What Does the Gold Market Know?

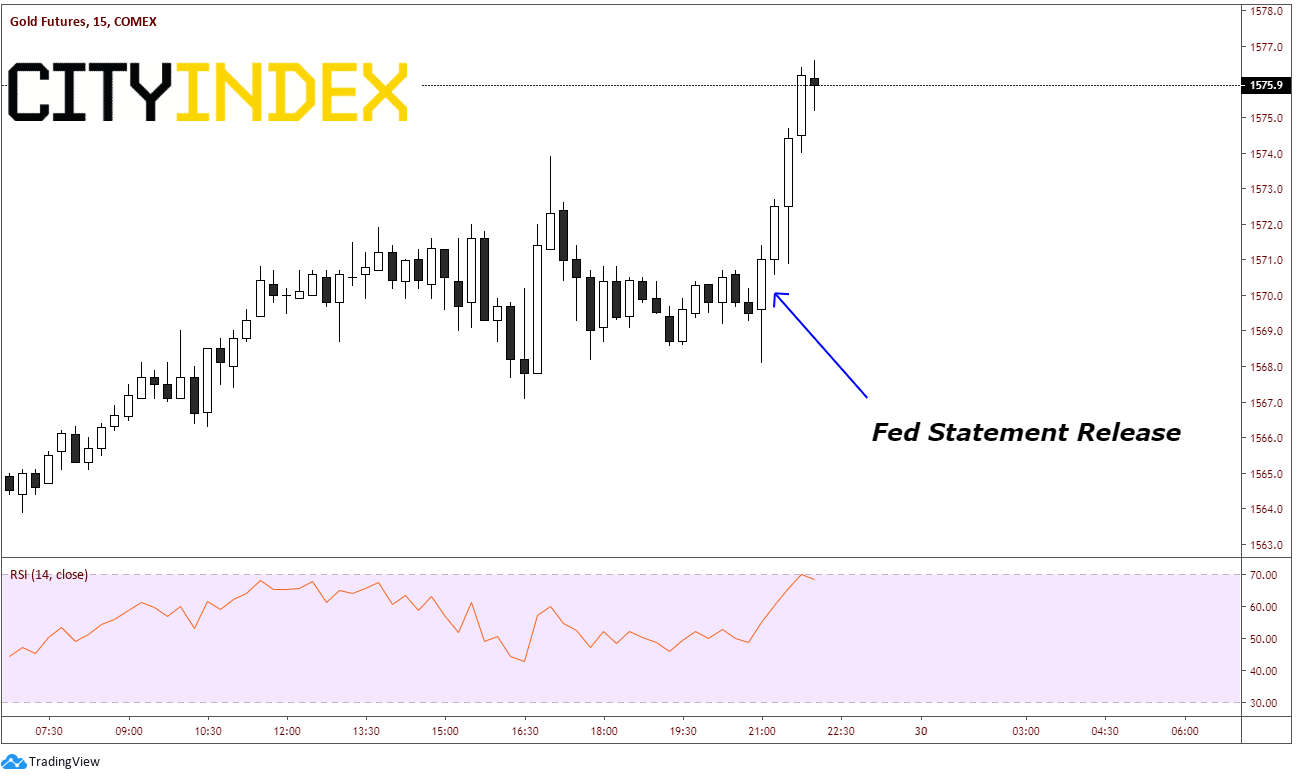

The FOMC left rates unchanged today, targeting the 1.5%-1.75% range, as expected. The only small change the Fed made was to raise the IOER rate by 0.05% and announced that they would be extending repo operations until April. Otherwise, the statement and the press conference were….boring (for lack of a better word). However, as soon as the statement was released, gold began to go bid:

Source: Tradingview, COMEX, City Index

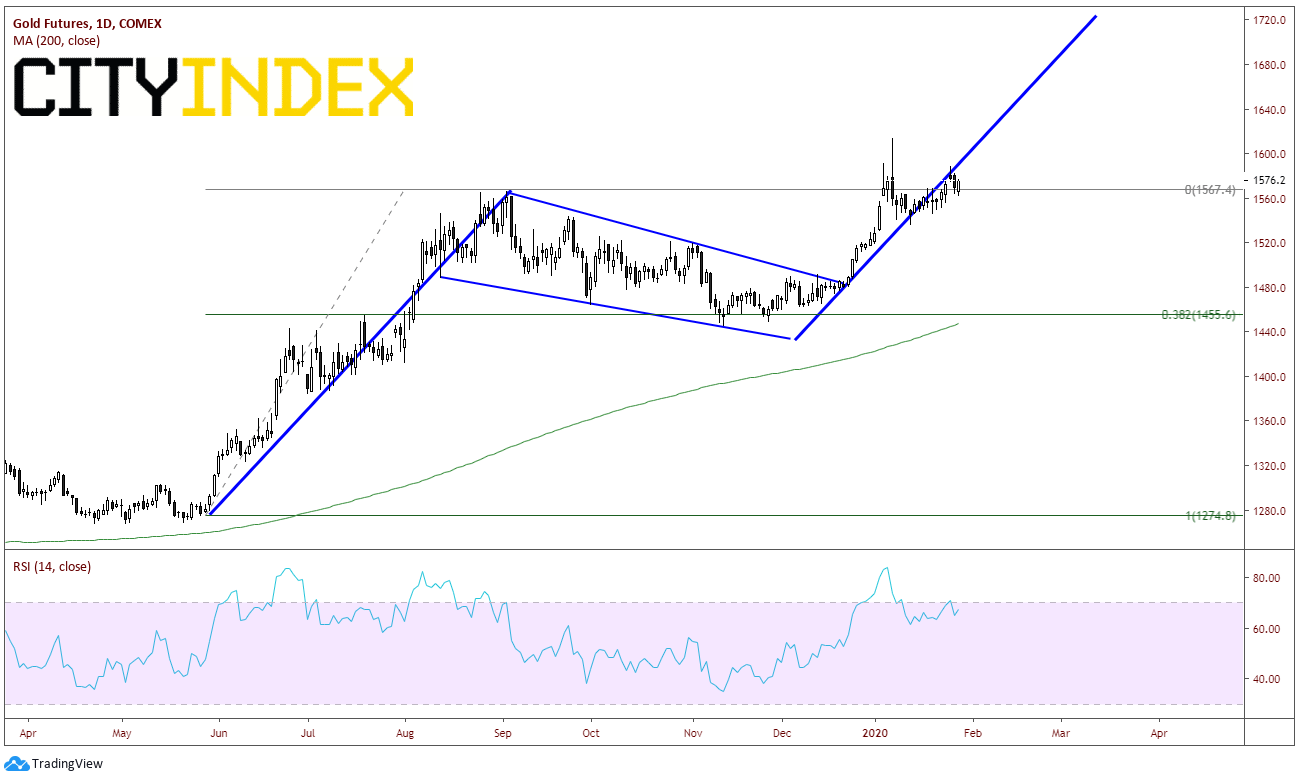

Perhaps it was just back to business as usual. Below is the base chart I’ve been using for Gold. It’s the daily futures chart, which has broken out of a flag pattern and is currently on its way to target near 1723. Price had paused along the way and the RSI moved to extreme overbought territory (above 80). They slight pullback gave the RSI room to unwind back into neutral territory.

Source: Tradingview, COMEX, City Index

Maybe someone knew early that Google was going to announce that they temporarily going to close all office in China due to the Coronavirus (source: Verge).

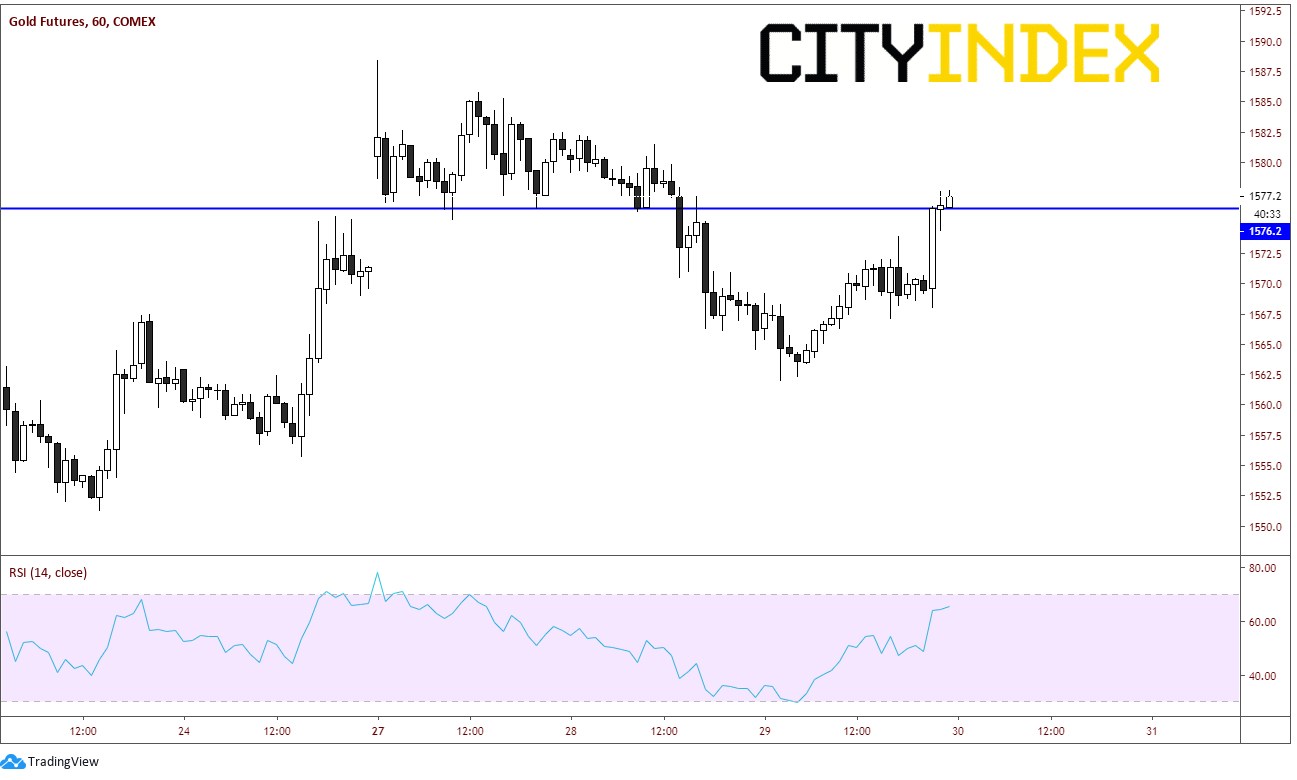

Or perhaps someone was just trying to push price higher through horizontal resistance, as seen on a 60-minute chart:

Source: Tradingview, COMEX, City Index

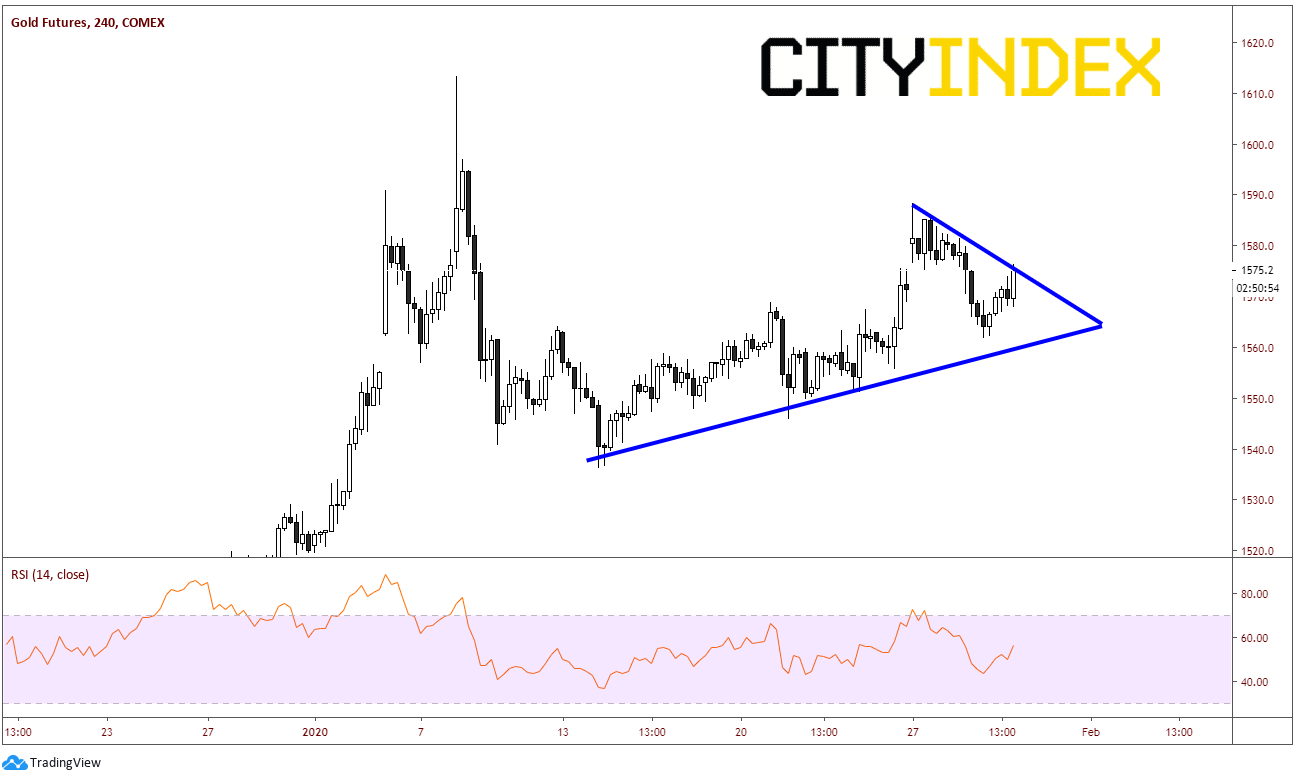

On a 240-minute chart, price is trying to break higher out of a symmetrical triangle. Perhaps someone was trying to push it through the upper trendline.

Source: Tradingview, COMEX, City Index

Does the Gold market know something other markets don’t? Whatever the reason for gold moving higher on the release of the FOMC statement today, it still looks like it’s trying to head towards the 1723 level! Price normally doesn’t move in a straight line, so expect some pullbacks along the way if it does continue higher!