Friday 14th February

Expectations:

- £3.77 billion operating profit up from £3.4 billion year earlier

These will be the first results under new Chief executive Alison Rose, who started her new position in October. The 62.5 % government owned bank is expected to report its third consecutive annual profit. Here’s what to watch:

PPI coming to an end

Friday’s results come after a tough Q3, where RBS posted pre-tax loss of £8 million, well short of the £720 million profit expected.

Whilst Q3 was marred by another write down in PPI at £900 million, Q4 will be the first results which do not carry the threat of a major PPI redress, given that the deadline for claims was at the end of the summer.

Traders will be keen to see that the Q3 disappointment was more of an anomaly rather than the start of a new worrying trend.

Interest rates

The BoE voted 7-2 in favor of keeping interest rates at 0.75% in its January meeting. This provided some relief given that expectations for a rate cut were at 50 / 50 and that the banks are already under considerable pressure with net interest margins, a closely watched metric.

Mark Carney earlier this week said that the low interest rate environment will be with us for the foreseeable future. Any rate hike is highly unlikely until well after the end of the transition period. Given that RBS is primarily a retail bank, lending is a key revenue driver, one that looks set to remain subdued for some time to come.

Cost savings

Whilst there was a lot to dislike in Q3 results, cost savings were a strong point. In Q3 the £300 million full year cost savings remained on track, traders will be watching this figure closely. There have also been rumors of large-scale job cuts, however details are unlikely to be announced this week and could focus on the under performing NatWest Markets and Ulster units.

Government’s reaction

Rumors are already circulating that Chancellor Sajid Javid might be looking to sell the government’s remain stake in the bank at the earliest opportunity. This will obviously depend on the bank’s performance.

Share price

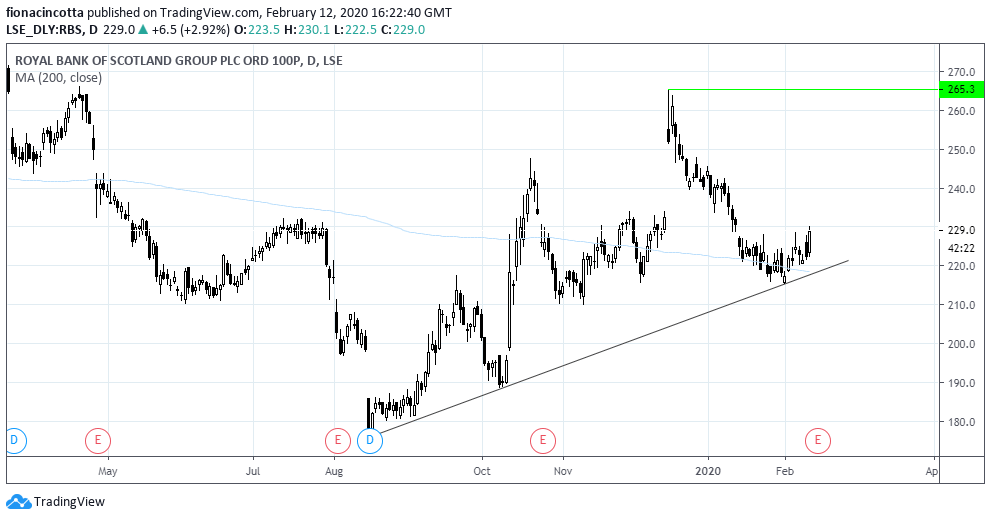

RBS share prose jumped 12% higher to 265p following the decisive Conservative win in the general election. However, with low interest rates and Brexit uncertainty lingering, RBS has steadily pared those election inspired gains. It bounced off a low and trend line support of 215p in early February. Immediate support can be seen around 220. A meaningful break below here could negate the current uptrend which has been intact since mid August.