The lack of market gyrations in recent weeks seemed conducive to this plan. The bellwether U.S stock index, the S&P500 trading in the middle of an eight week 3600 to 3200 range. While the German stock market, the DAX appeared even more steadfastly anchored within a fourteen-week 13500 to 12250 type range (basis cash indexes for both).

However, markets have an uncanny ability to find pressure points and provoke a reaction.

While traders may be willing to assigned a low probability to President Trump's re-election chances and given up on the idea of a pre-election fiscal deal, it has become increasingly difficult to ignore the surging second wave of COVID19 cases in Europe and the U.S.

In an article earlier this week we outlined the reasons why the EURUSD was vulnerable, due to positioning and a slowdown in European growth as a result of renewed lockdowns.

Overnight those fears appear much closer and spread to the DAX, as it was announced German Chancellor Merkel was considering a “lockdown light” and that France was considering full lockdowns in some cities.

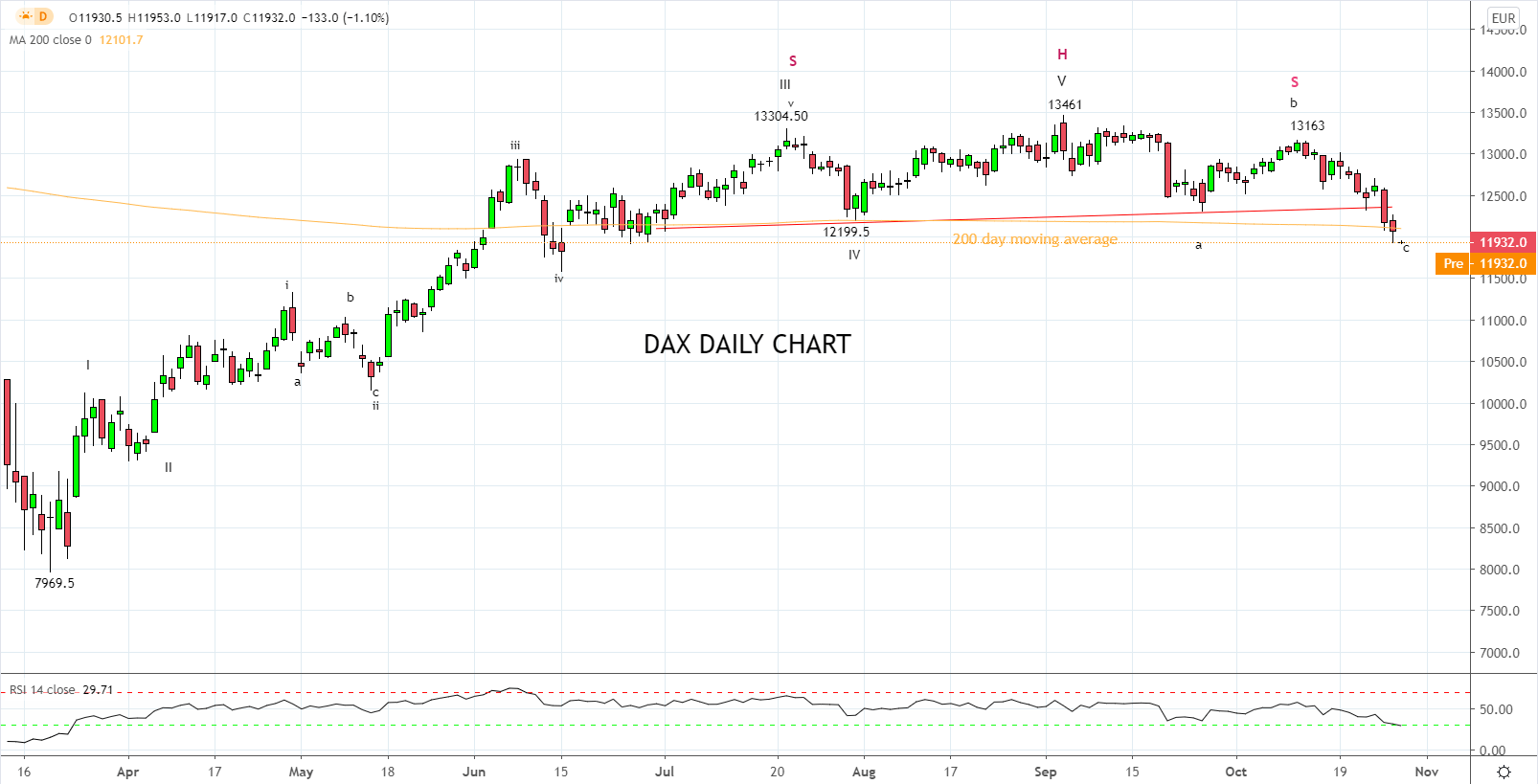

The Dax already on the backfoot after shares of SAP collapsed 20% earlier this week, closed below the bottom of its fourteen-week range, and below the neckline of a head and shoulders topping pattern as viewed on the chart below.

Admittedly a sustained break of the last bastion of support, the 200-day moving average is yet to be realised. However, based on the indicative pre-market open this could occur tonight and would then open the way for the DAX to retreat towards the high of late April, 11,300 area.

To negate the risks of the current correction deepening, the DAX needs to promptly reclaim the broken neckline 12,500 area on a closing basis.

Source Tradingview. The figures stated areas of the 28th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation