Bed Bath & Beyond Q1 earnings: when will they be released?

Bed Bath & Beyond (BBBY) will release first-quarter results before US markets open on Wednesday June 30, at 0815 EDT (1315 BST). This will cover the three months to the end of May.

What to expect from the BBBY results

BBBY has just completed the first phase of a three-year transformation plan and said it was looking to ‘start fresh’ in the new financial year after sharpening its size and scale, refining its portfolio of products, and strengthening its financial position. Last year, over 140 stores closed, it divested several non-core brands and it slashed over $1 billion off its debt pile.

It will be hoping to build on the momentum gathered over the past year. It has delivered comparable sales growth over three consecutive quarters and earnings have improved thanks to the shift to higher-margin online sales, which accounted for just under one-third of its total sales in the last financial year. It acquired over 10 million new digital customers, almost doubling the number of consumers buying online.

This will be helped by the fact that BBBY will be coming up against weak comparatives as the first-quarter of the last financial year covers the period when the pandemic first erupted and forced stores to close, which will flatter its results this year.

It has already said that net sales should be around 40% higher year-on-year, suggesting a figure of around $1.83 billion compared to $1.30 billion the year before. BBBY has said its margin should steadily improve this year and come in around 34% in the first quarter, delivering Ebitda of between $80 million to $90 million.

Analysts expect BBBY will turn to adjusted diluted earnings per share of $0.08 from a $1.96 loss the year before, while reported EPS of $0.05 would compare to an $2.44 loss.

Operationally, investors will want to hear about the initial performance of the new brands launched during the first-quarter - Nestwell, Haven and Simply Essential, which are three of the eight new launches BBBY plans to complete this year.

BBBY should have bought around $325 million of stock during the first-quarter after expanding its buyback programme last year, having previously planned on buying $300 million worth. That is part of the wider plan to up buybacks to $1 billion over the full year from a previous target of $825 million.

Investors will also want to see BBBY at least reaffirm its guidance for the full-year. The company is currently aiming to deliver $8.0 billion to $8.2 billion in sales and adjusted Ebitda of $500 million to $525 million.

Where next for the BBBY share price?

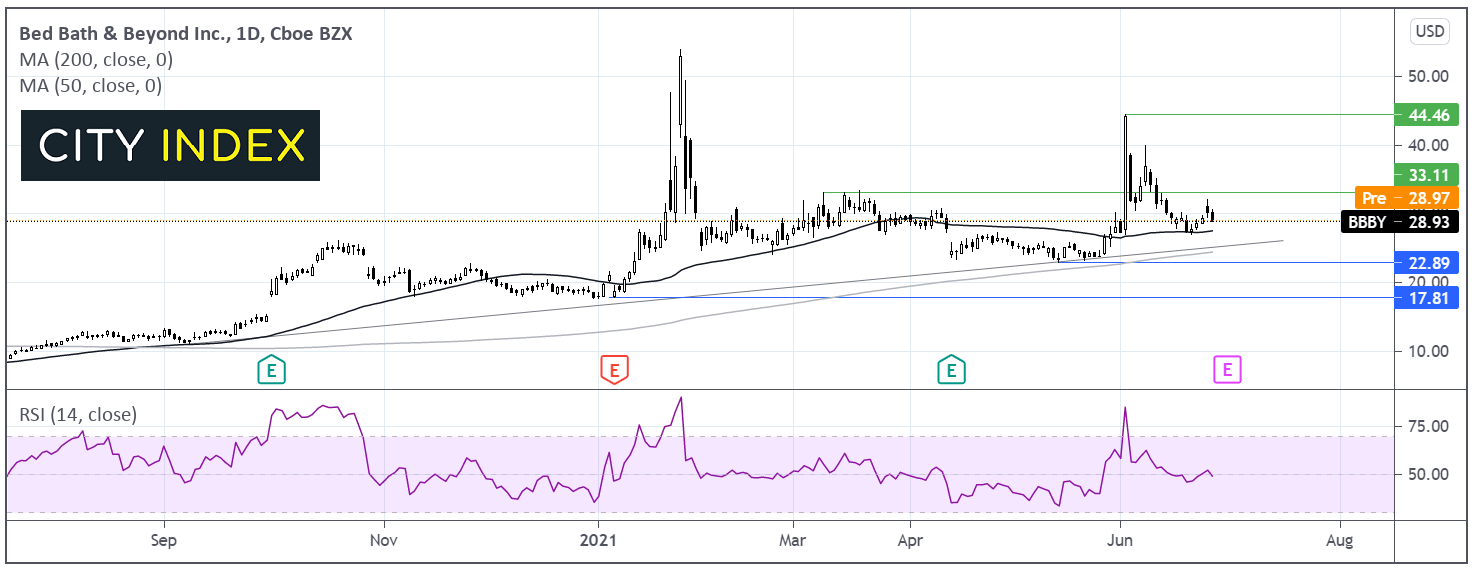

The Bed Bath and Beyond share price is trading above its ascending trendline dating back to mid-September. It trades above its gently upwards sloping 100 sma on the daily chart, and above the flat 50 sma suggesting a more neutral bias.

The RSI is also showing a neutral bias at 50 ahead if earnings so a post earnings break out trade could be worth watching for.

Buyers could be looking for a breakout trade above 33p resistance from mid-March to target 45p the June high.

Meanwhile sellers could be watching for a close below the ascending trendline at 25p and then 23p which could see sellers gain traction towards 17.8p.

How to trade Bed Bath & Beyond shares

You can trade Bed Bath & Beyond shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Bed Bath & Beyond’ or ‘BBBY’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade