When will Applied Materials release Q4 earnings?

Applied Materials is scheduled to publish fourth quarter earnings after US markets close on Thursday November 18.

Applied Materials Q4 earnings preview: what to expect from the results

Applied Materials delivered record revenue and earnings in the third quarter and both metrics are expected to climb to new highs when it releases results for the fourth quarter this week. The company, which supplies the materials and tools needed to produce ‘virtually every new chip and advanced display in the world’, has been riding the wave of booming demand for semiconductors over recent years and has been a key supplier to companies scrambling to supply the chips the world needs.

Wall Street is expecting fourth quarter revenue of $6.35 billion to beat the company’s guidance for $6.33 billion. That would be up from just $4.69 billion the year before and from the record $6.20 billion booked in the third quarter.

Operating income is forecast to rise to $2.08 billion from $1.33 billion the year before, which would also mark a small improvement from the $2.03 billion booked in the previous quarter. Below is a breakdown of analyst’s revenue and operating profit expectations by division and how they compare on both a quarter-on-quarter and year-on-year basis:

|

($, millions) |

Q4 2021E |

Q3 2021 |

Q4 2020 |

|

Semiconductor Systems Revenue |

4,603.7 |

4,454 |

3,070 |

|

- Operating Income |

1,589.0 |

1,785 |

1,509 |

|

Applied Global Services Revenue |

1,301.7 |

1,286 |

1,106 |

|

- Operating Income |

396.9 |

393 |

320 |

|

Display and Adjacent Markets Revenue |

405.0 |

431 |

485 |

|

- Operating Income |

92.1 |

99 |

95 |

(Source: Bloomberg)

Semiconductor Systems is expected to achieve record revenue thanks to strong demand from foundries, which produce chips on behalf of other companies that design them but lack the manufacturing plants to build them. The fact major foundries such as Taiwan Semiconductor Manufacturing Co (TSMC) are gradually shifting toward more advanced chips capable of handling more strenuous tasks as we embrace things like 5G and Artificial Intelligence bodes well for Applied Materials.

Meanwhile, its other major division, Applied Global Services, should follow a similar trend. The more of the company’s tools, which range from ones that etch designs to polishing, the more recurring revenue this generates for Applied Materials. The company is keen to grow subscription revenue and this division is key to achieving that. Plus, with the semiconductor industry operating at full capacity and stretching to meet demand, utilisation rates of the company’s tools should remain high.

Adjusted EPS is expected to rise to a new quarterly record of $1.95 from $1.25 the year before, in the middle of the company’s $1.87 to $2.01 guidance range, while reported EPS is also seen climbing to a new record of $1.93 from $1.23 last year.

If Applied Materials meets expectations in the fourth quarter, this should see annual revenue jump to $23.29 billion from $17.20 billion last year, with operating income rising to $7.36 billion from $4.53 billion. Annual adjusted EPS is seen increasing to $6.86 from $4.17 while reported EPS is forecast to climb to $6.46 from $3.92.

Where next for the AMAT share price?

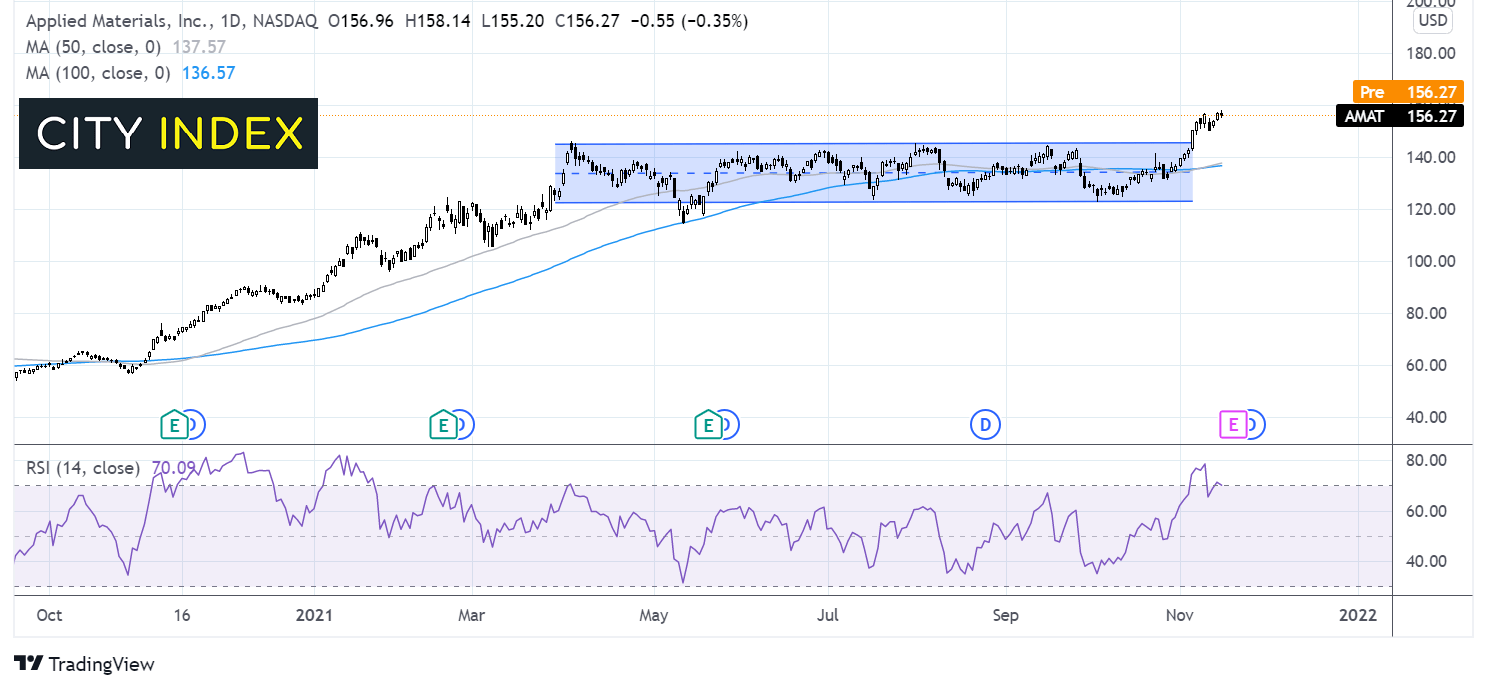

After rising across the first quarter of the year, Applied Materials share price traded range bound from April until early November. The upside was capped by $145 and the lower side by $123.

The price broke out of the holding pattern on November 4, hitting an all-time high of $158.

The RSI has tipped into overbought territory so there could be an easing back or some consolidation at this level before further gains.

Support can be seen at $145, the upper band of the holding pattern. A move back into the channel could see the 50 & 100 sma tested at $135.

It would take a move below $123 the lower band of the horizontal channel for sellers to gain traction.

How to trade Applied Materials shares

You can trade Applied Materials shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Applied Materials’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade