However, after crude oil made fresh cycle highs on Monday, report’s that Russian troops had been ordered to pull back from the border sparked a quickfire 5% pullback in the price of crude oil earlier this week.

That sell-off has been followed by another this morning following comments from Iran’s top nuclear negotiator Bagheri who said, “we are closer than ever to an agreement.” Bagheri referred to talks between Iran and the United States that aim to revive the Iranian Nuclear deal, which would limit Iran’s nuclear ambitions.

While the bar to a deal remains high, it could lead to the resumption of sanction-free Iranian crude oil supply estimated to be up to 900,000 barrels a day by year-end.

An amount that would help ease the current tightness in the oil market made worse by OPEC+ again missing production quotas in January, the tightest inventory levels in decades, low spare capacity, and geopolitical tensions.

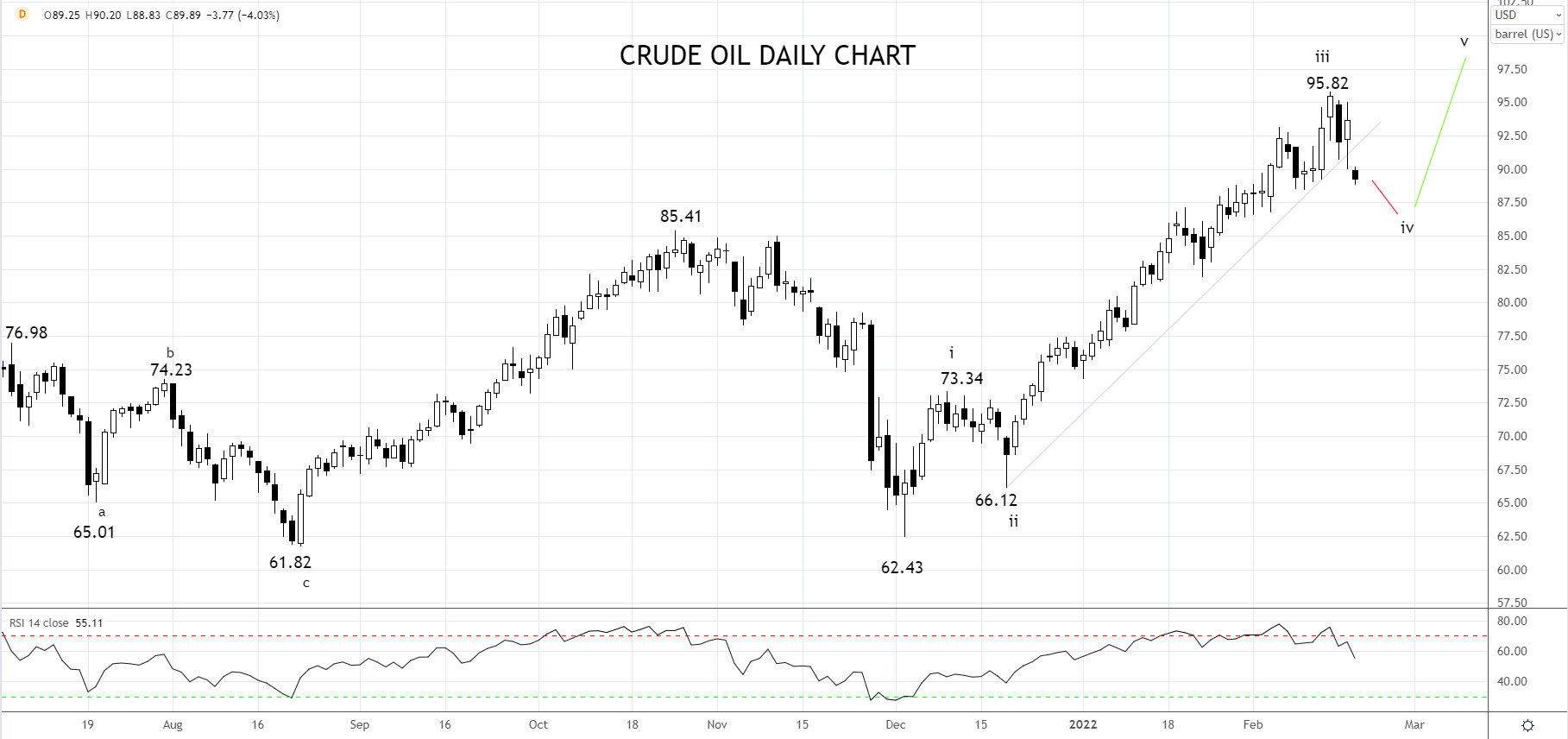

While there is a lot of moving parts to this, should a deal be struck with Iran in the coming days and presuming Russia – Ukraine tensions continue to ease, a break of recent lows near $88.50, should see the current retracement deepen towards support coming from the October highs at $85.40/00ish.

Presuming the retracement appears corrective, and there is evidence of basing near the support at $85.00, the bias would be for a return to trend and a retest of the $95.82 high before a push towards $100 per barrel.

Source Tradingview. The figures stated areas of February 17th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade