• HSBC Tuesday 28th April

• Barclays Bank Wednesday 29th April

• Lloyds Bank Thursday 30th April

• RBS Bank Friday 1st May

What to watch:

1. Loan provisions

As coronvirus wreaks havoc with the economy fears are rising that the economic downturn caused by the outbreak will make it harder for borrowers to repay their debt. Banks are staring down the barrel at the prospect of more loans going bad at the same time than in any other period in history.

Loan loss provisions charges are expected to surge to levels not even seen in the darkest days of the financial crisis. Each of the big 4 banks is looking at £1 - £1.5 billion in addition to standard charges this quarter and this number is expected to get worse for Q2.

Deutsche Bank reported on Sunday and gave us a taste of what is to come, saying it had taken €500 million provisions for credit losses during Q1, up 257% from a year earlier. HSBC is expected to report the largest provision of £1.4 billion whilst profits are expected to halve.

Unsecured retail lending is the focus of concern, so credit cards, personal loans and car finance. Barclays is particularly exposed as it is one of the top 10 credit card issuers in the US where more than 26 million people has lost their job in the last month.

That said, banks are better positioned to withstand the fallout from the coronavirus crisis, than they were to withstand the financial crisis.

2.Guidance

Guidance will also be closely watched, however, it is also worth keeping in mind that forecasting will be little more than guess work at this stage, given the lack of visibility across the quarter. Let’s not forget that we don’t even know how or when lock down is going to draw to a conclusion in the UK. Regulators are encouraging banks to moderate estimates until full repercussions are clearer.

3. Margins

Net Interest Income will be in focus after the BoE slashed interest rates to historically low levels. Retail and commercial focused banks such as Barclays, Lloyds and RBS tend to get most of their income from charging interest. These banks are particularly exposed. The fact that these banks also have high fixed costs owing to the many physical branches and thousands of employees mean that fixed costs will also be running high and margins squeezed further.

4.Trading

As we saw with US banks, those banks with larger trading divisions benefited from market volatility. Investors will be hoping that Barclays' trading arm will have benefited in the same way. Meanwhile, at RBS, investors will be looking for an update on the downsizing of this loss-making investment bank.

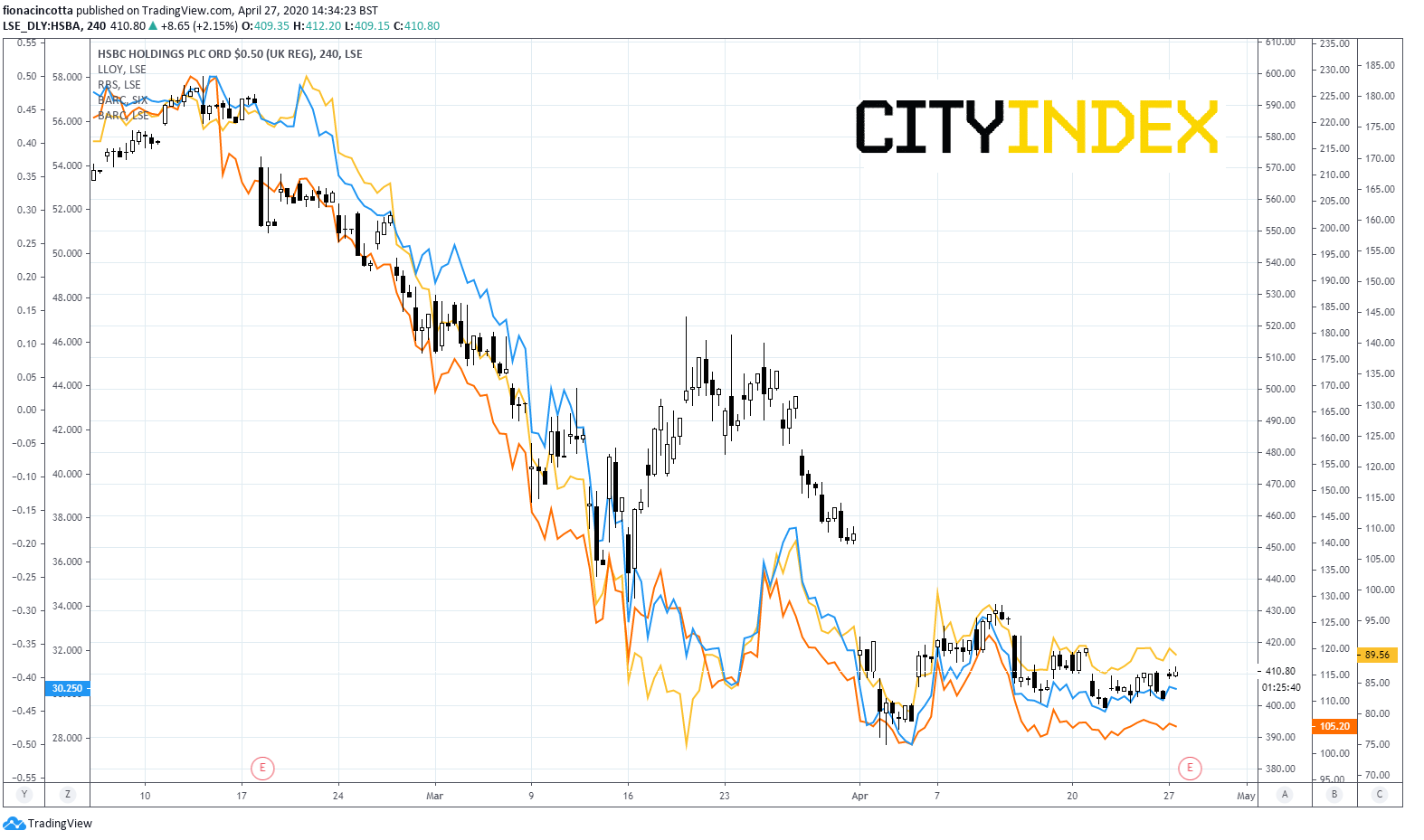

5.Share prices

UK Banks are off their lows struck at the end of March, but only just. Barclays share price has fared better than its peers, owing to its trading arm. This sector looks depressed and a long way off from any meaningful recovery. That said, we have seen with data that expectations are so low that even record falls can produce a rally thereafter.