BP Q2 Earnings Preview | BP Share Price | BP Shares

When will BP release its Q2 results?

BP will release earnings for the second quarter on the morning of Tuesday August 3.

BP Q2 earnings preview: what to expect from the results

BP’s transformation is set to continue when it reports its next set of quarterly results. The company surprised the markets earlier in 2021 after reaching its debt target around one year earlier than expected, fuelled by an acceleration in asset sales and a recovery in oil prices. That means BP has deleveraged itself and can now funnel more cash toward other areas, such as investing in the costly transition to cleaner energy and returning more cash to shareholders.

That prompted BP to launch a $500 million share buyback that was completed in the second quarter, complimenting the first-quarter ordinary dividend of 5.25 cents, flat from the previous quarter but still half what it was paying before the pandemic hit.

The intention going forward is to return 60% of surplus cash through buybacks, with the other 40% being hoarded in order to strengthen the balance sheet. This means surplus cashflow will be closely-watched. BP generated $1.7 billion in surplus cash in the first quarter but there are headwinds that could limit it in the second, primarily a $1.2 billion charge being booked related to the oil spill in the Gulf of Mexico back in 2010. That, combined with other charges and a smaller improvement in refining margins, prompted BP to warn that it expected to be ‘cashflow deficit’ in the second quarter.

Still, analysts are confident that shareholders will be rewarded even if second quarter cashflow is held back given the improving market conditions as prices recover and the global economy reopens. Oil prices hit their highest level in almost two years during the second quarter and refining margins have also improved significantly. BP will unveil its buyback plans for the third quarter when it releases its results and estimates from Bloomberg suggest a further $1 billion to $2 billion could be returned in 2021. Plus, an increase in its dividend has not been ruled out.

The headline figure that to be watched by analysts is underlying replacement cost profit. A consensus from Reuters shows markets are expecting a profit of $2.05 billion while a Bloomberg one places the figure slightly higher at $2.13 billion. That would compare favourably to the large $6.68 billion loss booked in the second quarter of 2020 but would be down from the $2.63 billion in profits booked in the first quarter of this year.

BP’s results will follow on from rival Shell’s second quarter results that were released on Thursday, when it beat earnings expectations. Shell, lagging slightly behind BP in terms of deleveraging, revealed it too has cut debt down enough to reintroduce a progressive dividend policy and launched a new $2 billion share buyback that will be completed before the end of the year. It rebased its quarterly payout to $0.24, some 38% higher than what was paid in the first quarter, and said its progressive policy aims to grow payouts by 4% per year.

Brokers remain bullish on BP’s prospects. The 27 brokers that cover the stock have an average Buy rating on the stock and a target price of 358.18 pence – over 20% higher than the current share price.

Where next for the BP share price?

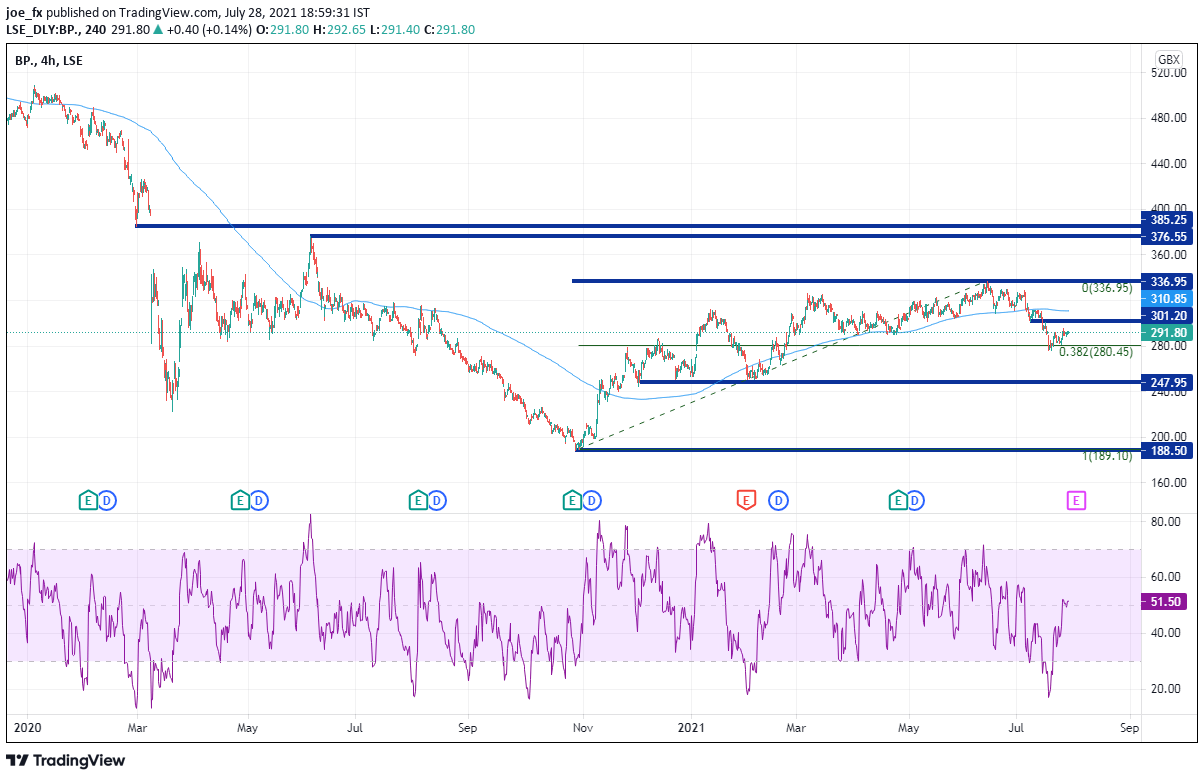

In early January 2020, BP was trading above 500. However, as the coronavirus pandemic played out over the course of the year, the price of the stock reached a low of 188.90 on October 29, 2020. The price bounced from those lows and has been trading between 250 and 336.95 since December 1, 2020. BP pulled back from the June 16 highs (336.95) to the 38.2% Fibonacci retracement from the lows of October 29 to the highs on June 16, near 276.30.

Horizontal resistance is at 301.20, just below the 200 Day Moving Average at 310.85. Horizontal resistance above is at 336.95, 376.55, and 385.25. Horizontal support is at the near-term lows of 276.30 and the range lows near 250. Below there, price can fall to the October 29, 2020, lows at 188.90.

How to trade BP shares

You can trade BP shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘BP’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade