The focus when BP reported today was always going to be in the dividend. After rival Shell slashed their dividend by 2/3rds surely it was only going to be a matter of time until BP followed suit?

BP cuts its dividend for the first time in decade after plunging into a record loss as the coronavirus pandemic crushed energy demand. The dividend was slashed by 50% to 5.25 cents, down from 10.5 cents a share. The last time that BP slashed its dividend was after the Deepwater Horizon oil spill.

Ugly but could have been worse?

BP reported $6.7 billion loss in Q2, compared with profits of $2.8 billion in the same period a year earlier. Whilst this is a very grim number, investors had been bracing themselves for worse, with expectations of a$6.8 billion loss. Thanks to the better than forecast loss investors are managing to look beyond the larger than forecast dividend cut sending the share price has soared 7%.

BP reported $6.7 billion loss in Q2, compared with profits of $2.8 billion in the same period a year earlier. Whilst this is a very grim number, investors had been bracing themselves for worse, with expectations of a$6.8 billion loss. Thanks to the better than forecast loss investors are managing to look beyond the larger than forecast dividend cut sending the share price has soared 7%.

In Q2 the average price of oil declined by more than half to $29.50 a barrel, down from $70 per barrel in early January. This slump forced BP to announce write offs to the tune of $17 billion whilst also slashing 10,000 jobs to shore up the balance sheet. BP breaks even at $40 per barrel.

The future’s green

With the demand for oil expected to remain weak and long term price forecast of oil remaining depressed pressure is expected to remain on oil majores. BP committed to its drive towards net zero. Ahead of the strategy presentation next month CEO Bernard Looney said the firm aims to increase its annual low carbon investment 10 fold to around $5 billion per year. BP will also cut emissions and invest heavily in renewables.

With the demand for oil expected to remain weak and long term price forecast of oil remaining depressed pressure is expected to remain on oil majores. BP committed to its drive towards net zero. Ahead of the strategy presentation next month CEO Bernard Looney said the firm aims to increase its annual low carbon investment 10 fold to around $5 billion per year. BP will also cut emissions and invest heavily in renewables.

Chart thoughts

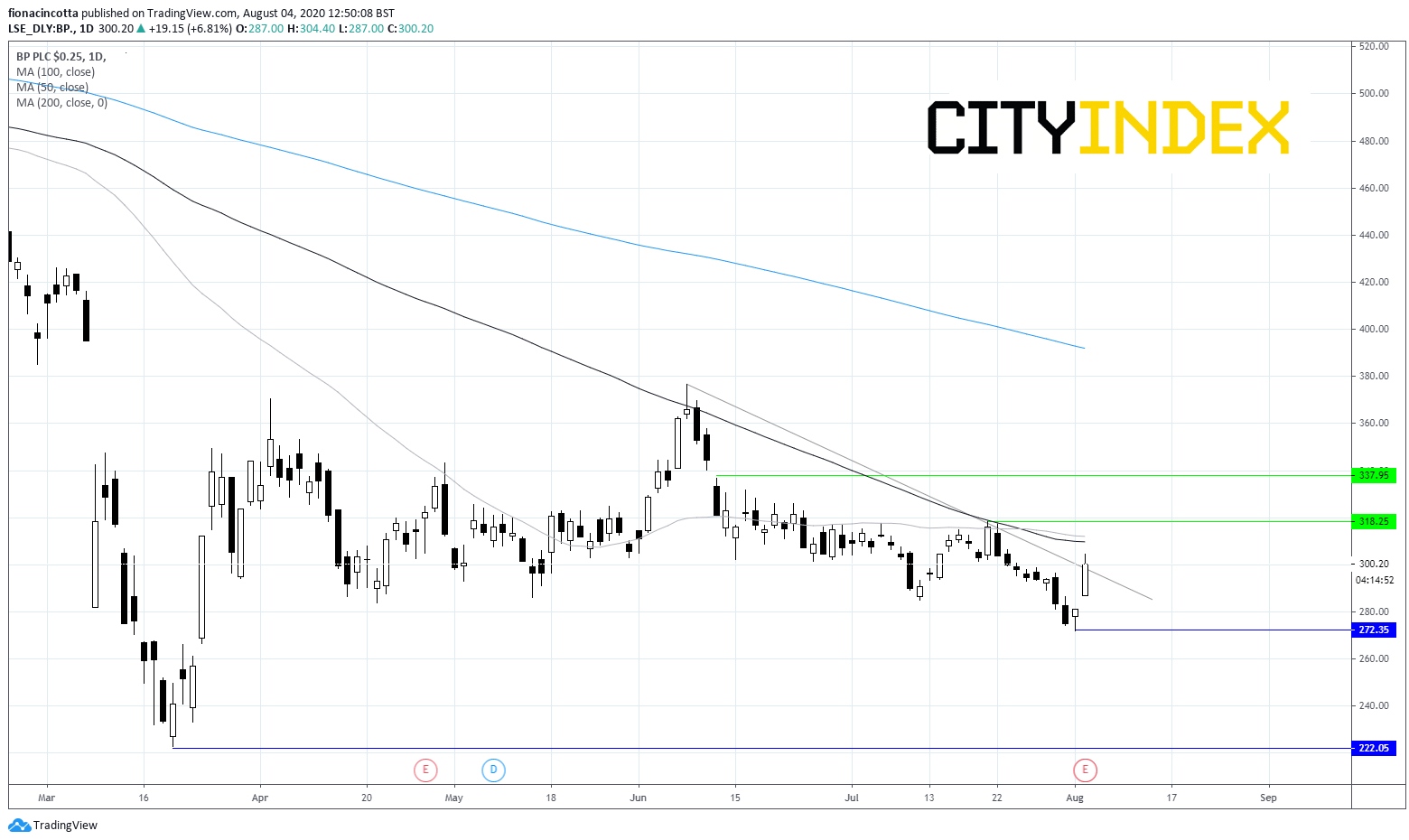

BP had been trading around -50% YTD after the covid rebound stalled early on. Today’s 7% jump in BP’s share price has push it above its descending trendline, which had held since early June. A close above trendline resistance turned support at this key 300p level could see the share price attack resistance in the region of 310p – 315p the 50 & 100 daily moving average.

Should BP fail to close above 300p then we could see the stock continue its downward trend towards 270p and 222p the March low.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM