The triumph of Donald Trump in the US Presidential election has had a massive impact on financial markets, both domestic and international. One of the starkest impacts has been on the US stock market, with record highs for the Dow Jones and S&P 500 in the wake of ‘The Donald’s’ win.

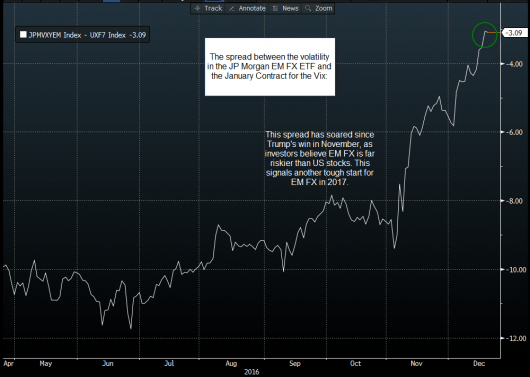

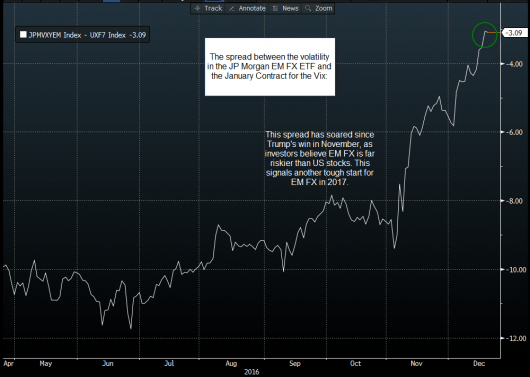

The chart below, however, shows that Trump has had a big impact overseas too. It shows the spread between the volatility of JP Morgan’s emerging market FX ETF and the January contract of the Vix index, which measures volatility in the S&P 500.

As you can see, this spread has reached its highest ever level (it goes back to 2000), which suggests that investors believe EM FX is riskier than stocks in the current environment. In fairness, there is good reason for this to be the case, for now. Firstly, Trump’s policies are boosting US equity market sectors like finance and industrials as markets price in the potential for a massive fiscal boost under the Trump administration. Secondly, EM FX has been hit hard by the rising dollar and rising US Treasury yields.

But here lies the problem, now that this spread is at its widest level for 16 years, how much further can it go? Essentially a rising dollar and rising US Treasury yields are also bad news for US stocks, but the market is not concentrating on that right now. While we still think that US stocks could move higher, the rally may move into a more tortuous phase in 2017, when investors try to push the market higher even though they know the risks that could disrupt the rally.

This chart is useful to keep in your tool kit if you are trading stocks right now. When this spread peaks and turns lower it could be time to sell those long US equity positions. In the short term, it also suggests another tough start for EM FX in early 2017.

Figure 1:

Source: City Index and Bloomberg