This high level of conviction stems from polls. However, for those who recall the 2016 U.S. election, Brexit, and the 2017 Australian election there are concerns that polls will again prove misleading.

More so given the outcome of the U.S. election is likely to depend on voting in a handful of swing states including Florida, seen as pivotal to Trump's re-election chances. Polls currently have Joe Biden ahead in Florida. However, there is a belief that the polls undercount support for Trump in swing states, now as they did in 2016.

The risks then for FX traders are for an election outcome less smooth than priced. This would trigger a recovery in the U.S. dollar against a Euro currency becoming increasingly vulnerable due to a rapidly accelerating second wave of COVID19.

Also indicative of vulnerability, the latest IMM positioning data shows that the market is holding approximately a $27bn net short U.S dollar position and the bulk of the position is held against the Euro.

Which prompts the question, even if the election delivers the Democrat victory it is positioned for - will slowing European growth and a market already positioned long the EURUSD undermine its upside prospects?

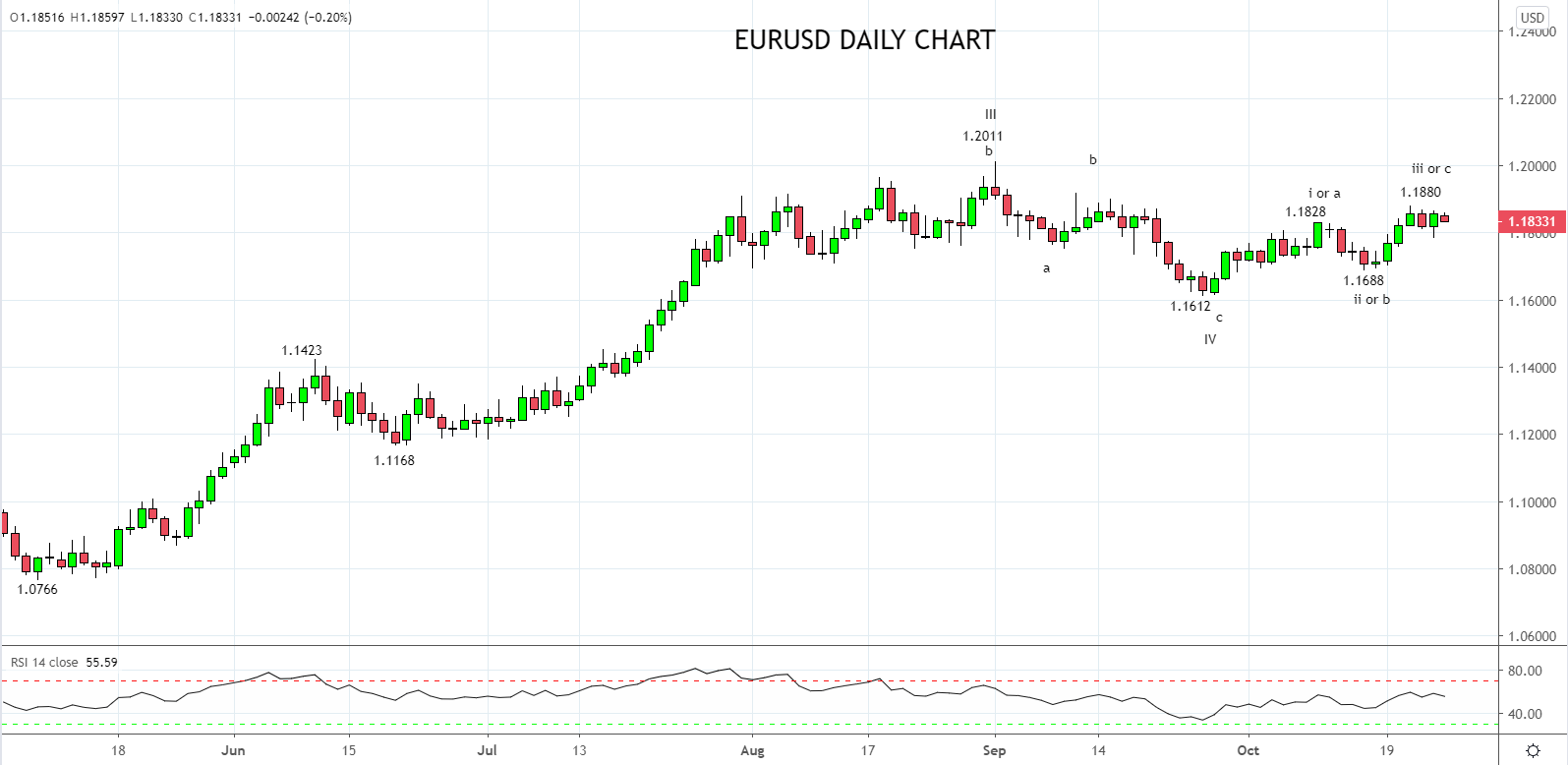

Technically last week’s break and close above resistance 1.1780/00 was a positive development for the EURUSD and suggests the latest leg of the uptrend has commenced towards 1.2000/1.2150.

However for the short-term bias to remain in place, the EURUSD needs to remain above near-term support 1.1780 and has no place trading below last week’s 1.1688 low.

Aware that a break and close below 1.1688ish would erode the positive technical backdrop and warn that a retest and break of the 1.1612 low is underway, with risks towards 1.1500.

Source Tradingview. The figures stated areas of the 26th of October 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation