As a reminder, at last year’s G20 Summit in Bueno Aires, Presidents Trump and Xi met over dinner on a Saturday night, December 1. Immediately before the dinner, President Donald Trump was quoted as saying he had an “incredible relationship” with Chinese Xi. After the dinner concluded it was confirmed that the two leaders had agreed to a 90-day tariff ceasefire.

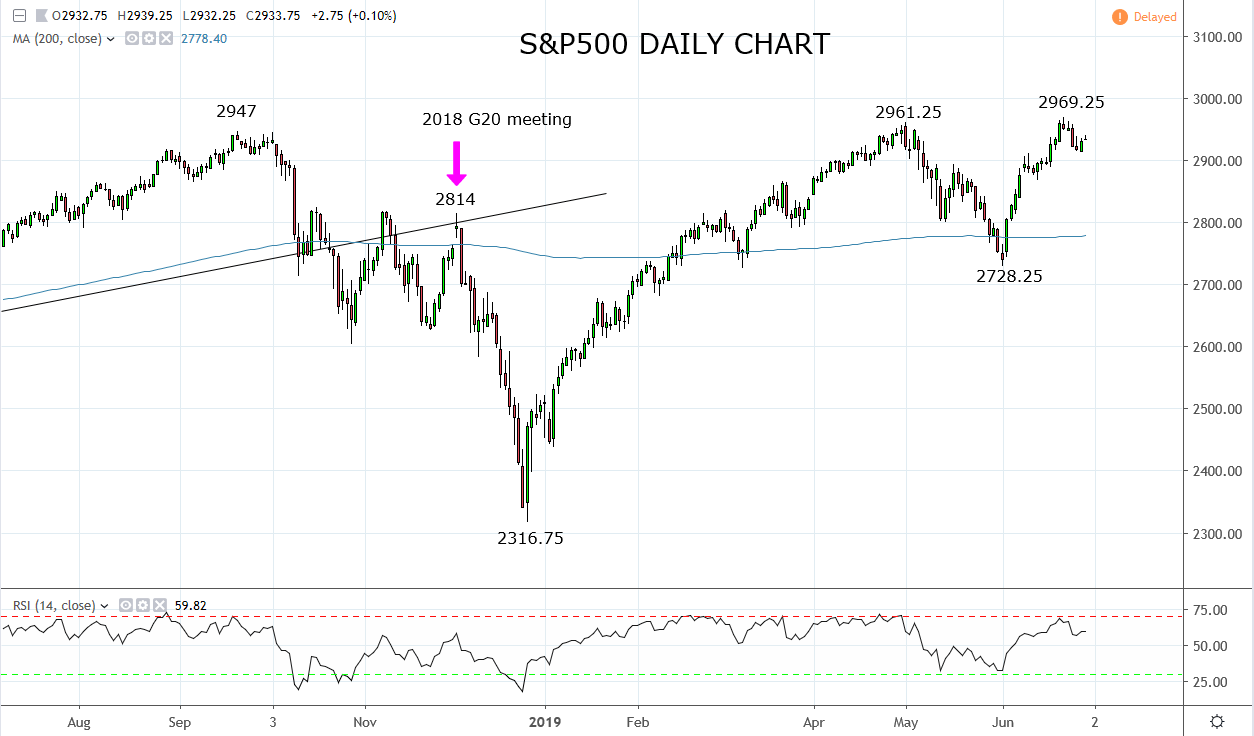

In response to this on Monday morning the 3rd of December, the S&P500 futures gapped about 1% higher on the open and proceeded to trade to a high on the same day of 2814. It is reported that $U.S.1.8bn of notional volume transacted in the first minute of trading! However, 2814 turned out to be the highest price the S&P500 traded before falling near -18% during the next 16 trading days of December.

One of the catalysts for the sudden reversal in risk sentiment was the arrest of Huawei Technologies Co’s Chief Financial Officer, Wanzhou Meng in Canada, the effect of which completely erased the goodwill generated by the G20 meeting.

When we think back to the backdrop of last year’s G20 as opposed to now, there are some key differences.

As can be viewed in the chart below, the S&P500 had in October 2018 broken below a long-standing uptrend as well as the 200-day moving average. The market had for all intensive arguments begun a corrective pullback and was vulnerable to further declines.

Today things are a little different. The S&P500 is trading well above the 200-day moving average, and after recently making new highs, it would be safe to say the market is an uptrend. A mature uptrend, but an uptrend no less.

The other key difference is the market currently enjoys a supportive central bank environment. Fed rate cuts are imminent as opposed to December last year when the market was bracing for a rate hike at the December FOMC and two more rate hikes in 2019.

The conclusion we draw is while the S&P500 appears on far more solid grounds this time around to stage a post-G20 FOMC rally, history warns it might be a good idea to let the dust settle for a few days, rather than act in haste.

Source Tradingview. The figures stated are as of the 28th of June 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.