What in the world is wrong with gold?

Imagine you went back in time six months and told an investor the following:

- Central banks would continue to buy up assets and expand the money supply

- Governments would continue to run record fiscal deficits

- The US dollar would fall

- Inflation expectations would rise

- Rioters would storm the US Capitol

I don’t know about you, but that sounds like an environment tailor-made for gold prices to surge into record territory to me. Instead, the yellow metal has been one of the most disappointing assets on the planet over the last two quarters, with prices down nearly -20% from their August peak and -8% year-to-date. Even January’s political turmoil wasn’t enough to boost gold: the “ultimate safe haven” asset fell 2% on the day that rioters stormed the Capitol and ultimately finished that week down 6% from pre-raid levels.

So why is gold so weak?

As with any question about a market movement, there are multiple answers.

First, it’s worth noting that gold has a reputation for being an uncorrelated investment, and falling while nearly every other speculative asset is surging into record territory is certainly confirmation of that. Many long-term gold holders are most interested in the yellow metal’s diversification benefits when their other investments are falling, an environment that we haven’t seen much of late. In other words, in order to take their victory laps while everyone else is losing, gold bugs by definition must occasionally lose money while every other investment is rising.

One other possible explanation is that cryptoassets like Bitcoin actually are gaining market share for the global “store of value” demand. After all, famous investors like Stanley Druckenmiller and Paul Tudor Jones both believe the idea has merit, and Bitcoin did surge 9% on the day of the Capitol riots. That said, despite its technological merits, Bitcoin will never be able to approach gold’s unfathomably long history of being a reliable store of value, so gold bugs would argue that this may be a more short-lived phenomenon.

The final explanation for gold’s recent underperformance could be that it’s just noise. As any experienced trader will tell you, markets don’t always move perfectly as they’re “supposed to.” It’s always possible that the market’s collective understanding of gold as a hedge against fiat currency debasement is no longer relevant, but more often, traders will ignore a seemingly relevant development before coming around to respect it again all at once.

Gold technical analysis

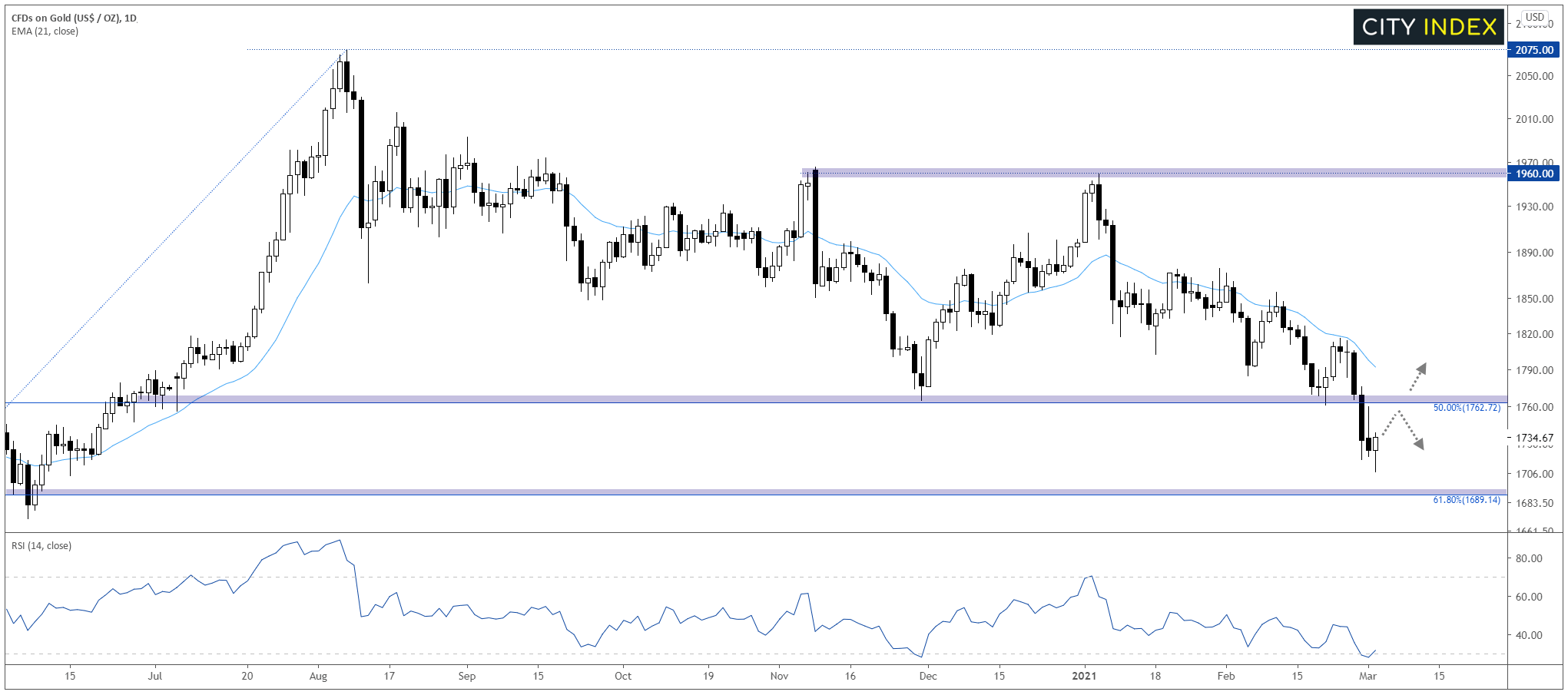

Just this morning, gold prices peeked below $1710 for the first time since June, though they have staged a decent bounce off the lows as we go to press:

Source: TradingView, StoneX

Moving forward, previous-support-turned-resistance at the 50% Fibonacci retracement of the March-August 2020 rally near $1765 could cap short-term rallies. Traders would need to see a break above that level to flip the near-term bias back in favor of the bulls. Meanwhile with traders selling any short-term rallies of late, the next downside level to watch will be the 61.8% retracement of that same rally near $1690, corresponding with some of the lows we saw through Q2 2020.

Learn more about gold and silver trading opportunities.