The NBS manufacturing PMI declined to 50.9 in June from 51.0 in May. A reflection of a slowdown in export growth momentum due to the Covid disruption on Shenzhen ports, nationwide safety inspections ahead of July 1st (the 100th anniversary of the Communist Party) as well as power and chip shortages.

The non-manufacturing PMI dropped to 53.5 from 55.2 as the Covid resurgence weighed on services in particular air travel, accommodation, and catering services.

As a result of the softer PMI data today, it is likely 2Q GDP will fall below 8% and bring with it policy fine-tuning, including faster local government bond issuance.

What does this mean for the RMB?

The RMB has been on the back foot against the US dollar since May after the PBOC pushed back against further appreciation via verbal guidance, a RRR hike on FX forwards, and higher QDII quotas.

The hawkish shift by the Federal Reserve two weeks ago sent the RMB lower again, as USDCNY rallied from below 6.4000 up to a high of 6.4895.

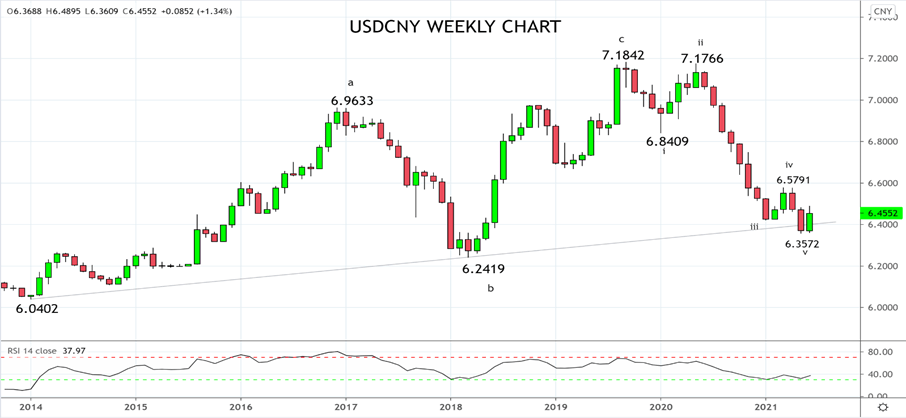

Technically the chart most important for USDCNY at this point is the monthly chart viewed below.

Should USDCNY close this evening (June 30) above 6.4600ish it would indicate the decline to the 6.3572 low was a false break lower below the trendline support from the 2014, 6.0402 low. And that USDCNY has completed a five-wave impulsive decline from the September 2019 high, above 7.1800

In this instance, the expectation would be for a stronger recovery in USDCNY towards 6.6000 in the coming weeks and traders may consider long USDCNY positions using the May 6.3572 low as the bullish reassessment level.

Source Tradingview. The figures stated areas of the 30th of June 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation