In just under a fortnight, on November 4th, the Federal Reserve is expected to start tapering its bond purchases, which will end some eight months later in mid-2022.

The Federal Reserve has provided the market with sufficient runway ahead of its tapering announcement. Comforted by the strength of the economic recovery, the market is well prepared and mindful that tapering of bond purchases is not monetary tightening.

Surging energy prices are sending energy bills and manufacturing costs higher. Against a backdrop of supply bottlenecks, measures of inflation continue to move higher, causing nervousness amongst central bankers and global interest rate markets to reprice higher.

The US rate curve is currently pricing a full 25bp hike by the September 2022 FOMC meeting and 50bp of hikes by December 2022, pressuring the consensus view the first tightening will not be until early 2023.

However, while nominal interest rates have moved higher, so have inflation expectations, and real yields (the interest rate adjusted for inflation and a key driver of the gold price) have remained range-bound.

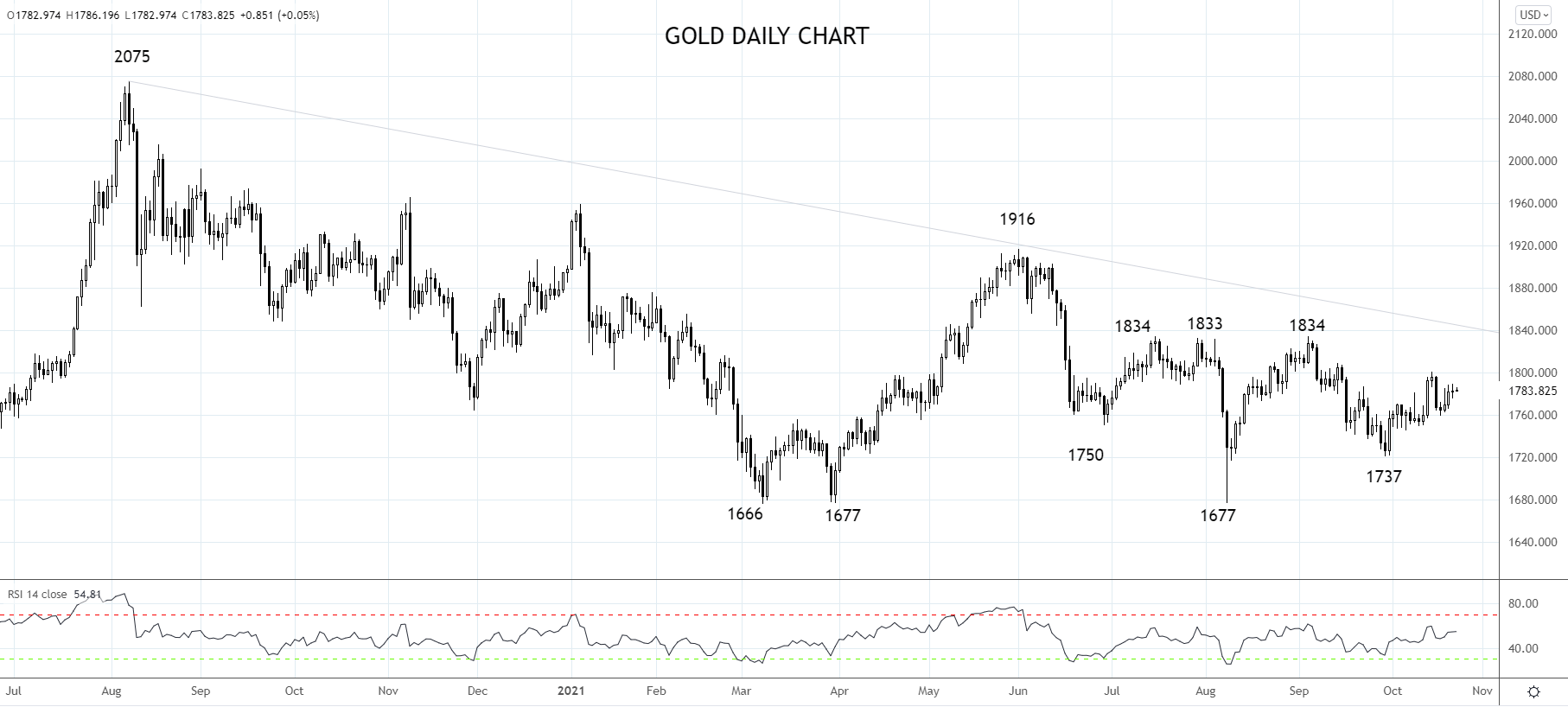

For example, last week, the gold price rallied to $1800 as US 10-yr real yields moved lower from ‒92bp down to below ‒100b. However, the downward momentum in US real yields was relatively short-lived. Having failed to break above the psychologically important $1,800 barrier, gold eased lower to be back trading around $1784.

Presuming the rise in US 10 year nominal rates remains in line with rising energy and inflation expectations it’s difficult to make a strong case for gold at this point.

Technically, while a break above resistance at $1800 would allow short-term upside, the critical resistance at $1835/45 (triple top and trend channel) needs to break to confirm a stronger recovery towards the June $1916 the August 2020 $2075 high.

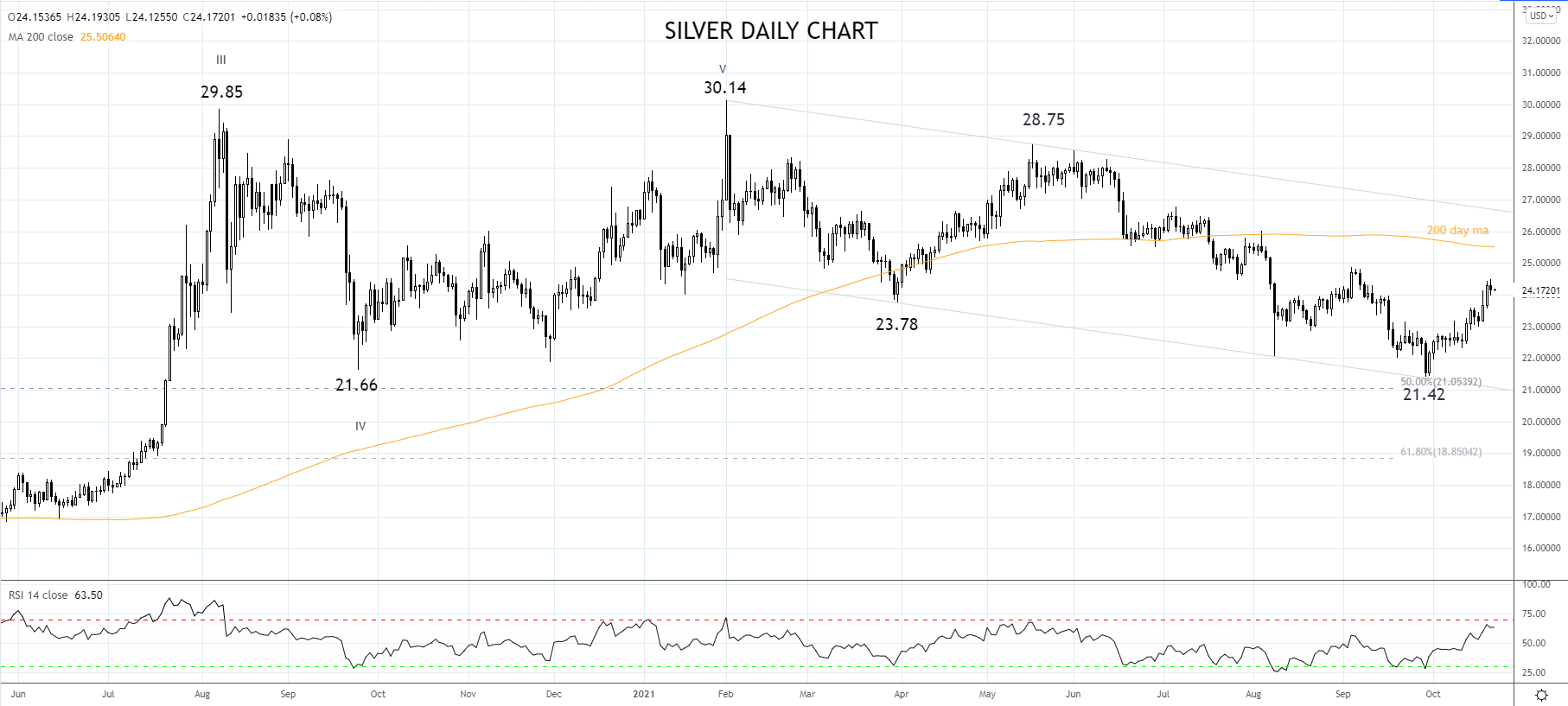

Turning to silver, part precious metal, and part industrial metal, it sees increased demand from green technologies such as solar power generation and EVs.

Technically the pullback from the February $30.14 high that tagged a band of critical support between $21.35 and $20.90 (includes trend channel support and the 50% Fibonacci retracement from the $11.64 low to the $30.14 high) appears complete at the $21.42 low.

Providing silver does not lose short term support at $23.00 nor the band of medium-term support between $21.45 and $21.00, we are bullish silver looking for the rally to extend towards a layer of resistance between $25.70 (the 200-day moving average) and $26.70 (trend channel resistance).

Source Tradingview. The figures stated areas of October 22nd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade