Boeing Preview | Boeing Share Price | Boeing Shares

When will Boeing release its Q2 deliveries report?

Boeing is expected to publish its second-quarter deliveries report on Tuesday July 13. This will set the stage ahead of the company’s quarterly earnings release due on Wednesday July 28.

What to expect from Boeing’s delivery update

Boeing’s delivery reports are short and sweet, outlining how many aircraft have been delivered to its airline and government customers around the world during the three months to the end of June.

We have seen the number of new aircraft being ordered by airlines slow amid the uncertainty caused by the pandemic, which has also prompted them to delay the delivery of new aircraft that had already been bought. However, Boeing has had the added problems with its 737 MAX, which has grounded planes and forced the company to delay deliveries in order to fix the problems and convince regulators they are safe.

Boeing delivered 77 commercial planes in the first quarter of 2021 and hinted that could improve in the second. 737s have made up the bulk of deliveries in recent quarters but production has been running at a low rate. However, output is steadily ramping-up this year to 31 per month by early 2022. Plus, it restarted deliveries of 787s in late March, having only delivered two in the first quarter, and is now producing five of them per month.

Investors will be hoping that the improved production rates will translate to increased deliveries and build on the momentum gathered since the third quarter of 2020.

Notably, Boeing has been losing ground to its rival Airbus over the past year, with the European manufacturer having delivered significantly more planes. Airbus usually reports after Boeing, and investors will also be closely watching those numbers when they are released.

|

Commercial Deliveries |

Q1 2020 |

Q2 2020 |

Q3 2020 |

Q4 2020 |

Q1 2021 |

|

Boeing |

50 |

20 |

28 |

59 |

77 |

|

Airbus |

122 |

74 |

145 |

225 |

125 |

Notably, the global monopoly held by Boeing and Airbus could be tested going forward as recent reports suggest Comac, a manufacturer backed by the Chinese government, is close to getting its first commercial single-aisle jet approved by authorities. Serious sums of money have been invested in development over the last decade and is thought to have over 1,000 orders lined-up, mostly from domestic airlines, but there is little doubt it will be targeting the global market in the future.

For context, Boeing has a backlog for over 5,000 commercial planes and has secured new orders for at least 334 planes since the start of 2021 alone - but it is the number it delivers and turns into cash that ultimately matters.

Where next for the Boeing share price?

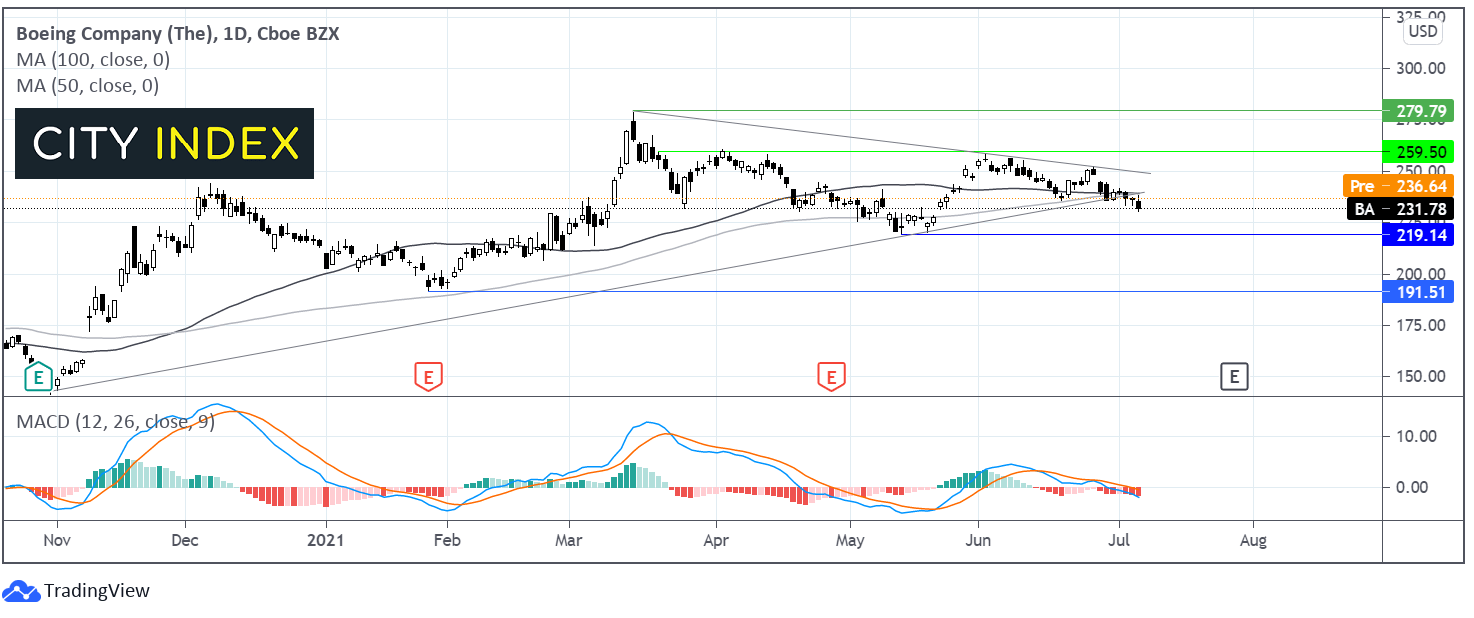

Boeing share price trades above its ascending trendline dating back to early November last year. The price hit resistance at 278 in mid-March and has been forming a series of lower highs, creating a symmetrical triangle pattern.

The price broke out below the ascending trend line support last week is a bearish signal. The bearish MACD is also supportive of further downside, which could bring horizontal support at $220 into focus, the May 12 low. A break below this level could open the door to a deeper selloff towards 191, the year to date low.

Any meaningful recovery would need to clear the $240 the confluence of the ascending trendline support turned resistance and the confluence of the 50 & 100 day ma. Meanwhile a move above the descending trendline at $250 could negate the negative bias and see buyers gain momentum towards $260 and $278.

How to trade Boeing shares

You can trade Boeing shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Boeing’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade