UK banks are due to report Q2 results. After the mixed signals from the US banks these results are keenly awaited to gain a deeper understanding of the coronavirus impact on the sector.

The key factors which could drive the share price movement:

1. Bad loan provisions

These represent the money that banks put aside in preparation for loans that they expect to be defaulted on or not paid back in full. Owing to coronavirus these provisions will be high. Businesses are folding and the number of people who has lost jobs is increasing and will increase further as the government’s job retention scheme transitions towards employer’s contribution. The Q1 banks set aside a lot less than US banks suggesting there are less well prepared for a big hit. Analysts expect the total UK credit hit to be in the region of £19 billion in 22020 alone.

These represent the money that banks put aside in preparation for loans that they expect to be defaulted on or not paid back in full. Owing to coronavirus these provisions will be high. Businesses are folding and the number of people who has lost jobs is increasing and will increase further as the government’s job retention scheme transitions towards employer’s contribution. The Q1 banks set aside a lot less than US banks suggesting there are less well prepared for a big hit. Analysts expect the total UK credit hit to be in the region of £19 billion in 22020 alone.

2. Net Interest Income (NII)

The BoE slashed interest rates to a 300-year low of 0.1% at the start of the pandemic, whilst this could encourage more lending the NII will be squeezed, pressuring margins. This is particularly a problem for the domestic focused banks which have small investment banking and trading divisions, such as Lloyds and Natwest.

The BoE slashed interest rates to a 300-year low of 0.1% at the start of the pandemic, whilst this could encourage more lending the NII will be squeezed, pressuring margins. This is particularly a problem for the domestic focused banks which have small investment banking and trading divisions, such as Lloyds and Natwest.

3. Trading Revenue

Some of these income headwinds could be offset by strong trading revenues. Similar to what we saw in the US banks earnings that those banks with larger trading divisions weathered the covid storm better thanks to record trading revenues amid increased volatility in the markets.

Some of these income headwinds could be offset by strong trading revenues. Similar to what we saw in the US banks earnings that those banks with larger trading divisions weathered the covid storm better thanks to record trading revenues amid increased volatility in the markets.

4. Brexit

The sector faces enormous uncertainty over Brexit, particularly as the EU has so far refused to commit to providing access to the bloc’s financial markets. Failure of the EU & UK to strike a deal could have consequences for the UK’s financial sector and the bank’s outlook.

The sector faces enormous uncertainty over Brexit, particularly as the EU has so far refused to commit to providing access to the bloc’s financial markets. Failure of the EU & UK to strike a deal could have consequences for the UK’s financial sector and the bank’s outlook.

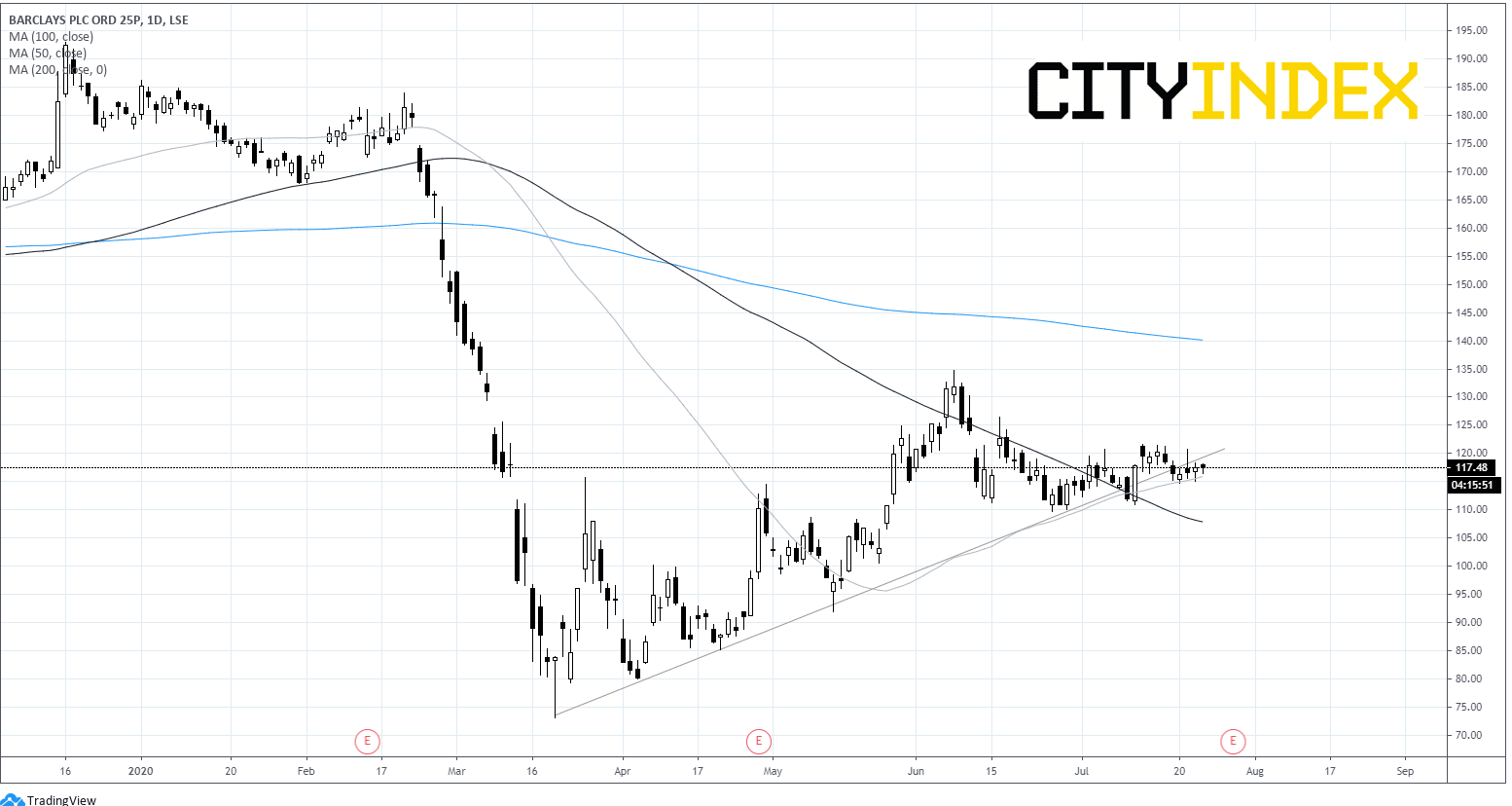

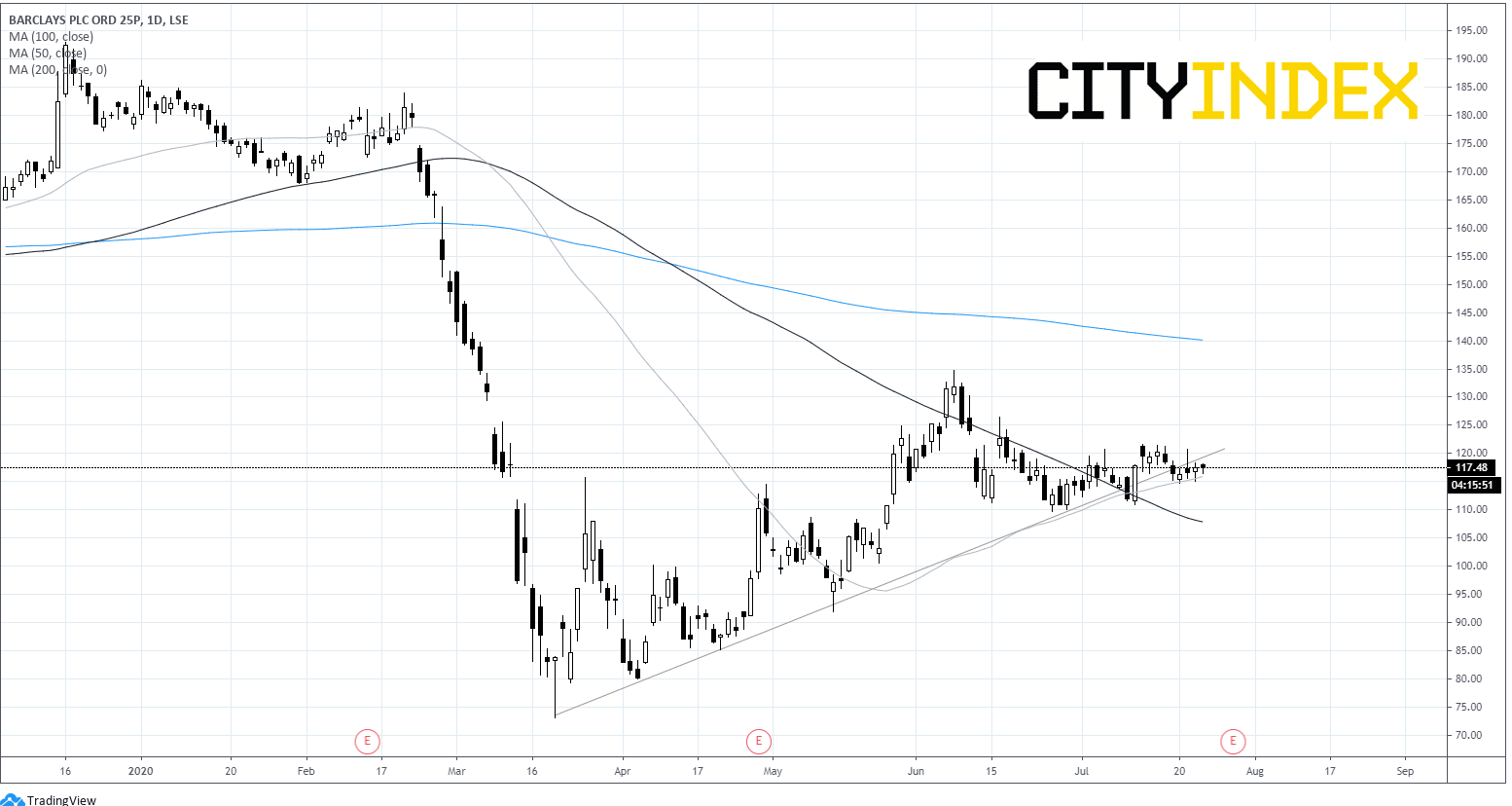

Barclays – 29th July

Barclays set aside more in provisions for bad loans in Q1 than its peers, has a better loan to deposit ratio and has a larger investment trading arm. Barclays has rallied 60% since its mid-March lows, however the rally has run out of steam around the 120p level where it has traded around for the past month, supported by its 50-daily average. Whilst the stock also trades above its 100 sma it has fallen below its ascending trendline support and trades. A decisive move above 120p rising trendline and 122p resistance could indicate more buying is on the cards. A fall below 115p (50 sma) could open the door to further losses.

Barclays set aside more in provisions for bad loans in Q1 than its peers, has a better loan to deposit ratio and has a larger investment trading arm. Barclays has rallied 60% since its mid-March lows, however the rally has run out of steam around the 120p level where it has traded around for the past month, supported by its 50-daily average. Whilst the stock also trades above its 100 sma it has fallen below its ascending trendline support and trades. A decisive move above 120p rising trendline and 122p resistance could indicate more buying is on the cards. A fall below 115p (50 sma) could open the door to further losses.

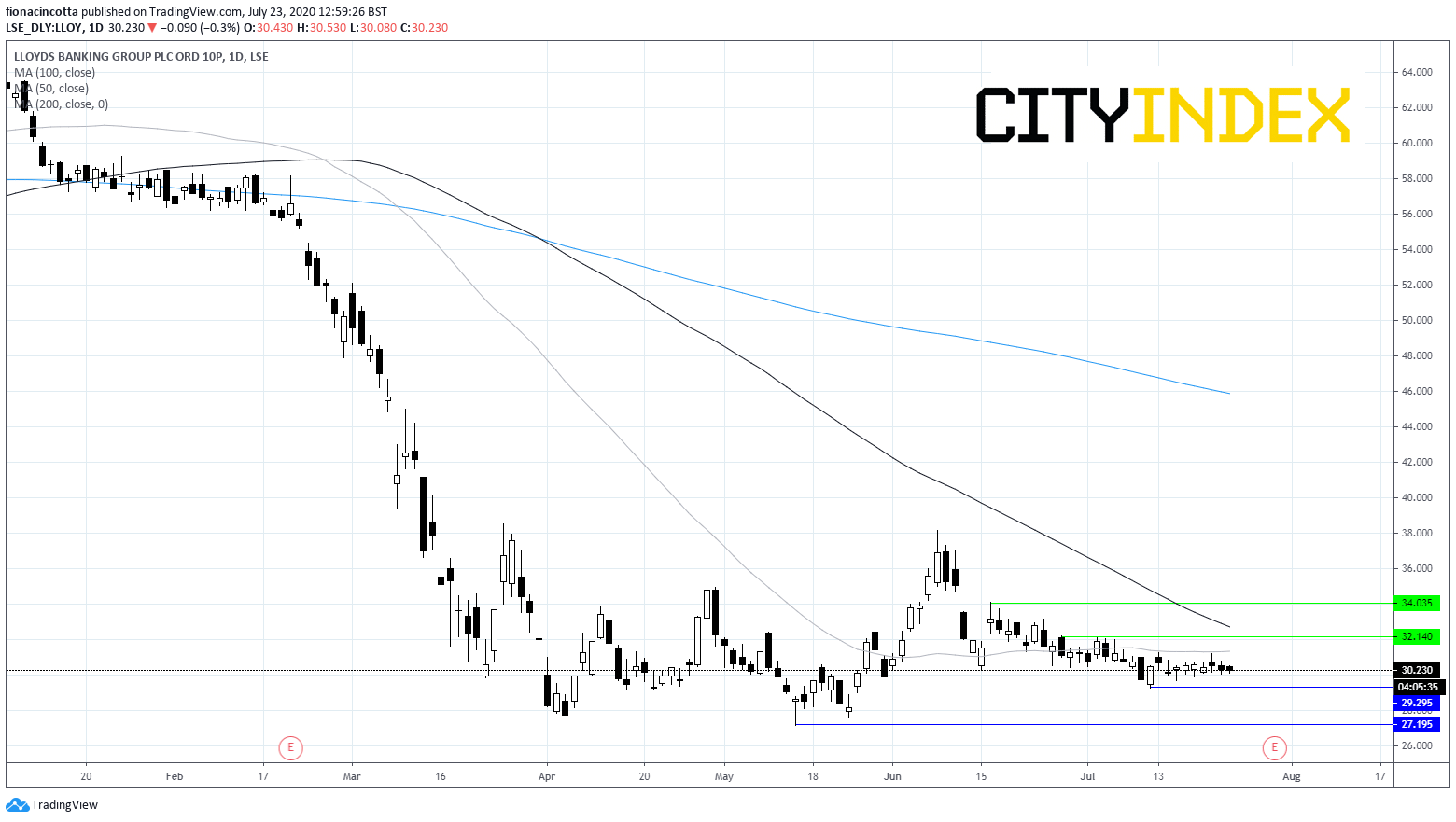

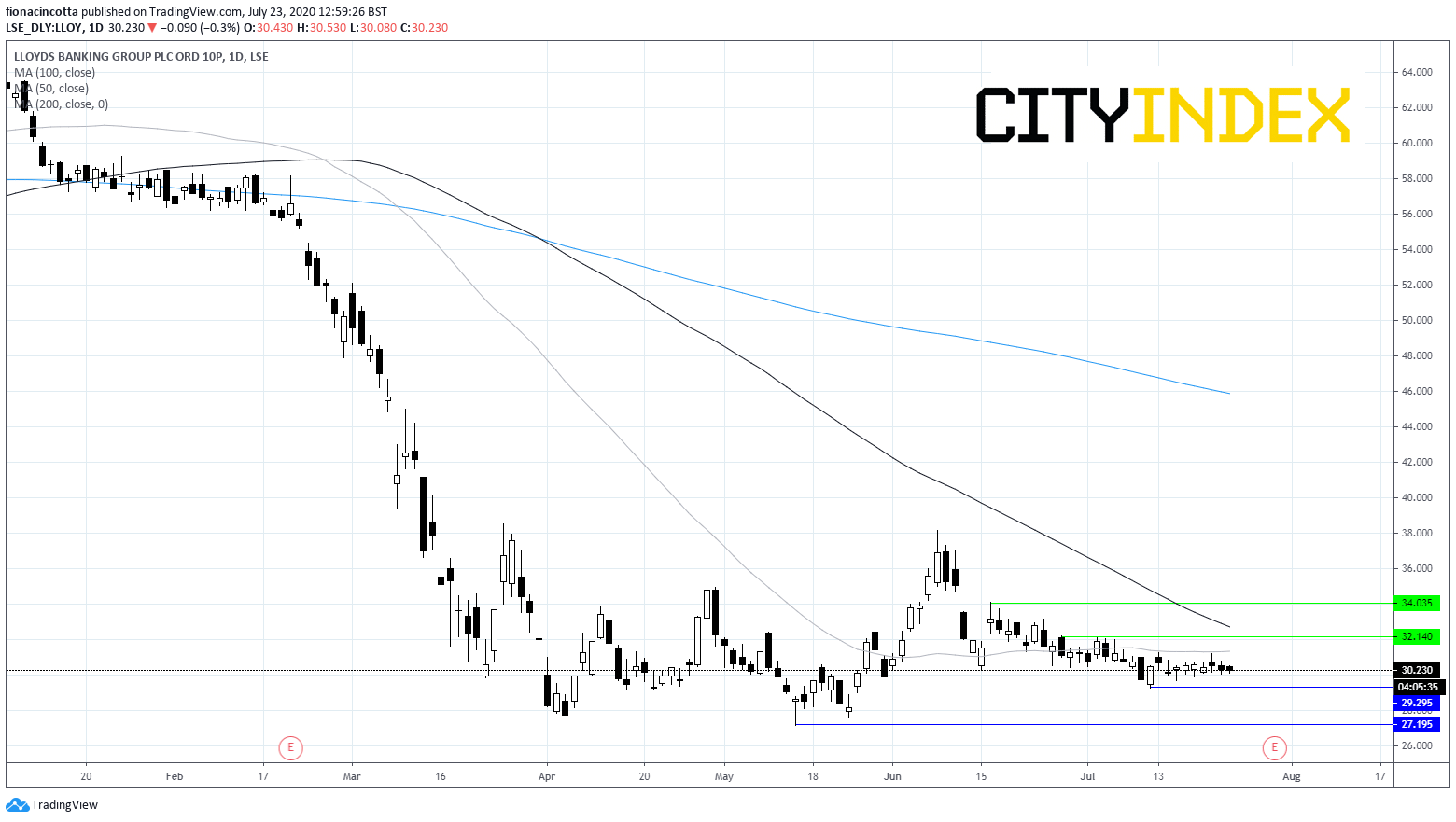

Lloyds -30th July

The retail focused high street bank limited income diversification. This is problematic in a low rate environment after the BoE cut interest rates to historic lows, squeezing NII. Lloyds share price has not experienced any rebound to speak of, instead bumbling along the low levels reached at the height of lockdown. The stock trades below its 50, 100 and 200 daily moving averages indicating that the direction of least resistance is southwards. A move above resistance at 32p could negate the current negative bias, a move below 29p could see more bears jump in.

The retail focused high street bank limited income diversification. This is problematic in a low rate environment after the BoE cut interest rates to historic lows, squeezing NII. Lloyds share price has not experienced any rebound to speak of, instead bumbling along the low levels reached at the height of lockdown. The stock trades below its 50, 100 and 200 daily moving averages indicating that the direction of least resistance is southwards. A move above resistance at 32p could negate the current negative bias, a move below 29p could see more bears jump in.

NatWest (Formerly RBS) – July 31st

RBS changed its name to NatWest 22nd July with the new chart providing limited information. The stock has picked up around 20% from 100p low which has offered support through most of the crisis. Investors should look for a break above 125p could point to further gains whilst any sign of 115p not holding could see the door open back to 100p

RBS changed its name to NatWest 22nd July with the new chart providing limited information. The stock has picked up around 20% from 100p low which has offered support through most of the crisis. Investors should look for a break above 125p could point to further gains whilst any sign of 115p not holding could see the door open back to 100p

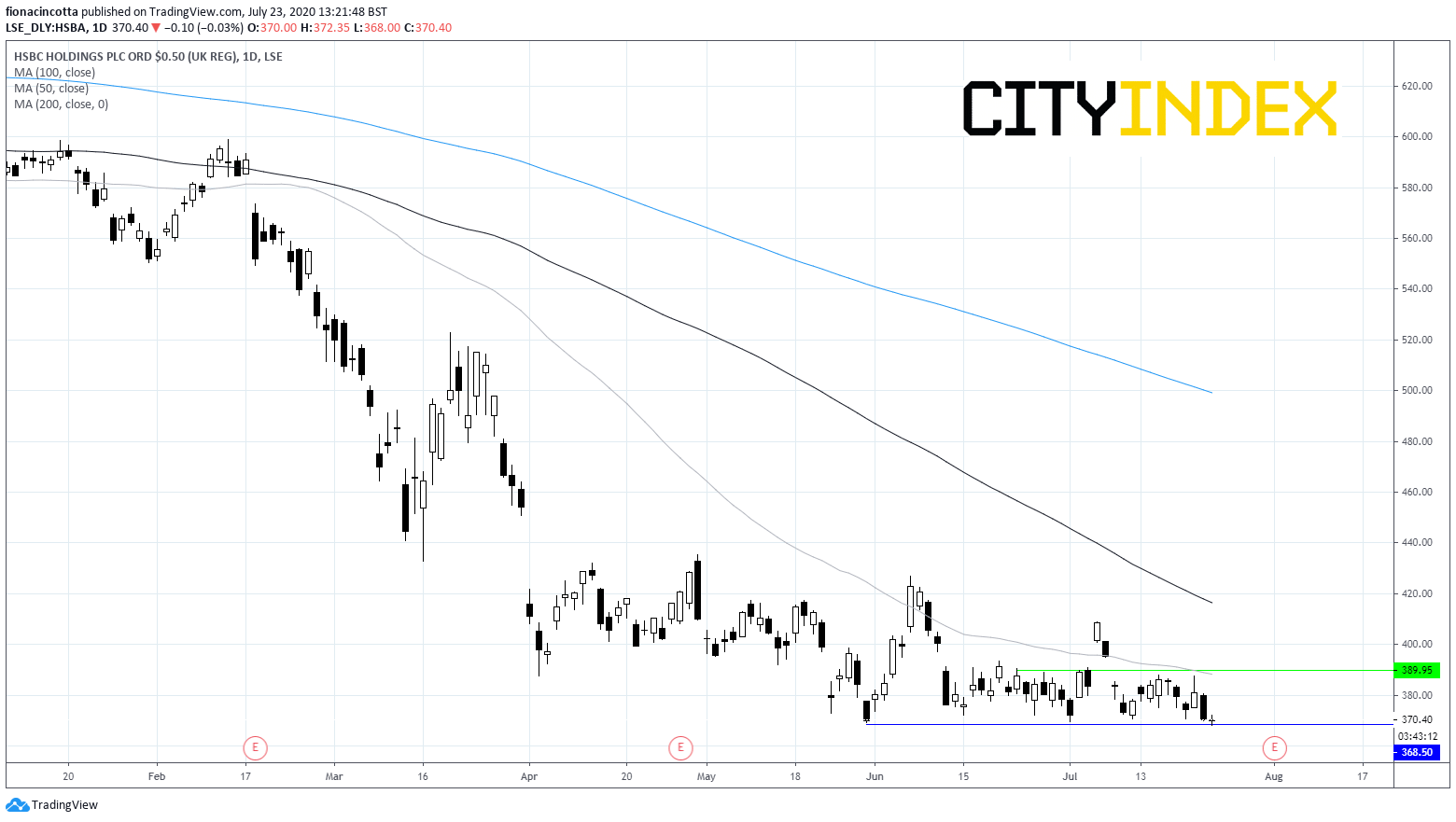

HSBC – 3rd August

HSBC has not only failed to hold its March lows but has declined further amid a combination of covid uncertainty and troubles over Hong Kong meaning investors are giving it a wide berth. The stock trades below its 50, 100 and 200 sma on a bearish chart. A rise above 390p could negate the current bearish trend although the path of least resistance is downwards.

Latest market news

Yesterday 08:33 AM