Whilst Coronavirius is dominating the airwaves in almost every direction, we will take a look at one company which may fair better than many others in the event of self-isolation on a large scale or even lock downs in some areas of the UK. But that is not to say that ITV isn’t without its own problems.

Traditional Advertising Revenues

Traditional advertising revenue has been an ongoing issue for the broadcaster over recent years. Not only are budgets under pressure, but firms are increasingly using the likes of Facebook and Google in order to get in front of potential customers. A 5% decline reported in November was better than forecast.

Traditional advertising revenue has been an ongoing issue for the broadcaster over recent years. Not only are budgets under pressure, but firms are increasingly using the likes of Facebook and Google in order to get in front of potential customers. A 5% decline reported in November was better than forecast.

Programmes

Thanks to well-timed one-off events ITV has managed to perform better than expected across recent quarters. This year, ITV will be relying on the Rugby World Cup to have done some heavy lifting to boost numbers. Investor could also be looking for confirmation that Love Island, a programme that has been driving performance since last year, is still on for next June. Following the tragic death of presenter Caroline Flack, the channel cancelled the usual spin-off showing a reunion of the winter participants.

Thanks to well-timed one-off events ITV has managed to perform better than expected across recent quarters. This year, ITV will be relying on the Rugby World Cup to have done some heavy lifting to boost numbers. Investor could also be looking for confirmation that Love Island, a programme that has been driving performance since last year, is still on for next June. Following the tragic death of presenter Caroline Flack, the channel cancelled the usual spin-off showing a reunion of the winter participants.

BritBox Streaming

Another element of the results which will be of great interest to traders will be the recently launched streaming service. An attempt to tackle the changes in the ways that we are watching TV. Traders will be keen to hear how the joint venture with BBC, BritBox is faring. The subscriptions market is extremely competitive and puts BritBox up against the likes of Netflix, Amazon Prime and Disney++. Early number suggest that BrtitBox is struggling to keep viewers after the month free trial. However, at the end of March BBC is due to move BBC programmes away from the likes of Amazon Prime & Netflix in UK. It will be interesting to see what affect that has on BritBox figures.

Another element of the results which will be of great interest to traders will be the recently launched streaming service. An attempt to tackle the changes in the ways that we are watching TV. Traders will be keen to hear how the joint venture with BBC, BritBox is faring. The subscriptions market is extremely competitive and puts BritBox up against the likes of Netflix, Amazon Prime and Disney++. Early number suggest that BrtitBox is struggling to keep viewers after the month free trial. However, at the end of March BBC is due to move BBC programmes away from the likes of Amazon Prime & Netflix in UK. It will be interesting to see what affect that has on BritBox figures.

Studios

Finally, in order to tackle falling advertising revenue, ITV is placing more focus on the making and selling of programmes in its Studio business. There have been some success stories here, such as Hell’s Kitchen, The Bodyguard and Line of Duty; traders will be hungry for more.

Finally, in order to tackle falling advertising revenue, ITV is placing more focus on the making and selling of programmes in its Studio business. There have been some success stories here, such as Hell’s Kitchen, The Bodyguard and Line of Duty; traders will be hungry for more.

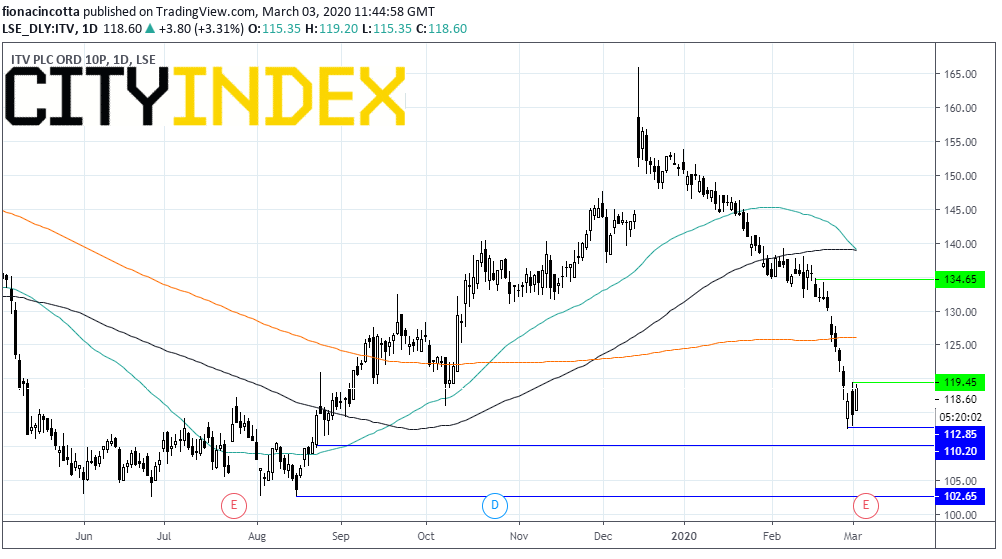

Chart Thoughts:

ITV has tanked 9% across the past week, outperforming the FTSE which sunk 11.5%. Today, ITV continues with its out performance jumping 3.5% compared to the FTSE’s 2% increase.

ITV trade below its 50, 100 & 200 sma, however it is also firmly in oversold territory on the RSI, suggesting that we could see more upside to come.

Immediate resistance is at 119.40 (yesterday’s high) prior to 125.95 (200 sma) 134.40 (high 18 February).

On the flipside watch for support at 112.65 (Friday’s low) prior to 110.15 (low 21st Aug) and 102.65 (low 15th Aug).

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM