In yesterday’s note, we touched on the tepid response by markets in Asia to the U.S. and China trade deal. Partly this was to do with reservations that the deal might fall apart before it was ratified in mid-November, heightened by concerns that Chinese media had not mentioned a “deal” in official commentary.

Allaying those concerns, the mysterious Taoran Note account on the WeChat platform, one of the few accounts to consistently escape censorship during recent trade escalations and thought to be backed by the government, published a note clarifying the following points.

Although the Chinese media has only discussed “substantial progress” rather than specifically mentioning a “deal”, the Chinese do intend to strike a deal. Additionally, both Chinese and U.S. negotiators feel they gained more from the trade talks than they gave, which suggests there is a little reason to walk away from the deal.

Providing the trade deal does stick we feel that AUDNZD should continue to rally, after broadly following the roadmap outlined in this article https://www.cityindex.com.au/market-analysis/where-to-rebuy-audnzd/. However, before the next leg higher in the cross can commence, there are two key Antipodean data points due for release over the next 48 hours.

First up tomorrow morning is the release of New Zealand Q3 CPI data which is expected to rise +0.6%, although the year on year rate is expected to fall to +1.4% as a +0.9% print falls out of the series. Then follows Australian labour force data for September on Thursday morning, with the market looking for a gain of +15k new jobs and the unemployment rate expected to remain steady at 5.3%.

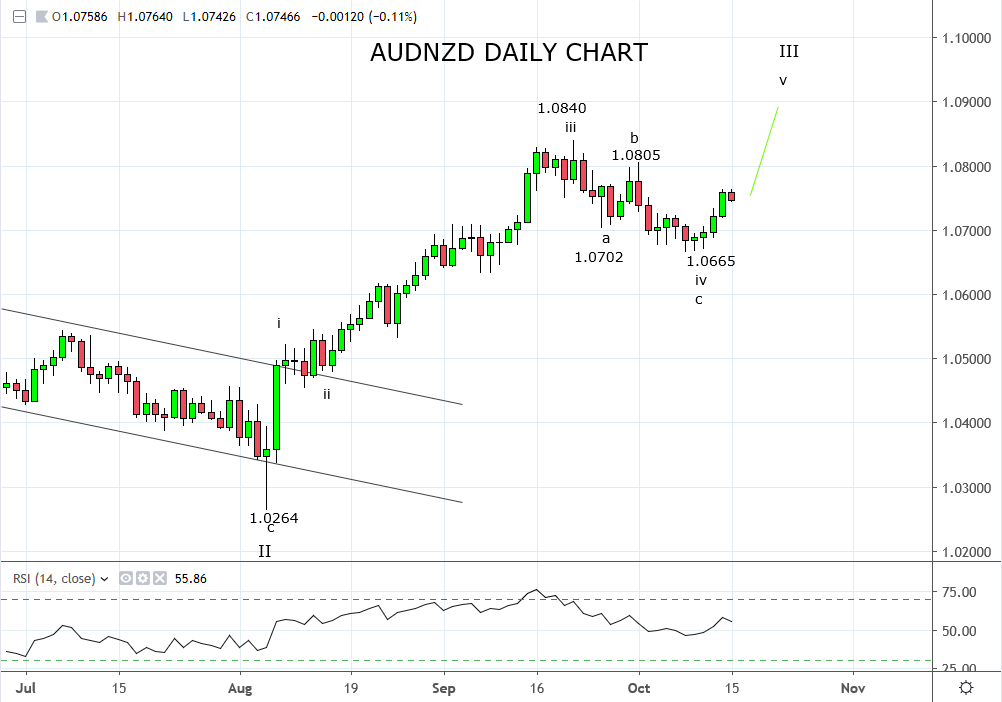

Providing there are no significant outliers in either data points, AUDNZD may soon commence its next leg higher in line with the technical view below.

AUDNZD Technical view:

AUDNZD looks to have completed a Wave iv corrective pullback at last week’s 1.0665 low and appears on the verge of confirming a Wave V higher is underway, towards 1.0850 and then 1.1000. With this in mind, we favour holding longs in the cross on dips to 1.0710, with a stop loss placed below 1.0655.

Source Tradingview. The figures stated are as of the 15th of October 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.