21st April 2020, after market close.

- EPS $1.62 +113% yoy

- Revenue $5.7 billion +26.1% yoy

Coronavirus. unsurprisingly, will be THE major theme across earnings season. However not all companies will be hurt by these unusual times. Netflix could well be a winner, with an increase in both streaming hours and subscribers as people across the globe stay at home under lock down.

What to watch:

1. Subscriber additions

Q4 saw Netflix add 8.8 million subscribers, 1 million more than forecast, impressive given that both Walt Disney and Apple launched streaming services in the quarter. Expectations are for 7 million new subscribers; the actual figure could be significantly more with reduced subscriber churn.

2. Operating margin

Another key metric that has steadily risen each year. For 2019 full year operating margin was 13%, up from 10% the previous year. Q1 management is forecasting a huge jump to 18%, although full year 2020 is expected to be 16%

3. Guidance

Guidance will be more important than ever. How will Netflix guide given that no one really knows how long lock downs will continue for? In Q2 2019 Netflix added 2.7 million subscribers giving weak comparable, plus the fact that lock down is already creeping well in Q2 means there is a good chance that guidance will be strong.

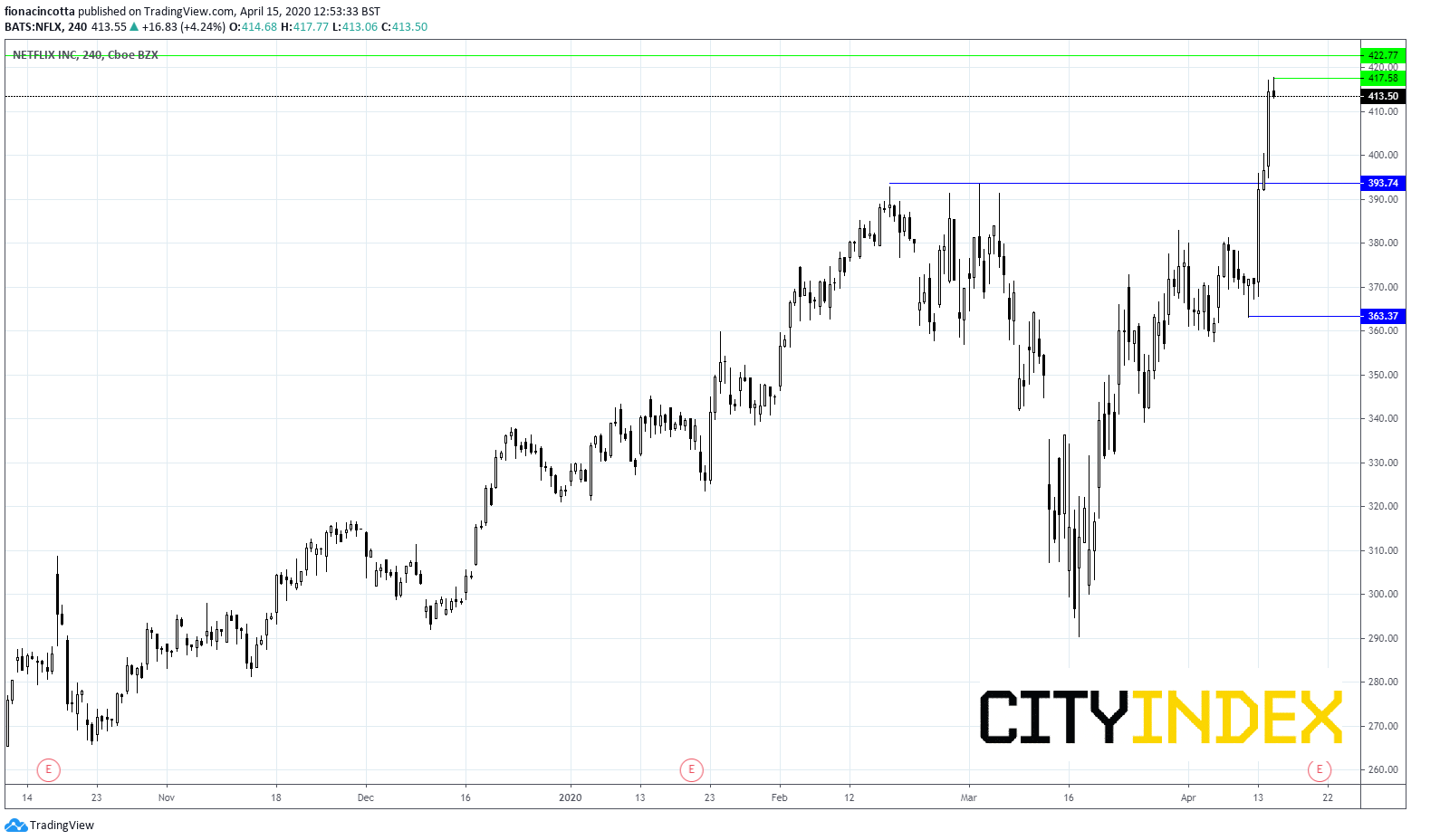

Levels to watch:

Netflix has seen a spectacular recovery from its low of $290 on 17th March. After surging 43% in a month, Netflix is trading just over 1% off its all time high of 423.1 reached in June 2018.

On the downside support can be seen around 393.75/394 and at 363.73 (low 9th April).