April 29th after market close

- Revenue $6.16 billion

- EPS -$0.25

What to expect

Tesla share price tore higher last week, boosted by Wall Street upgrades, despite near term demand grinding to a halt. The market has kept faith in the long-term growth trend towards electric vehicles and Tesla is establishing itself as the clear leader. So, what will Q1 results show?

Expectations are for a solid set of Q1 figures despite the coronvirus outbreak. Vehicle deliveries are expected to have jumped 40% to 88,000 in Q1 compared to a year earlier. Revenue is expected to have increased by over 30% and losses per share are due show a substantial improvement from -$2.90 to $-0.25. These would be the best Q1 results Tesla has had.

So far, there has been no comment over the impact of COVID-19 since company shut down much of its production in late March. As with all firms this season, the Q2 outlook and the forecast hit from the coronavirus outbreak could be a key driver for the share price performance.

Charts thoughts

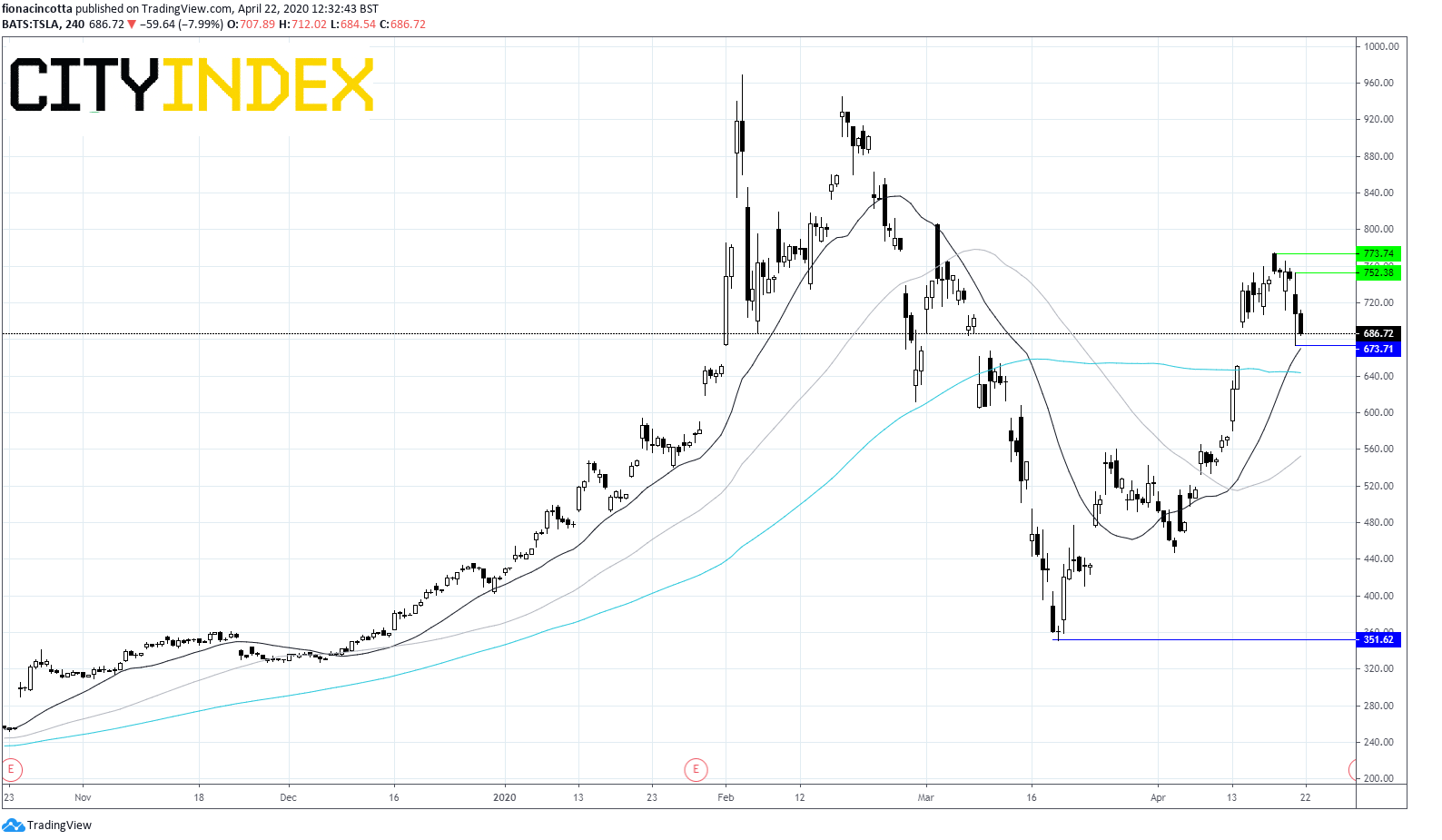

After falling 66% from its February high of $968 Tesla struck a coronavirus inspired low of $350 on 18th March. Since then the stock has surged to a high of $773. Continued volatility has seen the stock drop 8% in the previous session and is currently trading around $685.

Immediate support can be seen at $673 (yesterday’s low and 20 sma) prior to $642 (100sma) and $550 (50 sma).

Resistance can bee seen at $753 (yesterday’s high) prior to $773 (high 17th April).

This strong pick up across last week means that the bar is set high for the results. Disappointment could see traders book profits. That said the longer-term trend remains bullish, so any pull backs could provide a good buying opportunity.