Also supported by estimates from economists that about 75% of those made unemployed in the U.S, are currently receiving bigger pay checks from government support programs than they were receiving whilst working. All in all, the prospects of a V-shaped recovery seems to be back on track in the U.S.

Tomorrow sees the release of Australian jobs data for May data at 11.30 am Sydney time, that should help reassure a similar V-shaped scenario will play out in Australia in the coming months.

While a modest fall of 60,000 jobs is expected in May following on from the loss of 600,000 jobs in April the labour market is then expected to recover, until the next big test coming from the conclusion of the Jobkeeper program at the end of September.

In terms of what this means for the AUDUSD, the Reserve Bank of Australia’s minutes for the June meeting released yesterday contained the observation.

”Movements of the Australian dollar over the course of this year had been closely correlated with global equity prices”.

We could not have summed up the AUDUSD’s recent behaviour better ourselves. Furthermore we don’t think the AUDUSD currently has the capacity to break too far in either direction without first receiving a fresh directional lead from global equities.

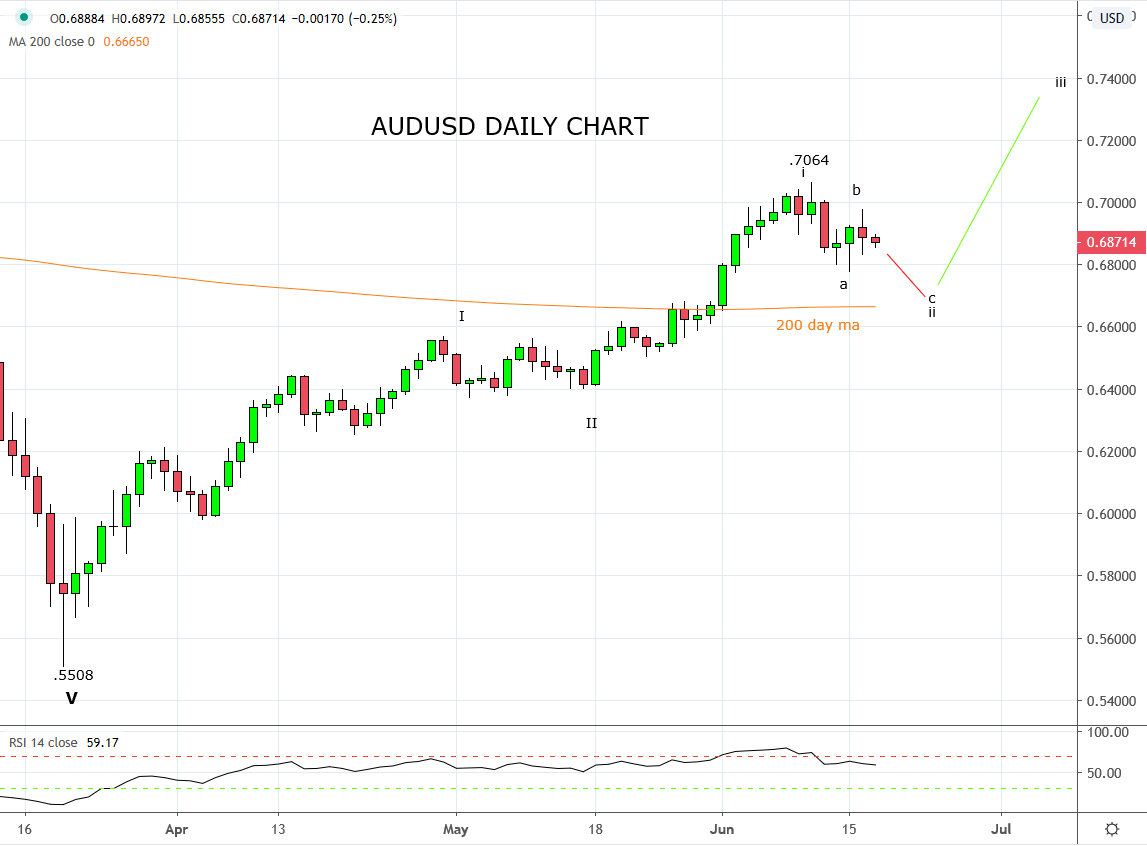

From a technical point of view, after a 15c rally from its March low, the AUDUSD is taking a well-deserved breather, and is anticipated to spend more time trading sideways, consolidating between .7050c on the topside and .6680c on the downside.

Should evidence of a base in the AUDUSD form near the .6680c support area, (bullish daily reversal candle) our bias is to be a buyer in anticipation of a retest of the recent .7064 high. Keeping in mind that should the AUDUSD experience a sustained break below .6680, it would signal a deeper pullback is underway towards .6400c.

Source Tradingview. The figures stated areas of the 17th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation