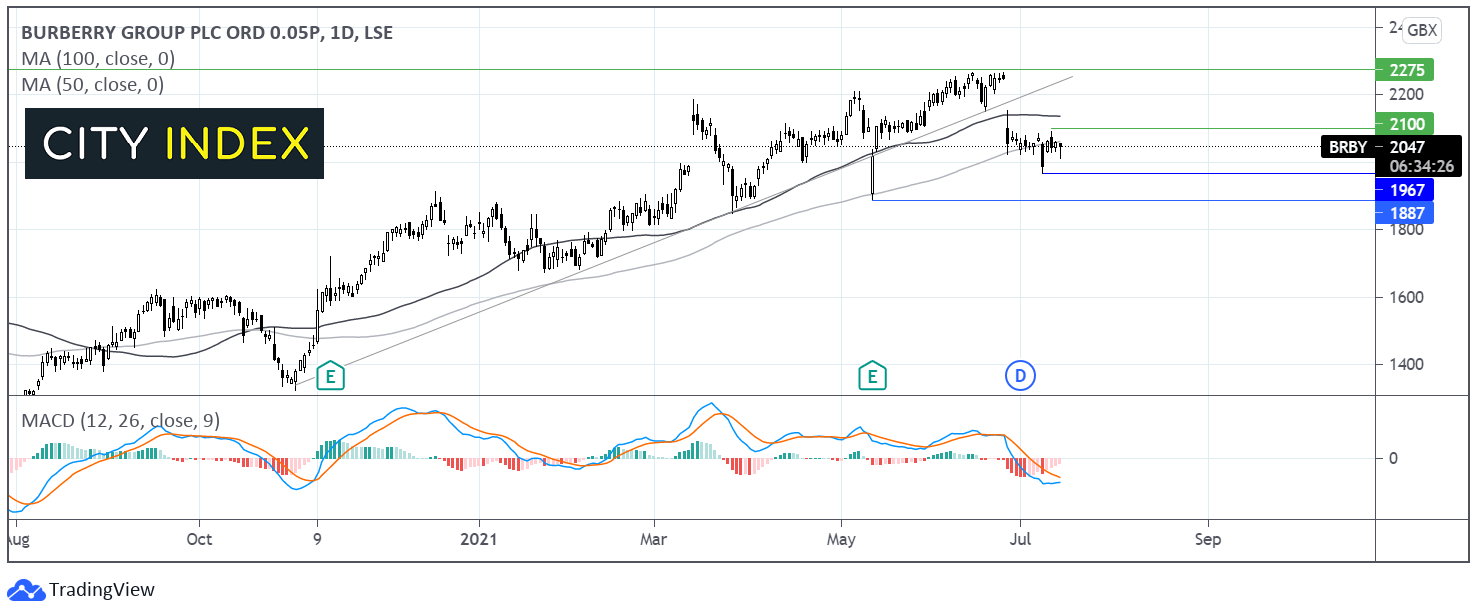

After trending higher since early October, Burberry share price broke below its ascending trendline and 50 dma at the end of June.

The price is currently finding support on the 100 dma. The receding bearish bias of the MACD provides some hope for buyers. Any recovery would need to retake 2100p the weekly high and close above the 100 dma at 2060p in order to look towards the 50 dam at 2135p.

Failure of the 100 dma to hold could see seller break towards 1972p the July low, opening the door towards 1883p the May low.

How to trade Burberry shares

You can trade Burberry shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Burberry’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade